Unlock the Crypto Bull Cycle: 5 Critical Insights Every Investor Must Master

The sirens are blaring again. Bitcoin smashes another all-time high, memecoins print millionaires overnight, and your cousin won't stop talking about his 'life-changing' altcoin bag. Welcome back to the frenzy.

But beneath the euphoric surface, patterns repeat. Understanding these mechanics separates the prepared from the panicked.

The Halving Isn't a Switch—It's a Fuse

Forget the instant moon narrative. The supply shock from Bitcoin's halving lights a long fuse. History shows the real explosion in price and sentiment comes 12-18 months later, as reduced new supply collides with creeping institutional demand. The clock started ticking last time; the powder keg is primed.

Retail FOMO Fuels the Peak (And Your Exit)

When mainstream news headlines scream 'Crypto Boom!' and shoe-shiners offer portfolio advice, recognize the signal. The final, parabolic price surge is almost exclusively driven by late-coming retail investors. Their entrance provides the liquidity for smart money to exit. It's not cynical, it's cyclical.

Altcoin Season Follows, It Doesn't Lead

Capital rotates, it doesn't appear from thin air. Bitcoin and Ethereum dominance must first peak. Profits from these large-cap rallies then 'wash out' into riskier altcoins, searching for exponential returns. Chasing altcoins before this rotation is like planting seeds in frozen ground.

Leverage Cuts Both Ways—Sharply

Bull markets are built on borrowed money, until they aren't. Excessive leverage amplifies gains but sets the stage for violent, cascading liquidations at the first sign of weakness. The market doesn't just correct; it hunts over-leveraged positions with algorithmic precision.

Narratives Trump Technology (For a While)

In the heat of the cycle, a compelling story about AI-agents on-chain or a tokenized real-world asset sector will outperform superior tech with poor marketing. Fundamentals anchor long-term value, but narratives drive short-term manias. Time your engagement accordingly.

The bull cycle isn't just about buying; it's about psychology, timing, and recognizing that the market's memory is notoriously short—except when it comes to separating fools from their money, a tradition as old as finance itself. The patterns are clear. The question is whether you'll see them before they see you.

Summarize the content using AI

ChatGPT

Grok

Today, we will examine two essential graphs to understand the bull cycle in cryptocurrencies. Moreover, the latest AAII survey provides a crucial signal regarding individual investors’ risk appetite. With the major Fed decision day at hand, these evaluations will facilitate your comprehension of the current phase.

ContentsAAII Survey and Risk AppetiteWhat Phase Are Cryptocurrencies In?AAII Survey and Risk Appetite

Known for its sentiment surveys, AAII has released its latest report, indicating that individual investors’ risk appetite is increasing. At the time of writing, the Bank of Canada has left interest rates unchanged. As many central banks are talking about ending the easing cycle, this decision is significant, with attention turning to Japan on December 19 after the Fed.

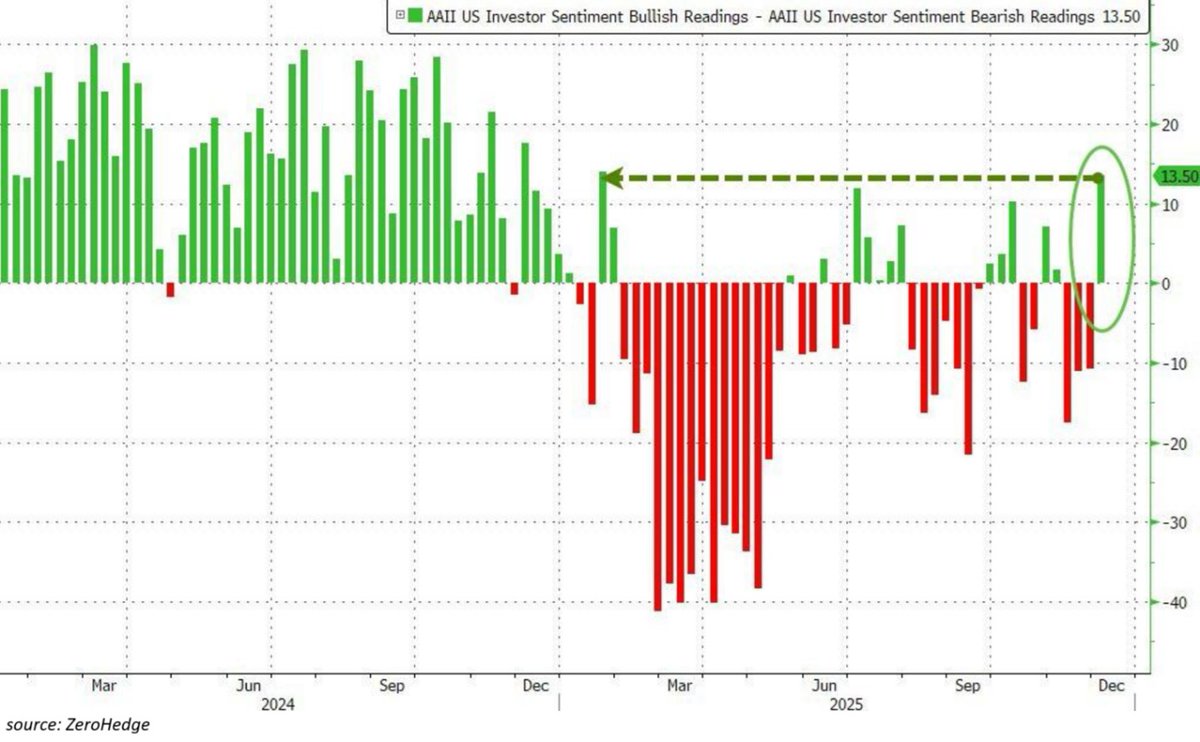

Returning to our topic, sentiment is improving. By examining The Graph below, you’ll observe one of the strongest risk appetite measurements in recent times, signaling a shift away from fear. About 44.3% of individual investors are optimistic about the stock market over the next six months. This is the best figure since October 8, and the highest level in the last 12 months was 45.9%. Sentiment has improved in the past three weeks, climbing 12.7 points.

TKL commented on the current situation, noting a drop in the percentage of individual investors expecting a decline, which fell to 30.8%, the lowest since January 23. Consequently, the disparity between bullish and bearish expectations soared to 13.5 points, marking the second-highest level this year. Everyone seeks a share of this market.

What Phase Are Cryptocurrencies In?

distances itself from $92,000 ahead of the Fed’s decision, while gains in altcoins remain limited.has positively diverged, surpassing the $3,300 target—a promising development. CryptoQuant analyst Darkfost highlights the influence of liquidations on the current fragility, with futures having already set an all-time high in volume for 2025. Binance dominates this space with a futures trading volume exceeding $24 trillion, which is more than double OKX’s $11 trillion and nearly twelve times Hyperliquid’s volume.

Such imbalance reveals the aggressive and speculative nature of the crypto market this year. Investors prioritize leverage for short-term trading over spot buying for long-term positions, observes the analyst. This trend has been the goal of exchanges through UI enhancements over the years. Is this beneficial for cryptocurrencies? CryptoQuant analyst argues that it renders markets more fragile. Volatility is now driven not only by spot supply and demand but also by forced liquidations and their domino effects, recalling the October 10 downturn. What lies ahead?

Leverage remains the primary driving force, and as long as it dominates, Bitcoin operates in a setting where prices become more unstable and harder to predict.

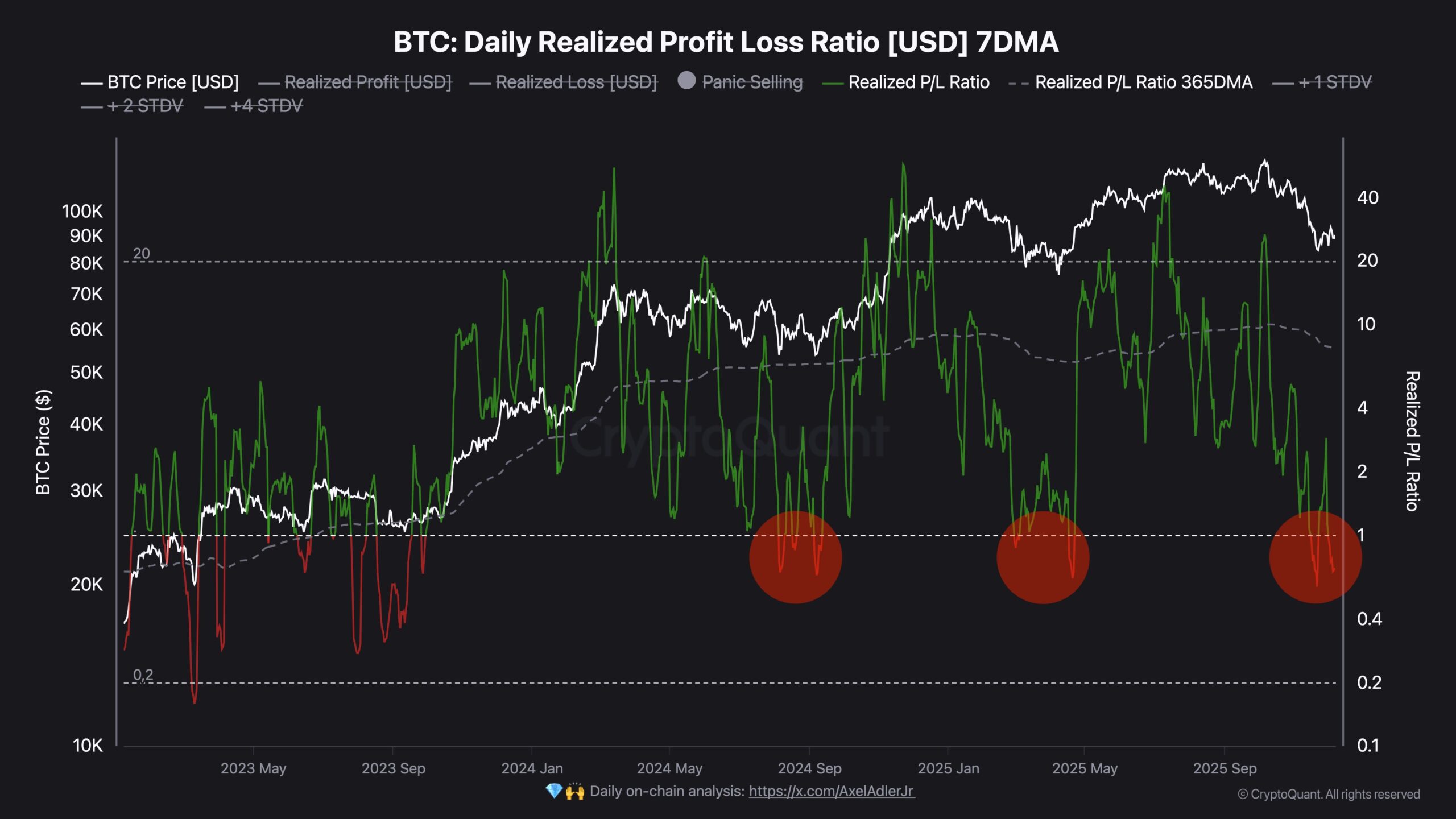

The second important graph is shown above. By analyzing this graph, Darkfost indicates that we are still in the middle of the cycle with a temporary correction in play. The Profit/Loss ratio (7-dma) has dropped below 1, signifying that losses have surpassed realized gains in the past weeks. This pattern was observed in previous corrections and historically indicates that the bottom is NEAR or already passed. Will historical data work in favor of the bulls this time?

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.