Crypto’s Moment of Truth: Markets Brace for Fed Decision Amid Dynamic Challenges

Will the Fed's next move be the catalyst that breaks crypto—or makes it?

The entire digital asset ecosystem holds its breath. Every trader, every algorithm, every decentralized protocol is tuned to one frequency: the Federal Reserve. Its impending interest rate decision isn't just a data point; it's a seismic event that will ripple through Bitcoin, Ethereum, and every altcoin chart.

The Liquidity Litmus Test

Traditional finance loves to talk about risk management—right before it chases yield off a cliff. For crypto, the Fed's stance is a direct injection or withdrawal of the market's lifeblood: liquidity. Easy money has historically fueled explosive rallies. Tightening has triggered brutal crypto winters. The correlation isn't coincidental; it's causal.

Navigating the New Normal

This isn't 2021. The landscape has shifted. Regulatory scrutiny is the new background noise, and institutional players now move markets with billion-dollar ETF flows. Volatility isn't a bug; it's a feature being stress-tested by macro forces. The market isn't just waiting for a decision; it's pricing in a new paradigm of higher-for-longer rates, where every basis point matters.

The verdict? Crypto doesn't just face challenges—it evolves through them. The Fed's announcement will be a moment of sharp, painful clarity. Then, as always, the market will absorb the news, price it in, and start hunting the next opportunity. After all, fear and greed are the only truly decentralized protocols.

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

As the weekend approaches, Bitcoin![]() $91,237 is trading below $90,000, while the market keenly awaits the Federal Reserve’s interest rate decision on Wednesday. Historically, weeks with Fed announcements display significant volatility in both directions. Current fears concerning companies like MicroStrategy (MSTR), ETF debates, and Japan’s economic stance suggest potential bearish trends. Naturally, cryptocurrencies are unpredictable and may defy expectations with surprises. Here’s a concise update of the key events from the last 24 hours.

$91,237 is trading below $90,000, while the market keenly awaits the Federal Reserve’s interest rate decision on Wednesday. Historically, weeks with Fed announcements display significant volatility in both directions. Current fears concerning companies like MicroStrategy (MSTR), ETF debates, and Japan’s economic stance suggest potential bearish trends. Naturally, cryptocurrencies are unpredictable and may defy expectations with surprises. Here’s a concise update of the key events from the last 24 hours.

Latest Developments in the Cryptocurrency World

Bitcoin’s increasing correlation with macroeconomic factors has elevated its stakes, displaying sensitivity to metrics like PMI and PCE. This shift has seen crypto enthusiasts turn into macro analysts, adapting to rapid changes in global markets. As such, we’ve summarized pivotal developments for you in the past day.

Cantor Fitzgerald reduced the price target for Strategy (MSTR) shares by 60%, down to $229, amidst MSCI delisting discussions and asset value declines. This is due to the potential risk from MSCI Index dropping companies majorly invested in digital assets.

Italy has set a deadline for crypto companies to comply with MiCA regulations by December 30. Meanwhile, Ripple![]() $2 CEO Brad Garlinghouse has set an ambitious Bitcoin price target of $180,000 by 2026.

$2 CEO Brad Garlinghouse has set an ambitious Bitcoin price target of $180,000 by 2026.

Ethereum![]() $3,125 Layer 2 network Base has successfully integrated with Solana

$3,125 Layer 2 network Base has successfully integrated with Solana![]() $137 using Chainlink’s interoperability protocol. Despite Bitcoin having receded 30% from its peak, analysts note that corrections of this magnitude haven’t historically reversed positive trends.

$137 using Chainlink’s interoperability protocol. Despite Bitcoin having receded 30% from its peak, analysts note that corrections of this magnitude haven’t historically reversed positive trends.

Ethereum is gearing up for a significant update this year to reduce the dominance of major staking pools on its network. The proposed change is aimed at maintaining decentralization, sparking debate within the community due to its perceived market intervention nature.

Twenty One Capital, steered by Jack Mallers, is set to merge with Cantor Equity Partners, preparing it to trade on the NYSE. The firm is Tether and Sofbank-backed, holding 42,000 BTC, positioning itself as a competitor to MSTR.

Chainlink (LINK) ETF

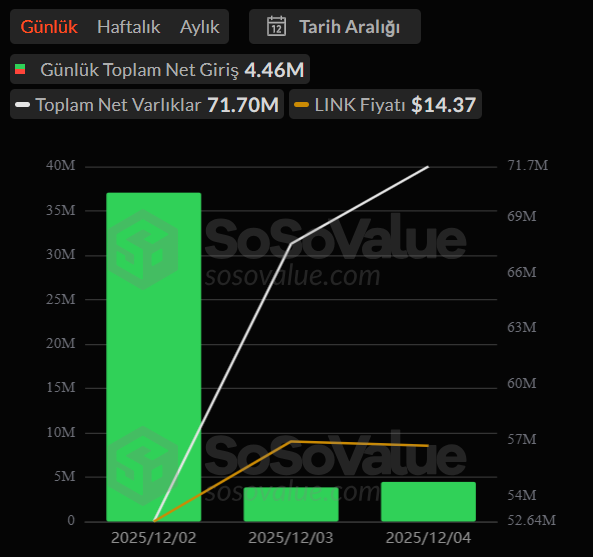

Chainlink![]() $14 introduced an ETF that might signal an opportunity, demonstrating resilience despite a fearful market environment. Initial entry was noteworthy, with a $37 million influx on its first day, yet participation dwindled thereafter, marking $3.84 million and $4.46 million for consecutive days.

$14 introduced an ETF that might signal an opportunity, demonstrating resilience despite a fearful market environment. Initial entry was noteworthy, with a $37 million influx on its first day, yet participation dwindled thereafter, marking $3.84 million and $4.46 million for consecutive days.

The ongoing albeit minimal entry amid a generally negative market sentiment provides an optimistic outlook. Once December 5th figures are released, a clearer picture will emerge. Currently, the LINK ETF, named GLNK, boasts a net asset value of $71.7 million, representing 0.72% of LINK’s market cap. Despite market challenges, this performance rate is commendable.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.