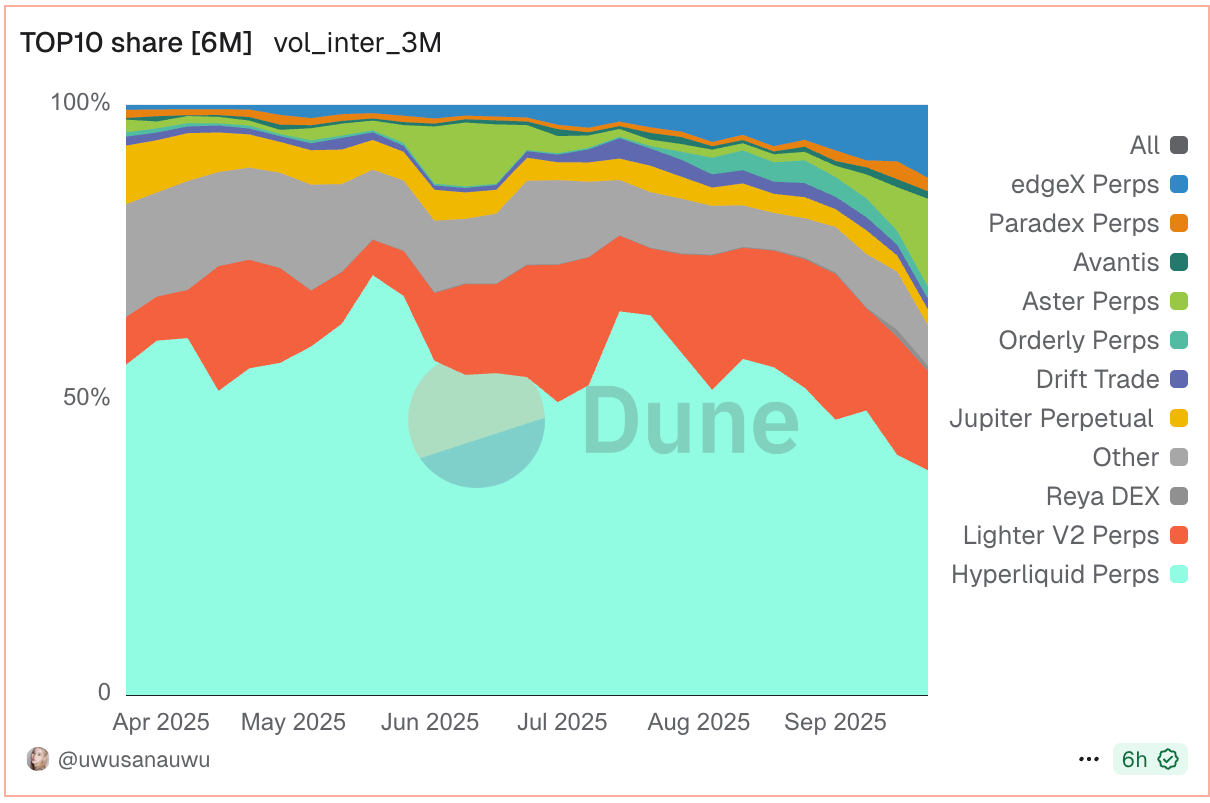

Hyperliquid’s Perpetual Share Plummets to 38% as Aster and Lighter Disrupt Derivatives Market

Hyperliquid's dominance in perpetual trading faces brutal pressure as competitors carve out major market share.

Market Shakeup Underway

Aster and Lighter aren't just gaining ground—they're rewriting the rulebook for decentralized derivatives. Hyperliquid's perpetual share collapsing to 38% signals a fundamental shift in trader preferences. The new platforms deliver faster execution and lower fees while maintaining robust liquidity.

Infrastructure Wars Intensify

These challenger protocols built their infrastructure from the ground up, bypassing legacy limitations that plagued earlier DeFi derivatives attempts. Their architecture handles complex positions without the gas wars that made perpetual trading economically unviable for smaller traders.

Regulatory Gray Zone Advantage

While traditional finance wrestles with compliance paperwork, decentralized perpetual platforms operate at internet speed—another reminder that innovation happens fastest where bureaucrats fear to tread. The 38% figure represents more than just market share loss; it's a verdict on which approach traders actually value.

As the perpetual wars heat up, one thing's clear: in crypto derivatives, yesterday's market leader is tomorrow's cautionary tale—usually right around the time they finish their third compliance audit.

The on-chain perpetual market has experienced rapid growth. All platforms combined have registered a cumulative trading volume of nearly $700 billion over the past four weeks, with activity reaching $42 billion in the last 24 hours alone.

The number of protocols has grown significantly from just two in 2022 to over 80 as of today. This expansion perfectly exemplifies capitalism at work: a thriving market attracts a flood of new entrants, increasing competition and eroding the market share and profitability of early pioneers.

The absence of traditional barriers to entry or exit, a key feature of the crypto market, allows anyone with the technical know-how to launch new protocols and compete.

Lately, a war of sorts has been unfolding between Hyperliquid and Aster. Last week, Hyperliquid listed Aster's native token ASTR, allowing users to long or short the token with 3x leverage. On Monday, Aster responded by offering Hyperliquid's HYPE perpetuals with 300x leverage.