Silver Prices Explode: Where Will the Next Mega-Surge Strike?

Silver just ripped higher. The charts are screaming. Now, everyone's scrambling to figure out where the next big move lands.

The Momentum Play

Forget the slow-and-steady narrative. This isn't your grandpa's safe-haven asset anymore. The recent surge has all the hallmarks of a momentum trade catching fire, drawing in speculators who wouldn't know a silver lining from a futures contract.

Decoding the Signal

Is this just a flash in the pan, or the start of something real? The price action suggests a fundamental shift. It's breaking patterns, ignoring traditional resistance levels, and behaving more like a tech stock than a precious metal—volatility included.

Predicting the Unpredictable

Calling the top or the next leg is a fool's errand, but the setup is clear. The move has created a new playing field. Watch for consolidation, then the next explosive breakout. It could be driven by anything: a weak dollar narrative, renewed inflation fears, or just good old-fashioned FOMO from traders bored of sideways action.

Silver's sudden burst is a stark reminder that in today's markets, everything can become a speculative asset—even the stuff we used to bury in the backyard. The only thing more volatile than the price might be the predictions about it.

Summarize the content using AI

ChatGPT

Grok

Since May, silver has consistently formed monthly green candles, hovering NEAR its all-time high. The surge in silver and gold prices has provided investors with rapid short-term gains without the occurrence of a third world war while the Fed transitions to quantitative easing. What are the analysts’ expectations for the future?

ContentsSilver Prices on the RiseSilver Price ForecastsSilver Prices on the Rise

The silver chart resembles the bull peaks of altcoins during an uplift year, but it has outperformed them this year. Drawing the chart to a monthly view in most altcoins reveals a stark contrast to silver’s direction. Although silver attained roughly 90% gains over seven months, it remains above $60.

The recent rise was triggered by the Fed’s interest rate cut and ongoing market tightness, leading to a new record. MUFG analysts explain this ascent through several justifications.

- Strong demand from India.

- Sustained appetite in ETFs.

- Continued physical supply constraints following the historic supply squeeze in October.

- The Fed’s anticipated 25bp rate cut.

In New York, futures marked a daily peak at $62.14. Although shipments have bolstered stocks in London vaults, tight conditions in the OTC market persist.

According to two members of the OCBC FX and rate strategy team, the cost of borrowing physical silver, referred to as silver lease rates, continues to rise, suggesting ongoing supply constraints and potential for further rises. However, we could witness some profit-taking if today’s Fed decision is favorable, prompting a brief pause in the rapid ascent. If not, silver may further extend its monthly green candle.

Silver Price Forecasts

Currently, silver aims to document the largest 12-month rise since 1979. Economics Professor Steve Hanke mentions that, as of January, China will initiate official export controls on silver, which could sustain the upward trend. Despite easing rare earth element restrictions in agreement with the U.S., China appears insistent on silver, with the climb largely driven by supply concerns. As the world’s largest silver exporter, this MOVE could aid the continued rise toward the year’s end. China used a silver standard until 1935, valuing it comparably to gold.

An analyst known as Oren predicts larger peaks as the Dow-Silver ratio breaks out of a 45-year-old pennant formation. He anticipates a frenzy in precious metals similar to the 1970s.

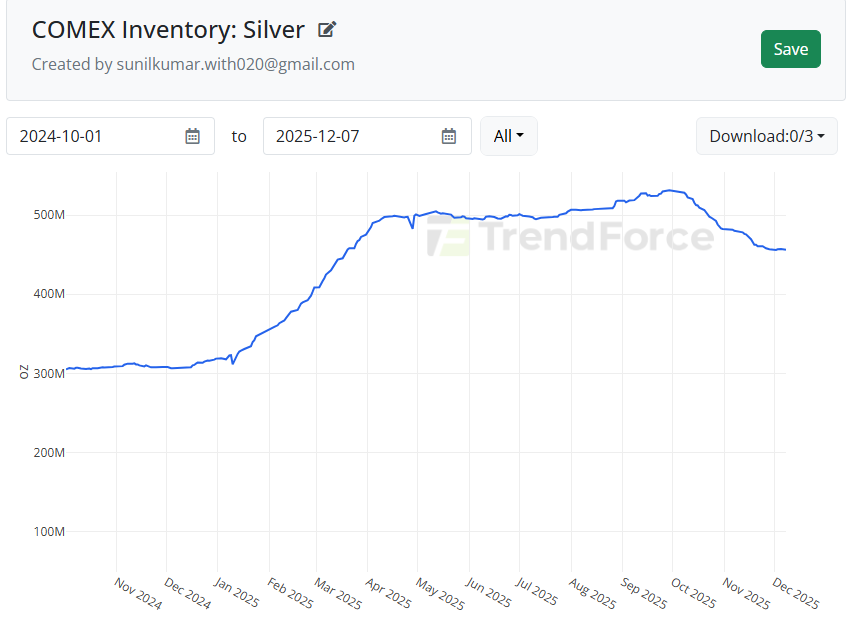

Analyst Macrobysunil states that this scenario delineates an apparent stress rather than a trend, anticipating a continuation of the rise due to short liquidations, liquidity gaps, and FOMO. His analysis focuses on COMEX stocks.

“For a year, COMEX stocks rose. Suddenly, within weeks, they fell by 50 million ounces. No replenishment, merely depletion. This isn’t repositioning. This is physical metal exiting the system. This is how confidence in paper values vanishes.”

Similarly, Rashad Hajiyev anticipates a continuation towards $70 as silver broke out of a 9-day flag formation yesterday.

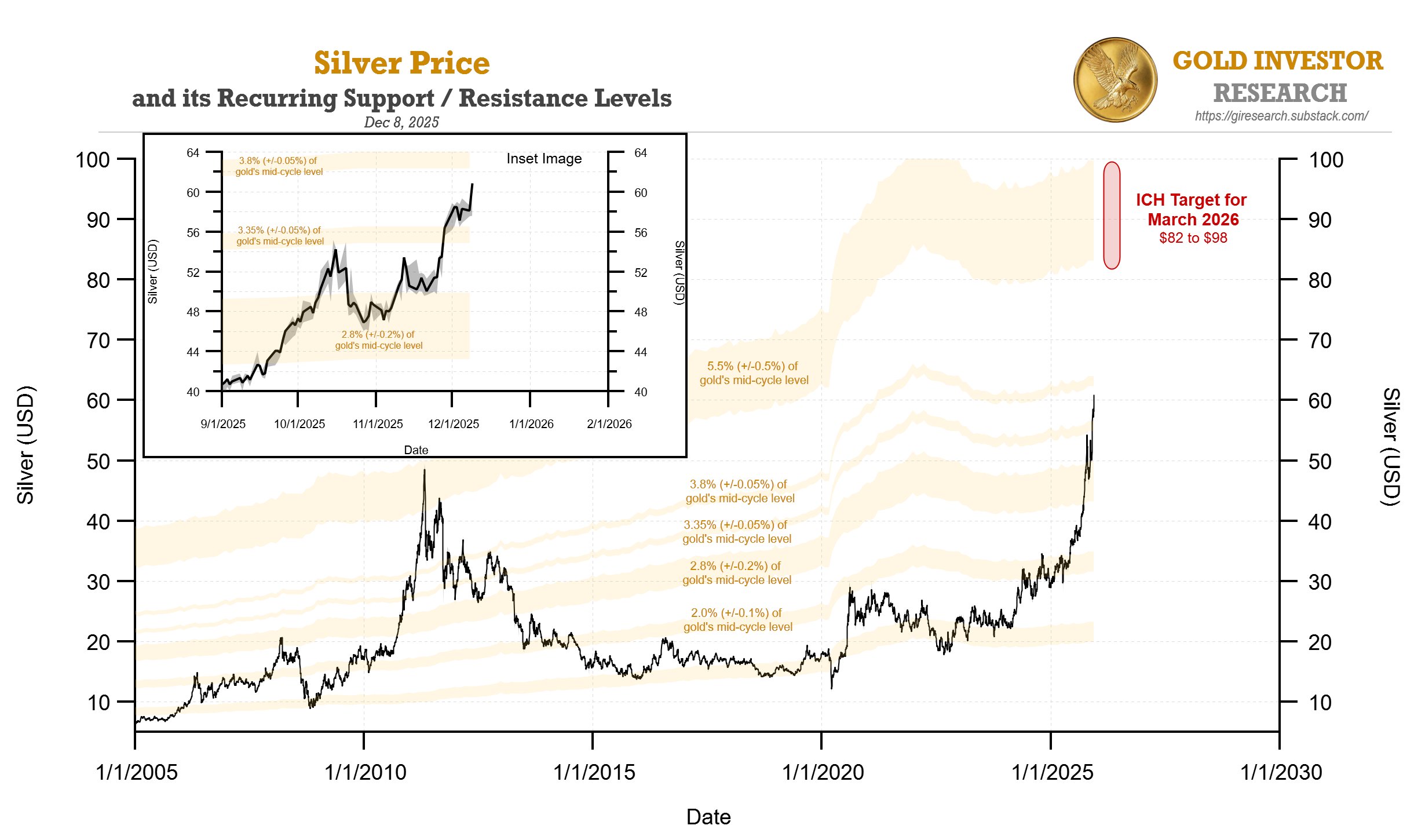

Finally, CRutherglen shared the chart above, commenting:

“Silver is nearing its short-term target around $63. Following this, the primary cycle peak target lies between $82 and $98, anticipated around March 2026.”

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.