Small Bitcoin Holders Are Making a Surprising Shift - Here’s Why It Matters

Retail investors flip the script, stacking sats while whales hesitate.

For years, the narrative around Bitcoin ownership focused on institutional giants and billionaire whales. Now, data reveals a quiet revolution happening at the grassroots level. Small-scale holders—often dismissed as 'retail'—are accumulating at a pace that defies conventional market wisdom.

The Contrarian Accumulation

This shift isn't about flashy headlines or nine-figure purchases. It's a steady, persistent drip of capital into wallets holding fractions of a single Bitcoin. While large holders occasionally sell into rallies, the cohort owning less than 1 BTC continues to grow its collective stack, acting as a stabilizing counterweight to volatile whale movements.

Decoding the 'Why'

Several forces drive this behavior. Persistent inflation erodes the purchasing power of traditional savings, making a hard-capped asset like Bitcoin increasingly attractive as a long-term store of value. The rise of user-friendly, regulated exchanges and automated dollar-cost averaging apps has demystified the buying process, turning accumulation into a frictionless habit rather than a speculative gamble.

A New Foundation for the Market

This broadening base of ownership could signal a maturation phase. A market supported by millions of distributed holders may prove more resilient than one reliant on a few centralized entities—a lesson traditional finance learned the hard way, though they'll never admit crypto solved it first. This decentralized conviction creates a stronger, less manipulable price floor.

The Bottom Line

Don't mistake small balances for insignificant impact. When millions of individuals make the same quiet bet against the legacy system, they're not just buying an asset—they're voting for a different financial future. And as any cynical banker will tell you, the most dangerous force in markets isn't a hedge fund; it's a patient crowd with a shared idea, especially when that idea bypasses their fees entirely.

Summarize the content using AI

ChatGPT

Grok

Small Bitcoin $90,610 holders, colloquially known as “shrimps” in the crypto world, are drawing attention due to their significantly reduced activity on the blockchain. Although this behavior initially seems reminiscent of the FTX collapse era, a CryptoQuant analyst argues that there is a misunderstanding in interpreting this current scenario. While the situation parallels the days of the FTX crash, the conditions today warrant a different assessment.

$90,610 holders, colloquially known as “shrimps” in the crypto world, are drawing attention due to their significantly reduced activity on the blockchain. Although this behavior initially seems reminiscent of the FTX collapse era, a CryptoQuant analyst argues that there is a misunderstanding in interpreting this current scenario. While the situation parallels the days of the FTX crash, the conditions today warrant a different assessment.

The Shrimp Phenomenon

Bitcoin investors possessing less than 1 BTC are commonly referred to as “shrimps.” The activity level of this group has recently hit an all-time low, previously regarded as a bottom signal for cryptocurrencies. Under normal circumstances, this WOULD be considered a strong indicator of a market bottom.

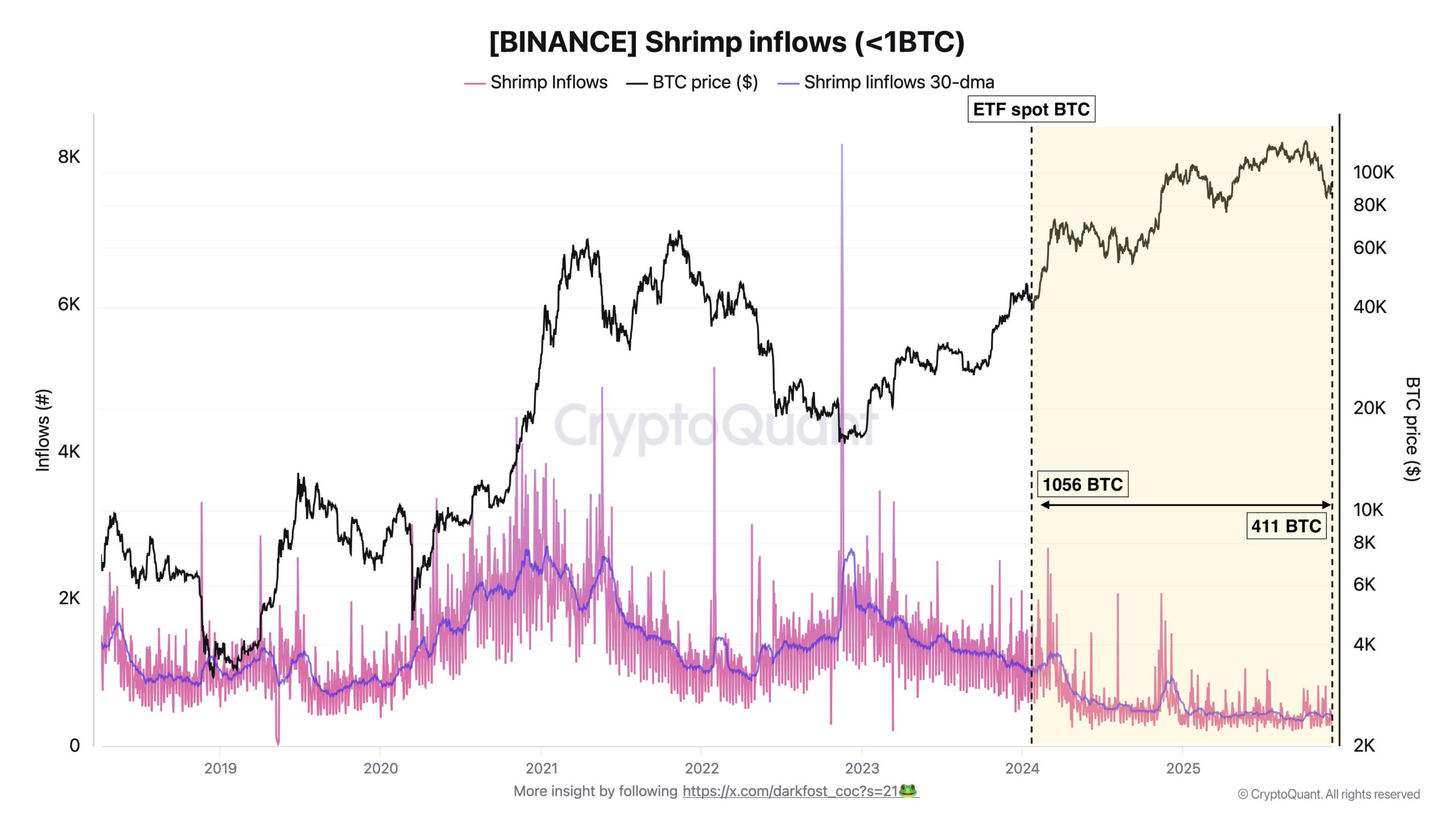

An analyst known as Darkfost shared a graph illustrating this trend:

“In the graph, this behavior is measured by the Bitcoin inflows to Binance, illustrated with a 30-day moving average to correct for noise and short-term volatility. In December 2022, at the end of the post-FTX panic, these small investors were still sending about 2675 BTC to Binance. Today, these flows have dropped to just 411 BTC, reaching one of the lowest levels ever observed. This is not just a simple pullback but a structural decline.

Historically, these individual investors tend to become more active when the market trends upward. For instance, during the 2020-2021 rally, they flocked to exchanges as prices rose. However, in this cycle, the opposite is happening. bitcoin is on the rise, yet small investors are less visible on exchanges. Their absence is striking compared to previous cycles.”

Changing Dynamics Among Individual Investors

What accounts for this change? Darkfost suggests that the introduction of spot BTC ETFs in early 2024 plays a significant role. Since then, small investors’ entries to Binance have decreased from 1056 BTC to 411 BTC, a 60% reduction. This indicates that ETFs are serving their purpose, providing a way to hold Bitcoin without the hassles of private keys, wallet security, exchange accounts, or custody risks. Consequently, ETFs have seen tens of billions of dollars in net inflows driven by this motivation.

The new all-time low reflecting the radical shift in individual investors’ market participation should be understood within this framework. Has their appetite diminished?

“This does not imply that small investors’ interest has waned. Instead, it may reflect a more mature stance. Many may favor long-term positions that can strengthen Bitcoin’s market structure rather than tracking short-term price movements through exchanges.”

Just moments ago, WSJ shared details about Nvidia chips. According to reports, the H200 chips produced by Nvidia will be sent to China after a special review by the US. This will be outside the normal procedure. While details of the security review are unspecified, it’s stated that chips produced in Taiwan will first go to the US for review and then be sent to China, with direct exports not permitted.

To stay updated amidst the constant FLOW of news, the CryptoAppsy news section may simplify your efforts.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.