Fed’s Next Move Could Trigger Crypto’s Wildest Ride Yet—Analysts Brace for Impact

Hold onto your digital wallets. The Federal Reserve's looming decision isn't just moving traditional markets—it's about to send crypto on a volatility bender that could make previous swings look tame.

The Central Bank Catalyst

Forget quiet consolidation. Analysts are mapping potential trajectories where every basis point change in interest rates gets amplified tenfold in Bitcoin and Ethereum prices. The correlation isn't perfect, but the leverage is undeniable. When traditional liquidity tightens or flows, crypto markets don't just react—they overreact with the enthusiasm of a day trader on their third espresso.

Playing the Macro Game

This isn't 2021's pure momentum play. Smart money is now parsing Fed statements with the same intensity as Bitcoin whitepapers, building positions around terms like 'quantitative tightening' and 'dot plot.' The game has evolved from simply buying the dip to navigating a landscape where macro policy dictates micro gains. Some funds are even structuring products to profit directly from the Fed-induced chaos—because why ride the roller coaster when you can own the theme park?

Decoupling Dream or Dependency Reality?

The eternal promise of crypto as an uncorrelated asset gets its next major test. Will digital gold shine as fiat stumbles, or will the 'risk-on' label stick during a broader sell-off? True believers see this as the moment for separation; pragmatists see another chapter in a complicated relationship with traditional finance. The irony, of course, is watching decentralized assets hang on every word from the world's most centralized bank.

Get ready. The Fed's press conference might be dry, but the crypto charts that follow won't be. Just remember—in this market, 'long-term hold' sometimes means making it through the week.

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

Trump has not made any significant announcements affecting cryptocurrencies in recent times. Currently, the market is left to its own devices while everyone focuses on Powell’s remarks in this Fed week. Today, QCP Capital analysts shared their latest forecasts for cryptocurrencies.

ContentsQCP’s cryptocurrency PredictionsExpectations for CryptocurrenciesQCP’s Cryptocurrency Predictions

Bitcoin![]() $91,885 and Ether are currently stuck at shallow levels. Bitcoin struggles to surpass $94,000 and altcoins have suffered in this process. While Bitcoin remains above $90,000, many altcoins have returned to key support levels.

$91,885 and Ether are currently stuck at shallow levels. Bitcoin struggles to surpass $94,000 and altcoins have suffered in this process. While Bitcoin remains above $90,000, many altcoins have returned to key support levels.

QCP Capital analysts believe the price movements on Sunday could be an early indicator of continued volatility during the upcoming holiday season. In the last 24 hours, bitcoin fluctuated between $87,700 and $92,287, while Ether sharply rebounded from $2,919 to $3,150.

“Despite the speed and magnitude of the movement, liquidations amounted to approximately $440 million, a relatively modest figure compared to typical levels seen this year. This suggests a continued decline in general interest in cryptocurrencies due to fatigue, caution, or simple disinterest as investors await clearer direction. There is a significant decrease in the urge to take positions.” – QCP Capital Analysts

The analysts highlighted that Google search data shows terms like crypto and BTC have fallen to bear market levels. Furthermore, open positions in futures are decreasing. BTC perpetual open positions have declined by 44% from the October peak, and for ETH, this figure exceeds 50%.

“The dynamics are clear: with declining participation and deteriorating liquidity, smaller flows are increasingly required to create significant moves.” – QCP Capital Analysts

Expectations for Cryptocurrencies

While individual and smaller investors calm down, institutions and whales continue to accumulate. Even though purchases from companies like Strategy and Metaplanet have slowed, approximately 25,000 BTC has exited exchanges in the last two weeks. Bitcoin ETFs and corporate treasury companies hold more Bitcoin than all cryptocurrency exchanges combined. The movement of a large portion of the BTC supply ready for sale from exchanges to long-term investor wallets is positive.

Not only Bitcoin but also ETH exchange reserves are moving in the same direction, with the lowest ETH supply in exchanges in the past decade. Considering the 10-year inflation and other details, this bottom is extremely intriguing.

“Sunday’s movements highlighted how shallow the market has remained with year-end liquidity reducing. Therefore, it’s not surprising that institutional accumulators continue to buy on dips rather than chase rises, especially since a sustainable break above $100,000 could rekindle large-scale treasury demand.”

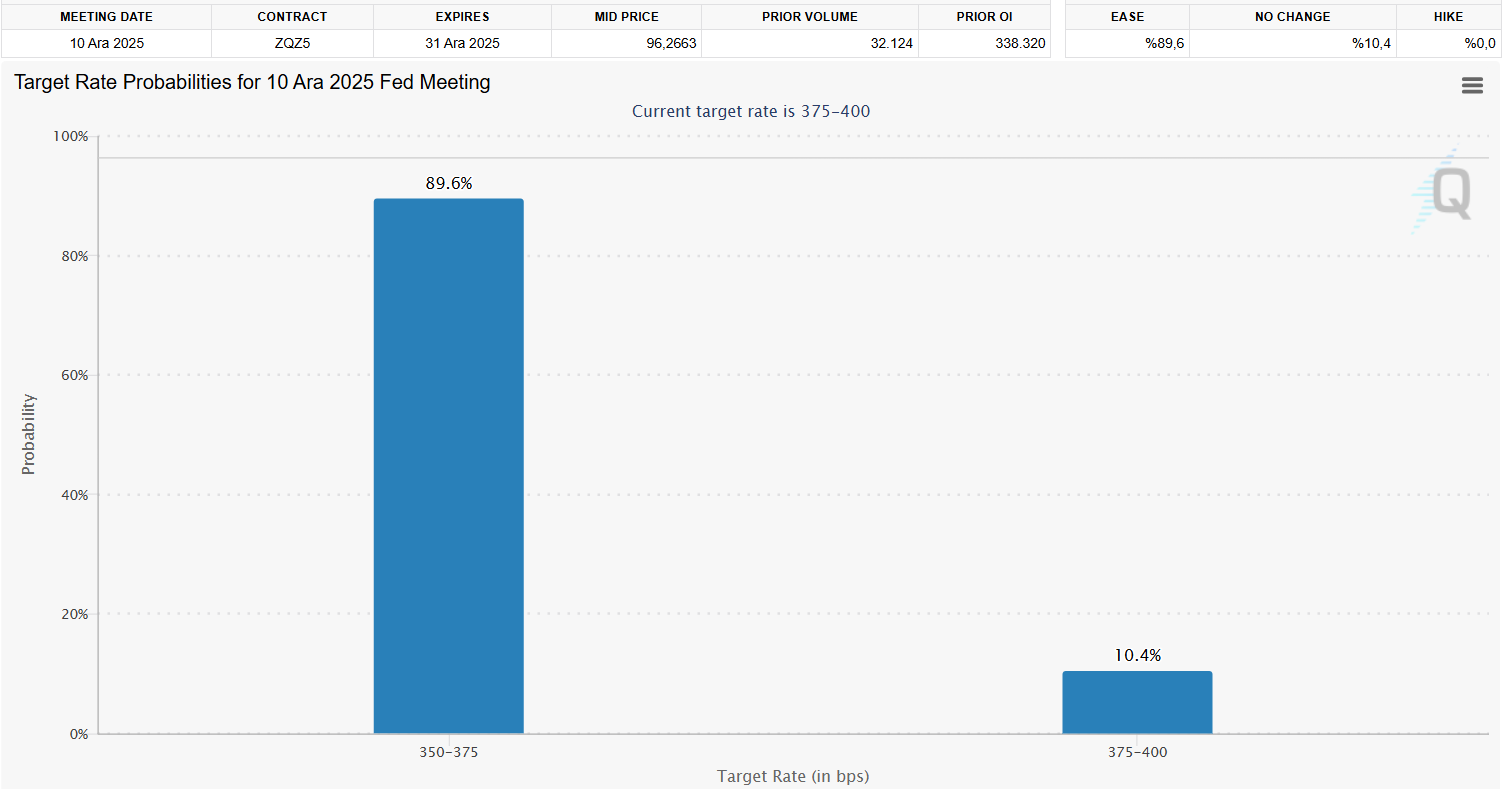

Analysts wrote that the main focus for cryptocurrencies is the Fed.

“Although a 25 basis point cut is largely priced in, markets will focus on any guidance regarding the Fed’s balance sheet strategy. Any hint about future asset purchases could trigger additional rallies in risk assets, including stocks and crypto.

For now, BTC is moving within a range, and both bullish and bearish camps will find evidence supporting their views. Ultimately, a clear break below $84,000 or above the psychological $100,000 level will determine the next major trend. Options markets reflect this: Last Friday, there was significant demand for the 25SEP26 50k/175k straddle, suggesting some investors are positioning for a noticeable MOVE once BTC breaks out of its current range.”

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.