Binance Uncovers Internal Misconduct in Token Manipulation Plot: A Wake-Up Call for Crypto Governance

Binance just exposed its own insiders in a token manipulation scheme—proving even giants aren't immune to internal rot.

The Anatomy of an Inside Job

Forget shadowy external hackers. This plot allegedly hatched within Binance's own walls. The exchange's internal surveillance flagged suspicious trading patterns—activity that didn't just break rules, it exploited the very trust the platform sells. No specific token names or dollar figures were disclosed, but the implication cuts deep: the system worked, but only after the breach occurred.

Governance Under the Microscope

Every crypto exchange sells security as a premium feature. This incident flips the script—what happens when the threat comes with an employee badge? Binance's response involved internal investigations and likely terminations, a standard corporate playbook. But in crypto's trustless ideal, this feels like a stark contradiction. It's the financial self-regulatory dilemma dressed in blockchain's clothing—police your own, until you can't.

The Ripple Effect for Crypto

Markets hate uncertainty more than bad news. This revelation lands as the sector battles for mainstream legitimacy. Regulatory bodies worldwide are already scrutinizing exchange operations; internal misconduct hands them a ready-made case study. For traders, it's a cynical reminder: your 'secure' wallet is only as strong as the humans guarding the vault. Sometimes, the biggest risk isn't market volatility—it's the people printing the charts.

Binance now walks a public tightrope—punishing misconduct while projecting strength. Their detection systems passed the test, but their preventative measures clearly failed. In traditional finance, this would mean congressional hearings. In crypto? It's Tuesday. The industry's relentless growth often outpaces its governance, leaving gaps where ambition overrides ethics. After all, what's a little internal manipulation between disruptors?

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

As the world’s largest cryptocurrency exchange by volume, Binance continues with its internal audits to identify and root out malicious actors. Regular internal audits are crucial for large companies to prevent employees from exploiting the organization and its clientele. These audits also act as a deterrent against unethical conduct, underscoring the importance of ethical integrity as the crypto industry expands.

ContentsBinance’s Suspicious Social Media PostInvestors Should Stay VigilantBinance’s Suspicious Social Media Post

made a peculiar post from its X account, featuring a tree adorned with tokens. Despite being swiftly deleted, the post did not go unnoticed due to the account’s half-million followers. The community quickly caught on to the anomaly.

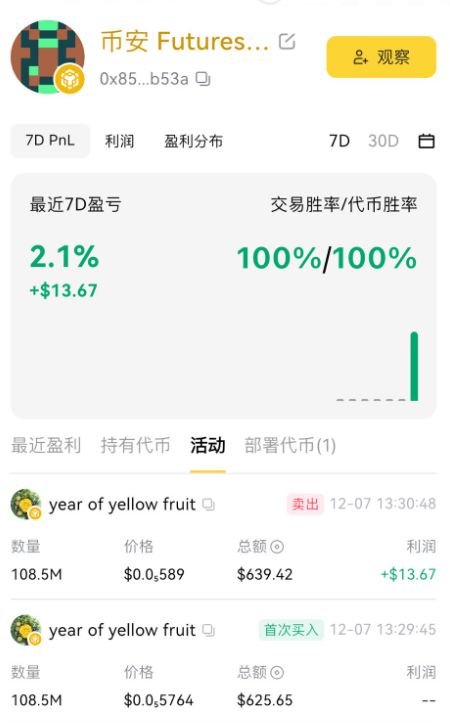

On-chain data confirmed that moments before the post, the image was used to create a token named “year of yellow fruit” on the.

Many speculated that the individual responsible for the post was linked to the token and attempted to market it discreetly. Amid the discussions, Binance revealed that an employee was caught using the official social media account for personal gain.

“These actions represent an abuse of duty for personal profit, violating our policies and professional conduct rules. The employee was immediately suspended and is facing disciplinary action.”

Following the Binance futures post, the token’s market cap surged to $3.6 million before plummeting by 83%. The latest announcement detailed the events as follows:

“On December 7, 2025, Binance’s internal audit department received a report of a staff member misappropriating insider information for personal benefit via official social media accounts. An investigation was promptly initiated, and we are sharing preliminary findings with the community:

The employee was linked to a token issued on December 7 at 05:29 UTC, and shortly afterward, token-related content was posted by the @BinanceFutures account. These actions amounted to an abuse of their position for personal profit, violating our policies and professional conduct standards.

We have proactively contacted the appropriate authorities in the employee’s jurisdiction, committing to collaboration and necessary legal actions in accordance with applicable laws.

At Binance, we prioritize user interests, committed to transparency, fairness, and integrity. We maintain zero tolerance for any kind of misconduct. We will continue to strengthen internal controls, improve policies, and ensure the prevention of such incidents.”

The company also announced a $100,000 reward for anyone reporting such breaches. This reward will be distributed among five individuals who reported the incident through Binance’s audit emails.

Investors Should Stay Vigilant

It’s possible for malicious individuals to exploit their positions within exchanges or other crypto firms for personal gain. This behavior is not exclusive to cryptocurrencies, given that people might use their positions for personal interests in various areas, such as banking or security firms.

Being aware that even official accounts could make deceitful posts could prevent you from taking such high risks for speculative gains. Staying cautious could benefit you greatly.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.