Bitcoin Pushes Higher While ETH Surges Past $4k - But Market Sentiment Plunges Into ’Fear’ Zone

Crypto markets show split personality as major assets climb while investor confidence craters.

Price Action Divergence

Bitcoin edges upward in cautious trading while Ethereum stages a sharp rebound above the $4,000 psychological barrier. The moves come despite worsening market sentiment that's slipped firmly into 'fear' territory according to key metrics.

Sentiment Versus Reality

Traders face the classic crypto conundrum—technical indicators pointing one direction while emotional gauges scream another. The fear reading contradicts the price action, creating tension between what charts show and what investors feel.

Wall Street's Favorite Paradox

Traditional finance types would call this irrational—but then they still think 9-to-5 trading hours make sense in a 24/7 global market. The disconnect between sentiment and price often creates the best buying opportunities for those who ignore the noise.

Crypto sentiment turns fearful

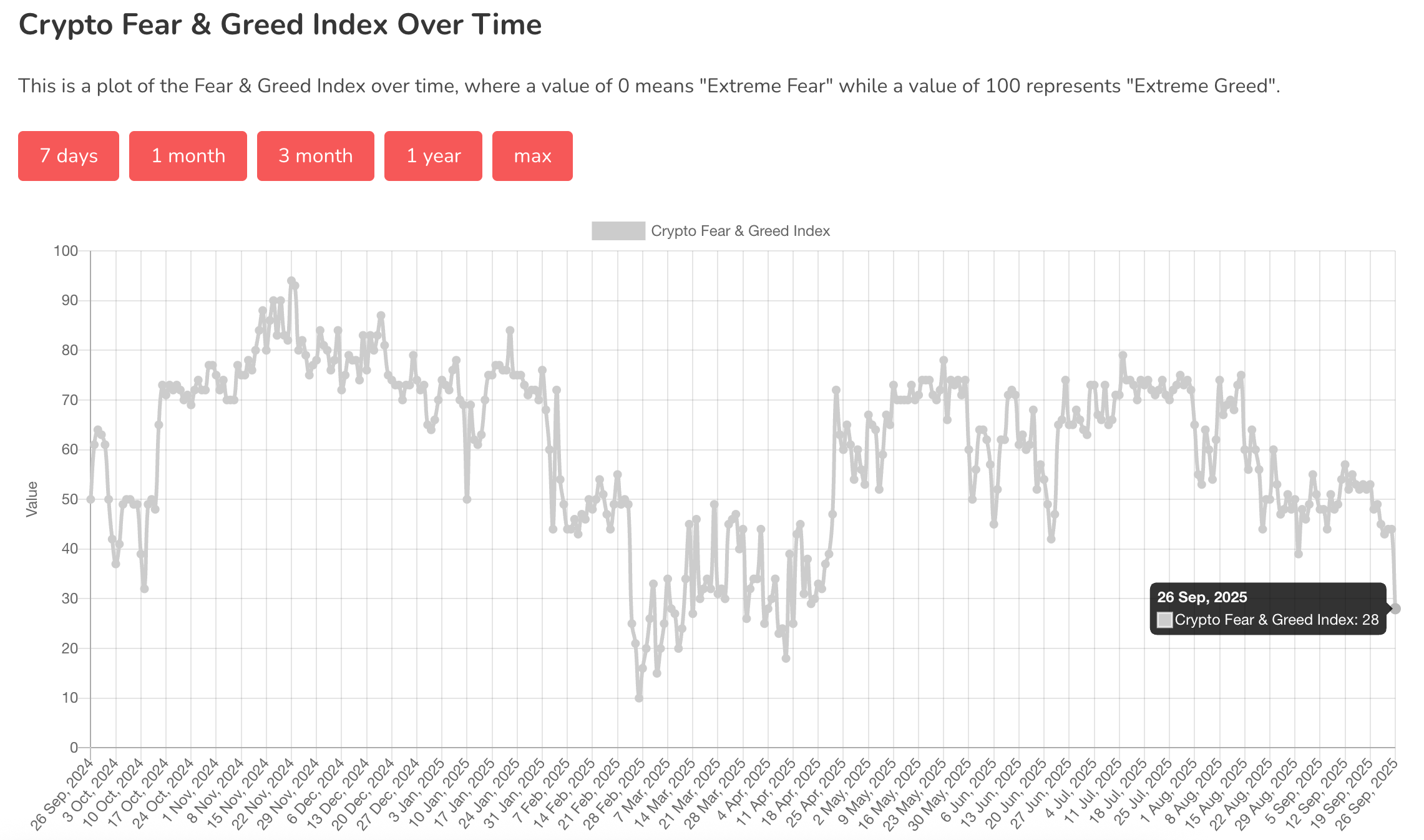

Meanwhile, sentiment in crypto remained fragile. The Fear & Greed Index, a well-followed sentiment indicator, plummeted to 28 on Friday, its most depressed level since mid-April signaling "fear" among traders. That reflected recent volatility after Thursday's $1.1 billion liquidation wave wiped out Leveraged long positions.

"In recent days, roughly $3 billion of levered longs have been liquidated," noted Matt Mena, strategist at digital asset manager 21Shares. With excess leverage largely flushed out, he said positioning has swung to an extreme bearish, Mena noted: popular tokens such as BTC, SOL, and Doge now show a long-to-short ratio of just one-to-nine.

That, combined with the Fear & Greed Index at NEAR extremes lows, "sets the stage for a potential short squeeze," Mena argued.

Paul Howard, senior director at trading firm Wincent, didn't share to positive outlook and warned that the market could drift lower before stabilizing. He pointed to BTC dipping below its 100-day moving average under $110,000 and the total crypto market cap sliding under $4 trillion as signs of weakness.

"The market is in a healthy correction without panic or significant uptick in volatility," he said. "It is likely that we grind lower the coming weeks,” adding he is beginning to question whether crypto revisits record highs in 2025.