Ethereum Defies Gravity: Bullish Surge Shatters Market Doubts

Ethereum's relentless climb continues—flipping bearish sentiment into fuel for its ascent. While traditional markets wobble, ETH charts its own course with the stubborn elegance of a decentralized powerhouse.

The Unstoppable Ascent: No pullback, no apologies. Ethereum's price action mocks the 'overbought' chatter as institutional money quietly stacks positions.

Liquidity Wars: Watch retail FOMO ignite when Wall Street's 'risk-off' narrative finally cracks—the same suits who called crypto dead now scramble for exposure.

One immutable truth remains: in a world where central banks print doubt, Ethereum prints blocks. (And yes, that's a subtler burn than your average stablecoin's 'algorithmic' peg.)

Summarize the content using AI

ChatGPT

Grok

Ethereum (ETH) $3,321 surged towards $3,400 on Tuesday, hitting a three-week peak. This surge was driven by weak employment data from the U.S., which bolstered expectations for an earlier-than-anticipated easing in monetary policy. Nevertheless, investor caution persists due to low network activity and limited Leveraged buying interest despite the price gain.

$3,321 surged towards $3,400 on Tuesday, hitting a three-week peak. This surge was driven by weak employment data from the U.S., which bolstered expectations for an earlier-than-anticipated easing in monetary policy. Nevertheless, investor caution persists due to low network activity and limited Leveraged buying interest despite the price gain.

Declining Network Fees Weaken Market Signals

In the past 30 days, ethereum network fees have plummeted by 62%, highlighting not only the contraction in transaction demand but also a marked shift in user behavior. During the same period, competing networks like Tron, Solana![]() $138, and HyperEVM saw a lesser drop of 22%. In contrast, Base network transaction volume skyrocketed by 108% and Polygon jumped by 81%, showcasing that Ethereum’s Layer 2 ecosystem is expanding quicker than its main network.

$138, and HyperEVM saw a lesser drop of 22%. In contrast, Base network transaction volume skyrocketed by 108% and Polygon jumped by 81%, showcasing that Ethereum’s Layer 2 ecosystem is expanding quicker than its main network.

The Fusaka upgrade on December 3, aimed at enhancing rollup efficiency, may partially explain the decreased transaction fees due to technical improvements. However, according to DeFiLlama, Ethereum’s decentralized exchange (DEX) volume dwindled from $23.6 billion to $13.4 billion in four weeks. Concurrently, decentralized application (DApp) revenues plunged to $12.3 million, marking a five-month low.

In terms of Total Value Locked (TVL), the picture is mixed. Leading protocols such as Pendle, Athena, Morpho, and Spark reported significant declines, leading Ethereum’s total TVL to fall from $100 billion to $76 billion in two months. Despite this, Ethereum maintains significant dominance in the decentralized finance (DeFi) sector with a 68% market share.

Macro Expectations Support ETH While Risks Loom

The U.S. Department of Labor announced 1.85 million layoffs in October, the highest figure since 2023. This data strengthened expectations that the Federal Reserve might implement a 0.25-point rate cut on Wednesday. Market attention is now focused on Powell’s post-meeting statements.

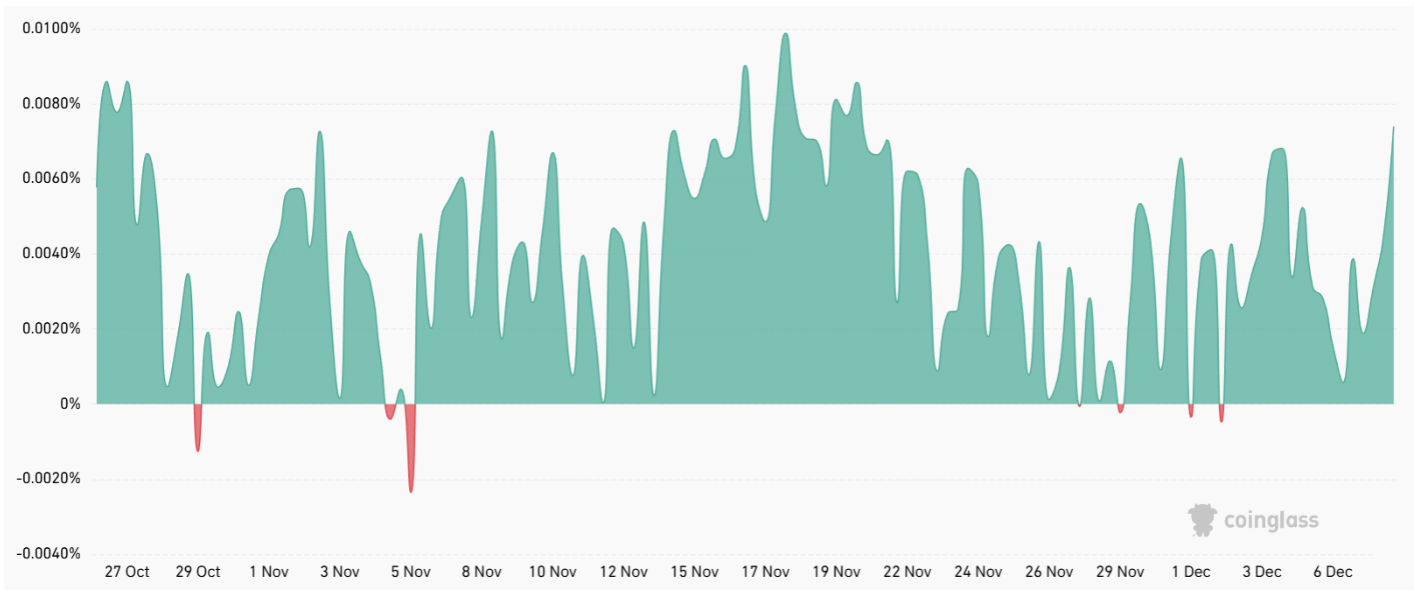

The annualized funding rate in futures trades dances around 9%, indicating a balanced leverage distribution between buyers and sellers, hence no imminent bullish outlook. ETH remains 32% below its all-time high of $4,597.

Meanwhile, former U.S. Securities and Exchange Commission member Paul Atkins expressed on FOX Business that U.S. markets might be tokenized within “a few years.” According to Atkins, blockchain technology will play a crucial role in modernizing financial markets by providing transparency and predictability, which bolsters long-term expectations for the Ethereum ecosystem.

A similar trend was observed last week in the solana ecosystem, where SOL‘s price increased by 12% in a short span while network fees surged and new user acquisitions accelerated significantly. The recovery in Solana’s transaction volume indicates that the growth seen in Ethereum, dominated by Layer 2, is being realized directly through main networks in rival chains.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.