Big Players Steer Crypto Markets Under Watchful Eyes: The Power Shift You Can’t Ignore

Whale wallets and institutional funds aren't just participating in crypto anymore—they're actively steering the ship. While retail traders chase momentum, the real price action gets dictated by a handful of massive, often opaque, transactions. It's a market of followers, not leaders.

Follow the Money, Not the Hype

Forget the social media noise. The clearest signal in today's crypto landscape comes from blockchain explorers tracking whale movements. A single transfer from a dormant wallet or a series of coordinated buys from known institutional addresses can ignite—or extinguish—a rally in minutes. Liquidity pools bend to their will.

The Regulatory Gaze Intensifies

This concentration of power hasn't gone unnoticed. Watchdogs are scrambling to map these influence networks, applying traditional market surveillance logic to a decentralized ecosystem that was built to resist it. The tension is palpable: every large trade now happens under a microscope, with analysts and authorities alike trying to distinguish strategic accumulation from potential manipulation. It's the ultimate game of cat and mouse, played with billions on the line.

So, what's an investor to do? The old 'buy and hold' mantra gets complicated when the market's direction hinges on a few key players' whims. It demands a new strategy—one that watches the watchers, tracks the flow of capital, and recognizes that in crypto, the 'free market' often dances to the tune of its wealthiest patrons. Just like in traditional finance, but with less paperwork and more memes.

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

On December 8, a repetitive scenario unfolded yet again, causing some vexation among market enthusiasts. Following a robust weekend recovery, Bitcoin (BTC)![]() $91,885 reversed its upward trend shortly after the U.S. markets opened. As of the writing, BTC had retracted to $90,900 following the U.S. market close, with approximately three hours left until the daily candlestick closure. Various parties purport to have identified the underlying causes of these downturns, a notion we will now examine.

$91,885 reversed its upward trend shortly after the U.S. markets opened. As of the writing, BTC had retracted to $90,900 following the U.S. market close, with approximately three hours left until the daily candlestick closure. Various parties purport to have identified the underlying causes of these downturns, a notion we will now examine.

Why Are Cryptocurrencies Falling?

U.S. markets usually open at 17:30 Turkish time on business days. For some time, cryptocurrency prices have commonly turned downward shortly after market openings. This repeated occurrence has solidified beliefs among traders that cryptocurrencies inevitably decline following the U.S. market opening. People have thus grown accustomed to preparing for short positions, confident in these predictable shifts.

Technical analysis attempts to convert investor psychology into mathematical terms, often proving effective. This predictable downturn has anchored itself in traders’ minds as a trigger, earning a degree of validation. Since early November, BTC has routinely dipped following U.S. market openings, with similar patterns noted in the second and third quarters.

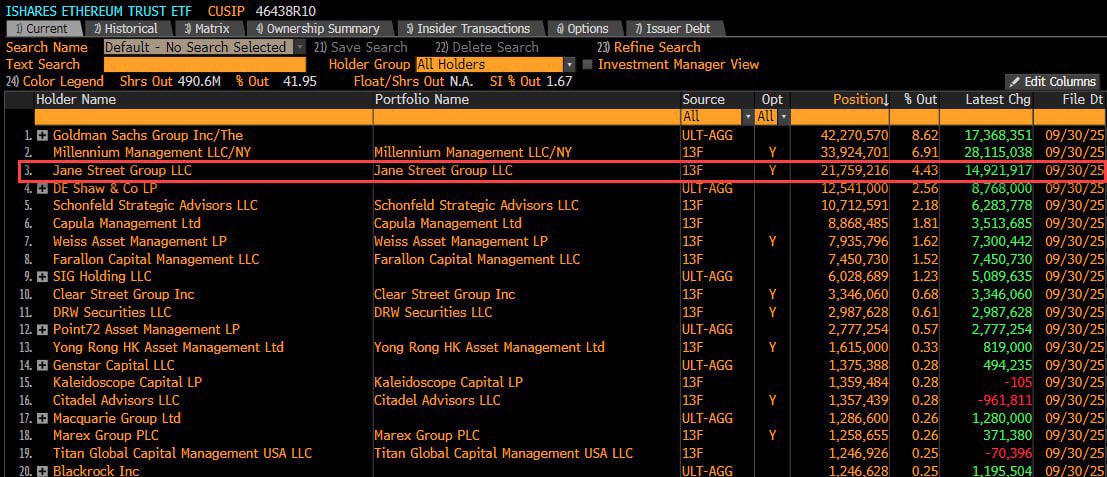

Some, like Zerohedge, LINK these movements to Jane Street. This firm’s pattern aligns too consistently to overlook. The sequence typically involves a swift drop within an hour of the market opening, followed by gradual recovery, a pattern BullTheoryio attributes to high-frequency trading firms.

Jane Street is among the largest high-frequency trading firms globally, possessing the speed and liquidity to maneuver markets within mere minutes. Historical parallels arise, particularly with the 2022 crypto crash where market makers, including Jane Street, allegedly provoked further downturns to capitalize on volatility though their involvement has stayed unproven.

BullTheoryio details a simple four-step process: driving BTC down at the opening, pushing the price into liquidity gaps, re-entering at lower prices, and repeating daily. Presently, Jane Street holds a substantial $2.5 billion position in BlackRock’s IBIT ETF, their fifth-largest position suggesting that BTC’s decline stems more from strategic manipulation than macroeconomic fragility.

Ultimately, as these major players complete their purchases, BTC could regain upward momentum. The theory suggests large-scale BTC accumulation maneuvers may perpetuate this simple scenario briefly, yet market complexities involving volatility and releasing substantial positions on the futures side pose a greater challenge.

Are Cryptos at the Bottom?

Predicting movements in any stock involves analyzing its weaknesses or strengths and forecasting the next phase. In contrast, evaluating cryptocurrencies isn’t that straightforward due to variations in speculative behaviors and diverse regional risk appetites, among other factors. Sometimes prices shift due to a multitude of factors, like Jane Street’s manipulation or other intertwined reasons.

Considering 100kg sacks illustrates this complexity: moving it on Earth differs vastly from attempting it on the Moon due to differences in gravity influencing ease of movement. Thus, understanding the multitude of factors around price shifts offers insights into market readiness for upcoming shifts.

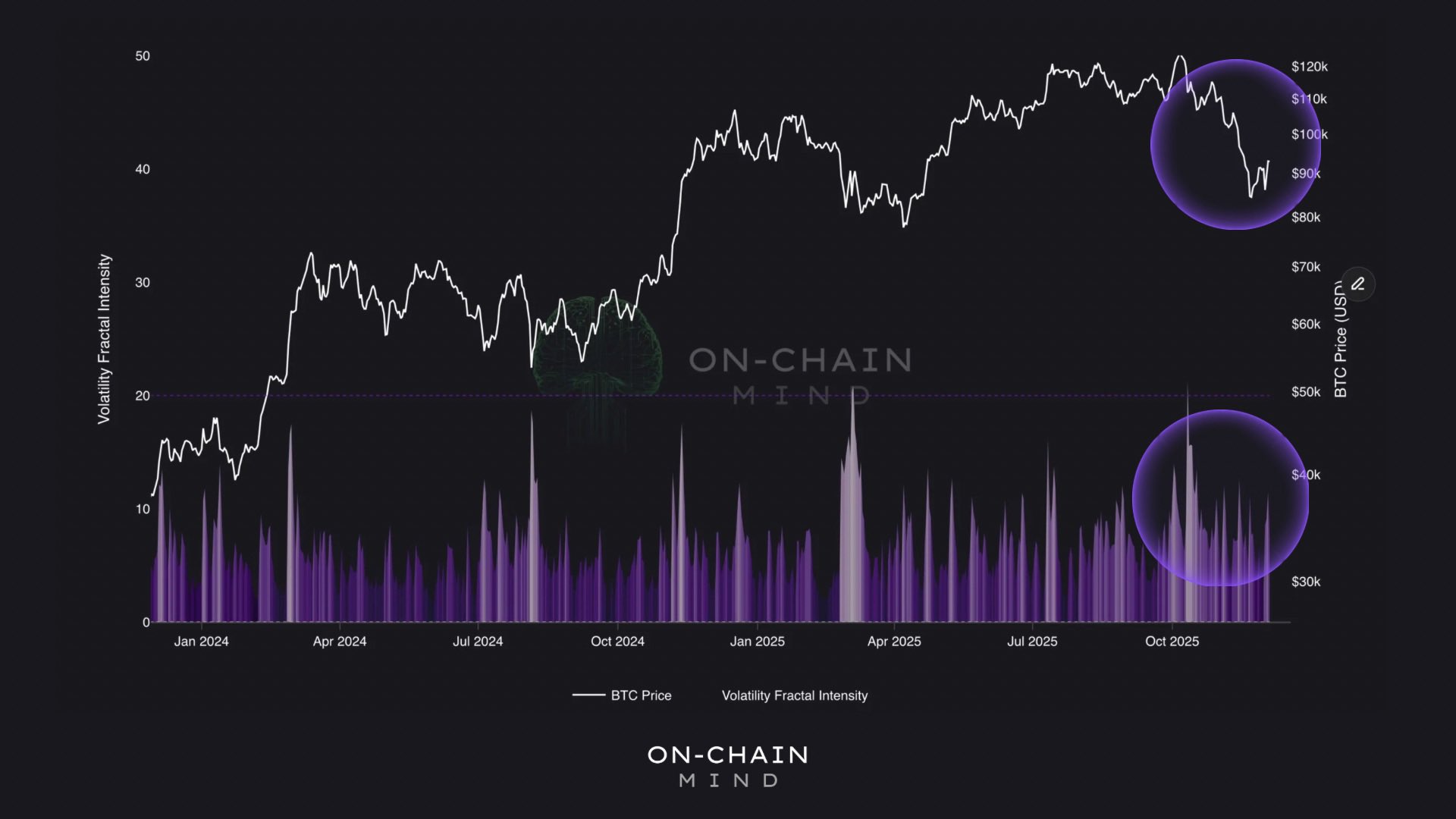

According to OnChainMind, volatility fractals currently indicate we’re not witnessing the bottom yet. This tool aligns BTC’s volatility with fractal-defined waves, suggesting deeper accumulation and rallying environments should unfold under low-volatility conditions, differing from the ongoing high-volatility phase post-October peaks.

“A crucial indicator isn’t yet aligned: volatility fractals continuing at high levels that preclude significant bottoms.”

Despite this, understanding key elements influencing cryptocurrencies helps interpret market signals proactively. Staying informed through platforms like CryptoAppsy aids traders in deciphering nuanced market flows and price direction.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.