The Fed’s Decision Today Could Shake Markets: What It Means for Crypto

The Federal Reserve's latest policy announcement just dropped—and digital assets are already feeling the tremor.

Markets hold their breath every time the central bank speaks. Today's call on interest rates and economic projections wasn't just about traditional finance. It sent immediate ripples through Bitcoin, Ethereum, and the broader altcoin landscape. Liquidity expectations shifted in an instant.

Decoding the Central Bank's Signal

Forget the dense FOMC statement. The real story is in the market's reaction. When the Fed tightens or hints at easing, it doesn't just move Treasury yields. It recalibrates the entire risk-on versus risk-off playbook. Crypto, sitting at the volatile edge of that spectrum, often gets the most dramatic swing.

A hawkish tilt can temporarily drain momentum from speculative assets. A dovish signal? That's rocket fuel for narratives around digital gold and decentralized finance. Today's language is being picked apart by algorithms and traders on a global scale.

Beyond the Immediate Volatility

The knee-jerk price move is one thing. The longer-term implication is another. Fed policy shapes the macro environment—the very soil in which crypto either flourishes or struggles. It influences institutional capital allocation, the strength of the U.S. dollar, and the public's appetite for alternative stores of value.

Each meeting is a puzzle piece in a larger picture of monetary normalization, inflation fighting, and economic stewardship. How crypto navigates this landscape will define its next chapter.

So, the Fed spoke. The market reacted. Now, the real work begins—separating the short-term noise from the long-term signal. After all, in finance, the only thing more predictable than a central bank meeting is the crowd's overreaction to it.

Summarize the content using AI

ChatGPT

Grok

December 10th arrived, marking a crucial moment as the market anticipated the Federal Reserve’s interest rate decision. Recent weeks witnessed fluctuating expectations, particularly following statements by the New York Fed President, with expectations for a rate cut reaching over 80%. Meanwhile, Bitcoin $92,039 has remained above $92,000. What can we expect today?

$92,039 has remained above $92,000. What can we expect today?

Key Points in the Fed’s December 10th Rate Decision

This meeting carries additional significance as it includes the release of interest rate projections. Quarterly economic forecasts and the DOT plot will reveal the Fed members’ expectations for the short, medium, and long term. The Fed only publishes these dot plot charts four times a year, making December’s meeting the most crucial as it provides insights into the trajectory followed annually.

The decisions taken throughout the year might not completely reflect their viewpoints, but today will unveil which steps were supported by the 19 Fed officials. A vote by 12 members determines the decision. Last December, four wrote in a rate 25 basis points above the committee’s set level, though only one showed dissent, indicating a more intricate scenario today with members advocating both significant cuts and hikes.

What should we focus on today? Nick Timiraos answers succinctly;

“At 2:00 PM, when forecasts get announced, glance at the 2025 column of the dot plot. If the committee lowers rates as anticipated between 3.5% and 3.75%, any marking 3.875% are secretly conveying expectations. Count these. All 19 dots aligning WOULD mean a unanimous decision. Last December, four higher points hinted at a then-fragile consensus.”

Hours before the Fed meeting, Trump, at 2:00 AM, suggested checking whether Biden’s appointees to the Fed had their commissions e-signed, possibly facilitating their removal. This could lead TRUMP to appoint his supporters, potentially disturbing markets and reigniting debates about Fed independence.

Expectations in the Cryptocurrency Market

Powell’s statements hold immense importance for cryptocurrencies, especially regarding messages for 2026 and commentary on monetary expansion. Should the focus shift to employment recovery, expectations might price in two or fewer cuts next year, leading to a fall in cryptos. Pseudonymous analyst AlphaBTC commented;

“Recent weak employment data slightly disrupted rate cut hopes, causing unease in traditional finance markets. Now, Fed decisions and wage data draw attention. A hawkish Fed or stable wages might prompt another sales wave.”

FOMC Economic Projections — Updated dot plot crucial for rate cut expectations.

FOMC Statement — Tone (hawkish/dovish) could sway yields, USD, and stock movements.

FOMC Press Conference — Powell’s Q&A often triggers a second wave of volatility.”

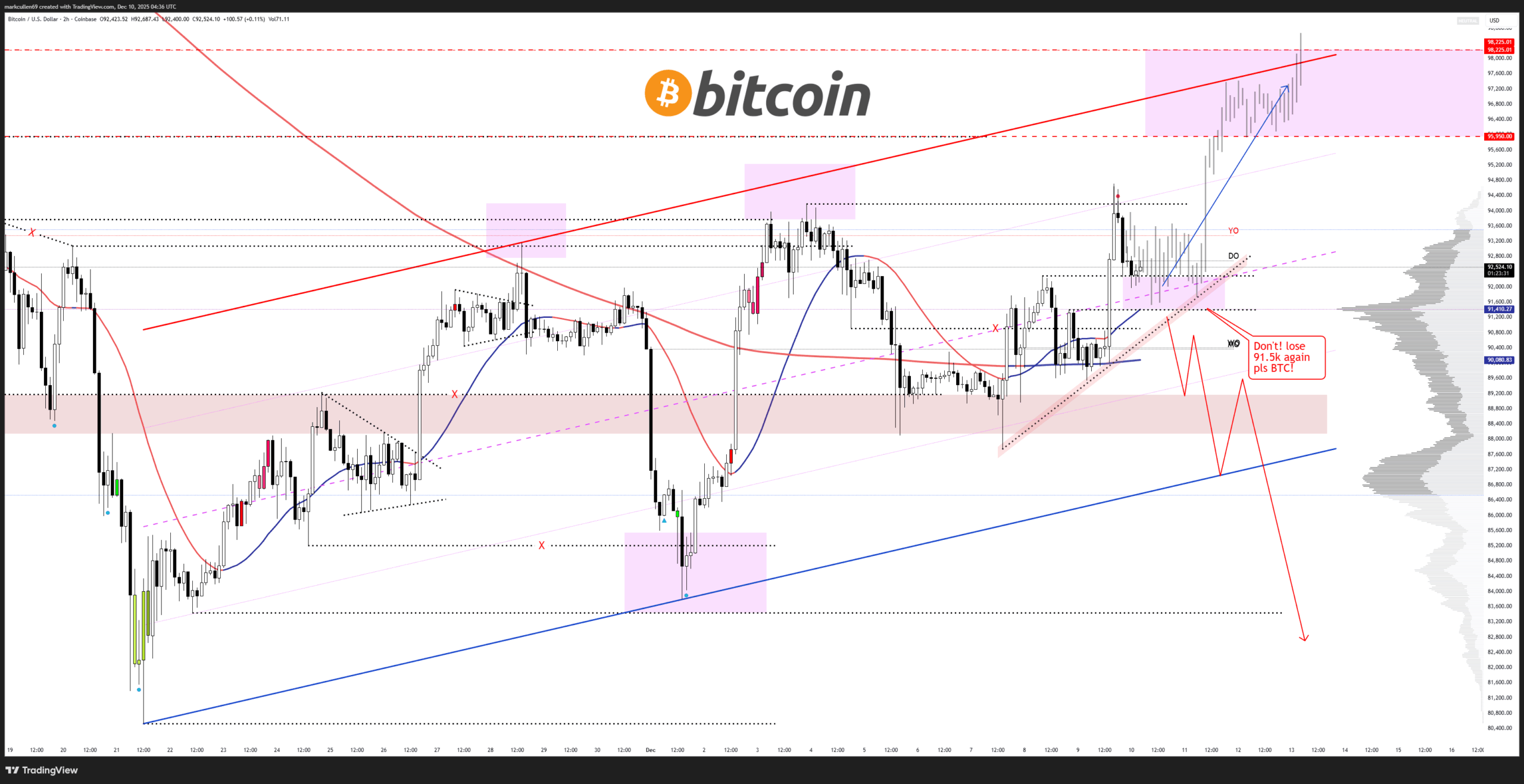

For Bitcoin, the focus is the simple moving average at $98,000. A support level at $93,300 must hold, paving the way to $108,000 upon clearing the 50SMA. These moving averages guide, with the SMA200 level critical at $108,000, marking vital supply areas. The $94,000 yearly opening level remains a pivotal resistance, which bulls struggled to break yesterday.

In a negative scenario, losing $90,000 could lead to a drop towards $87,500, followed by a fall to $84,000, with altcoins experiencing further turmoil. AlphaBTC remarked;

“BTC saw a nice pushback, reverting to support. The 97-98k level remains my target from weeks back. However, Bitcoin must hold at the 91.5 level, or blood may spill in the charts.”

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.