HBAR Plunges Below Critical Support as Institutions Dump Holdings

Institutional selling tsunami crashes HBAR through key technical levels

The Great Unloading

Wall Street's favorite pastime—dumping digital assets when retail least expects it—has hammered Hedera's native token below crucial support. The same institutions that once championed 'blockchain innovation' now race for exits faster than traders spotting a Fed announcement.Technical Breakdown

That vaunted support level? Shattered. The institutional exodus triggered cascading sell orders, creating the crypto equivalent of a bank run without the velvet ropes. Market structure now resembles Swiss cheese—full of holes and smelling faintly of desperation.Finance's Ironic Twist

Remember when institutions promised 'long-term conviction'? Turns out their conviction lasts about as long as a meme stock rally. The smart money proves once again it's mainly smart at timing their own exits while leaving retail holding the bag. Market Analysis

Market Analysis

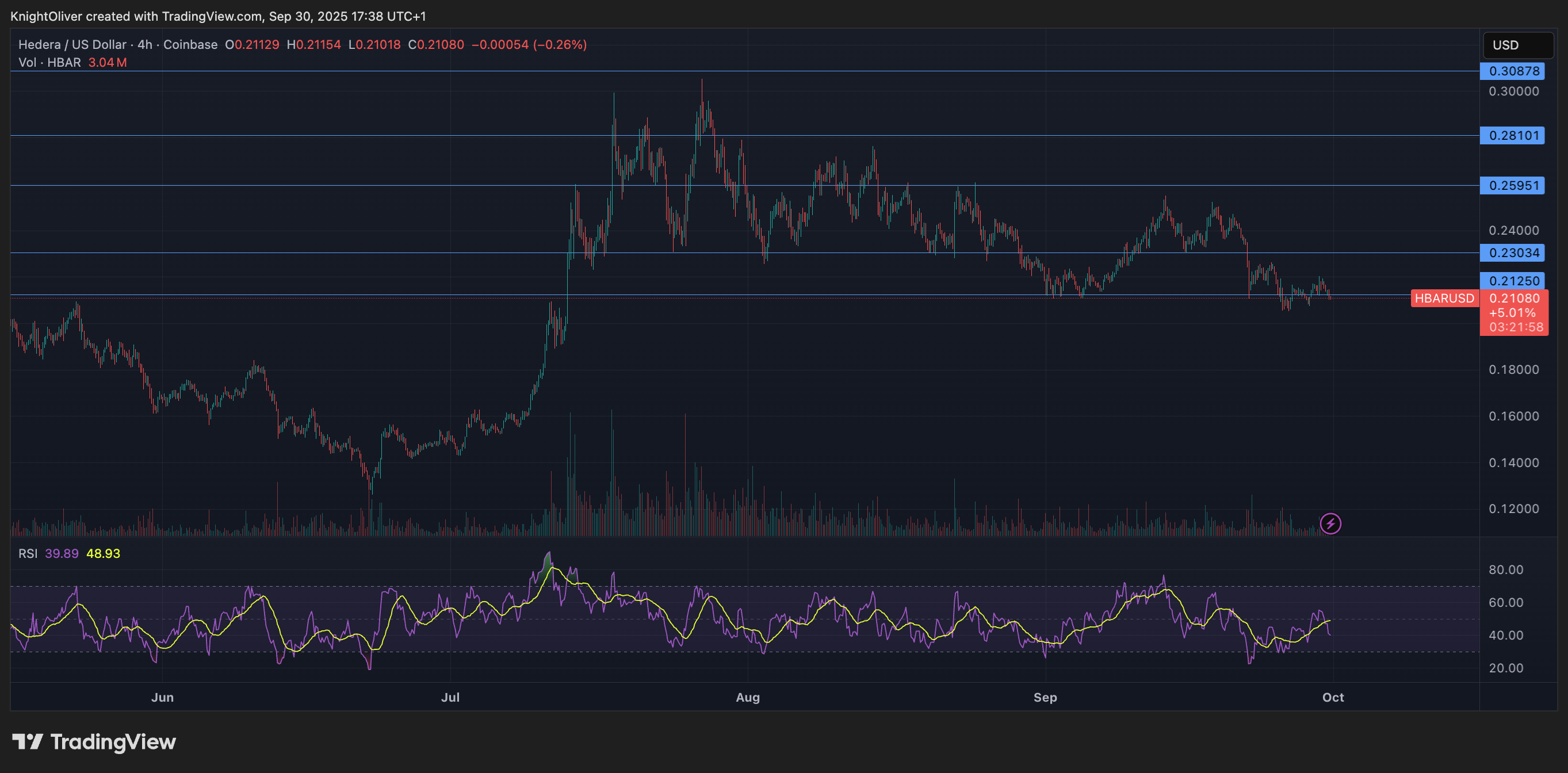

- Resistance established at $0.22 during September 29 evening trading with institutional profit-taking on above-average volume.

- Support zone identified around $0.21-$0.21 with multiple corporate buying opportunities throughout morning sessions.

- Volume surge to 54.88 million tokens in final hour indicating accelerated institutional risk management protocols.

- Extraordinary trading activity reaching 5.90 million tokens during 3:10 PM interval and 4.51 million at 3:11 PM.

- Break below established support zone suggesting potential continued corporate de-risking in enterprise blockchain sector.

- Price stabilization efforts near $0.21 level by session end with sustained institutional trading volumes.

Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.