Strategic Pivot Supercharges Bitcoin Portfolio: The Audacious Allocation Shift

Institutional players aren't just dipping toes—they're diving headfirst into digital gold.

The Rebalancing Play

Forget cautious dollar-cost averaging. A new wave of asset managers is executing aggressive tactical shifts, funneling capital directly into Bitcoin's core infrastructure. This isn't speculation; it's a calculated hedge against monetary debasement and traditional market correlation.

Beyond the Balance Sheet

The move signals deeper conviction. It's a direct investment in the network's security and a bet on its long-term store-of-value thesis, bypassing the fluff of peripheral crypto narratives. Active treasury management now means actively managing Bitcoin exposure.

The New Reserve Asset

While traditional finance debates yield curves, forward-thinking strategies are being rewritten around hashrate and hodling—proving sometimes the boldest move is to simply hold the hardest asset available. After all, in a world of quantitative easing, buying Bitcoin is the ultimate cynical hedge against the very system that prints the money.

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

Strategy, the world’s largest Bitcoin![]() $91,885 reserve company, has recently found itself at the center of numerous discussions. The company revised its targets for this year downward due to the current market conditions and announced that they might sell BTC if necessary, which fueled fear, uncertainty, and doubt (FUD). Subsequently, they created a cash reserve, which sparked further debates.

$91,885 reserve company, has recently found itself at the center of numerous discussions. The company revised its targets for this year downward due to the current market conditions and announced that they might sell BTC if necessary, which fueled fear, uncertainty, and doubt (FUD). Subsequently, they created a cash reserve, which sparked further debates.

Significant Bitcoin Acquisition

As the article was being prepared, Strategy announced last week’s BTC purchase. They acquired a total of 10,624 BTC, one of the highest figures observed in a long while. The company spent $963 million for this purchase, effectively addressing questions regarding why they weren’t investing in bitcoin with their $1.4 billion cash reserve, doubting their trust in BTC.

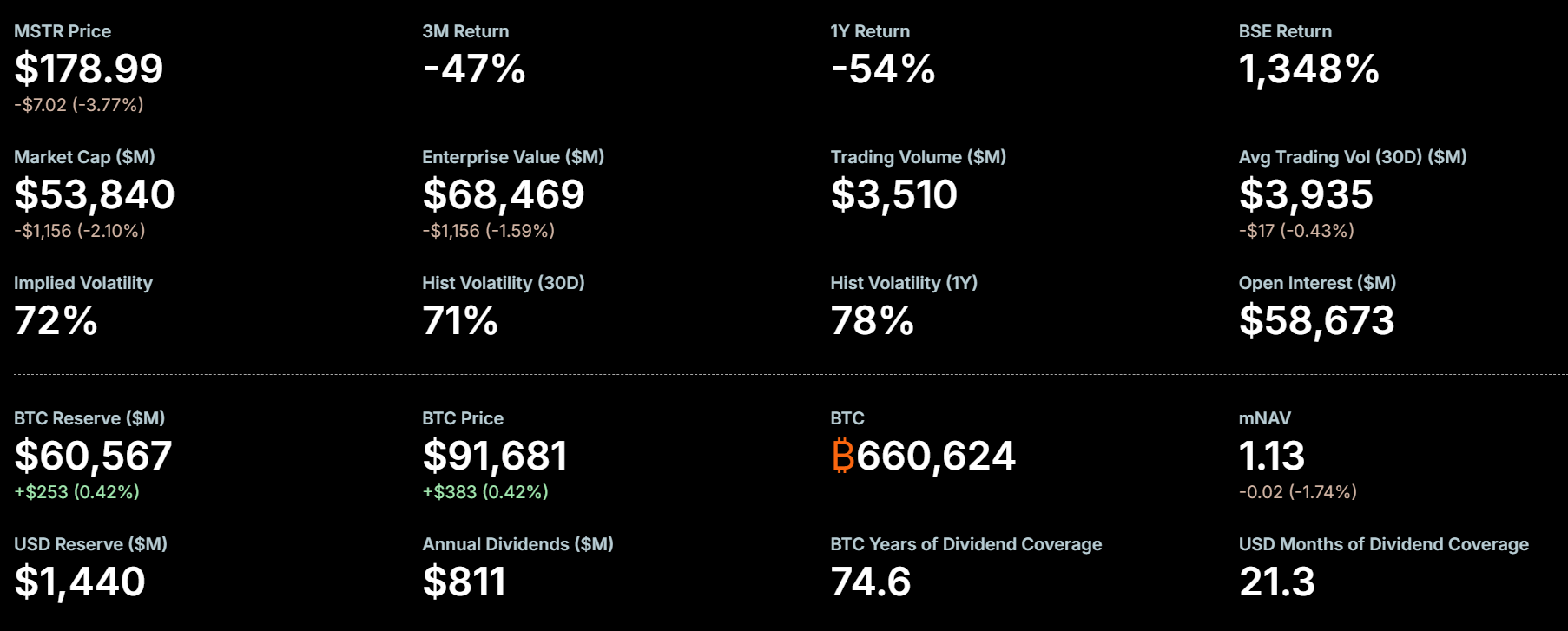

With this new acquisition, Strategy’s total assets have risen to 660,624 BTC. The recent purchases were funded through the issuance and sale of MSTR and STRD preferred shares, done at an average cost of $90,615. This indicates that they can continue to find significant cash above MNAV 1, which stands at 1.13, far from the dip observed last week.

Concerns and Responses

The average cost of all acquisitions to date has increased to $74,696, reflecting the substantial growth in their reserves since the November elections.

As is typical with each buying announcement, BTC prices dropped, but this purchase was significant. At the time of writing, TRUMP announced plans to sign a major executive order for artificial intelligence this week. If Trump’s move supports risk markets, it could also boost cryptocurrencies.

The third major development involved statements from WHITE House Senior Advisor Hassett, who mentioned:

“Powell is likely in agreement that rate cuts are a prudent step. We should lower rates a bit more and continue with cuts while monitoring data.

Trump has many good options. (Praised Fed’s Waller, Bowman, and Warsh) Trump faces a difficult choice.

Positive supply shocks will help the economy. AI makes the economy operate a bit faster.

Trump will deliver important messages about the economy this week. A lot of good news for the economy is expected.

Negotiating ACA subsidies is possible. Discussions will be held with Senate Republican Leader Thune today.

In a similar scenario to the 1990s, there is room for the 10-year yield to fall.”

Regarding Trump’s announcement this week, Hassett said, “He will clearly state that there is a single set of rules for U.S. companies.”

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.