BTC Price Prediction 2025: Can Bitcoin Really Hit $200,000 This Cycle?

- Bitcoin Technical Analysis: The Road to $200K

- Key Factors Supporting Bitcoin's Bullish Case

- Potential Roadblocks to $200,000

- The Path to $200,000: Key Levels to Watch

- Frequently Asked Questions

Bitcoin's current rally has the crypto community buzzing with excitement as BTC tests key resistance levels near $118,000. With institutional adoption accelerating, Fed rate cuts providing tailwinds, and technical indicators flashing bullish signals, many analysts believe $200,000 could be within reach. This in-depth analysis examines the fundamental and technical factors driving Bitcoin's price action, explores critical resistance levels, and evaluates whether the $200K target is realistic in the current market cycle.

Bitcoin Technical Analysis: The Road to $200K

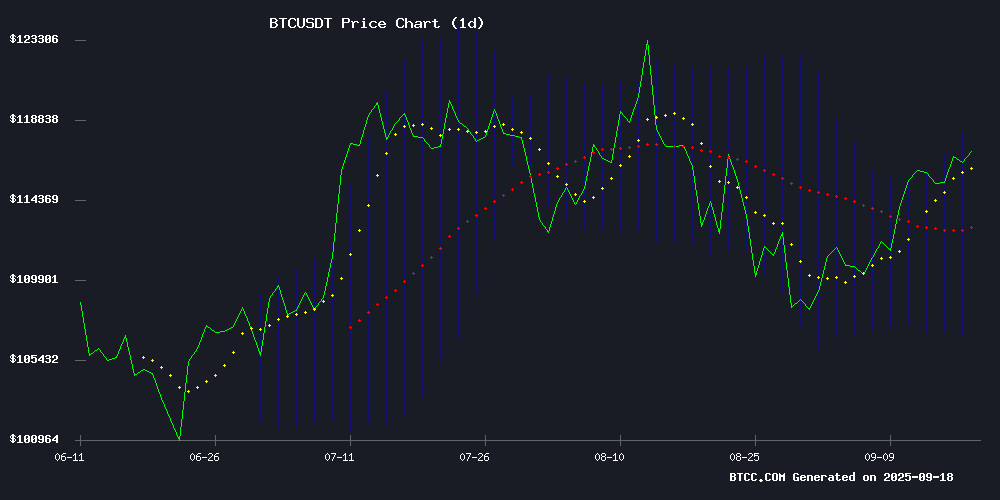

As of September 2025, bitcoin is trading at $117,865, showing strength above the critical 20-day moving average of $112,934. The MACD indicator remains slightly negative at -2,953.68, suggesting some lingering bearish momentum, though the histogram shows potential convergence that often precedes trend reversals.

Source: BTCC Trading Platform

"The $118,800 level represents a major psychological and technical barrier," notes the BTCC research team. "A sustained break above this level with strong volume could open the floodgates for a MOVE toward $125,000 initially, with $200,000 becoming a realistic longer-term target."

Key Factors Supporting Bitcoin's Bullish Case

1. Institutional Adoption Reaches New Highs

The launch of Poland's first Bitcoin ETF on the Warsaw Stock Exchange marks another milestone in institutional adoption. With over 400 listed companies and nearly $600 billion in market capitalization, WSE's endorsement carries significant weight in Central and Eastern European markets.

2. Federal Reserve Policy Shift

The Fed's recent 25 basis point rate cut - the first since December 2024 - has injected fresh Optimism into risk assets. While traditional markets wavered, Bitcoin held firm, demonstrating its evolving role as an institutional asset class.

3. Record Accumulation by Long-Term Holders

On-chain data reveals a surge in accumulation address inflows, with CryptoQuant reporting record BTC purchases by strategic holders. This suggests deep-pocketed investors are positioning for potential macroeconomic turbulence.

Potential Roadblocks to $200,000

While the bullish case appears strong, several factors could derail Bitcoin's march toward $200K:

| Challenge | Impact |

|---|---|

| Corporate Demand Cooling | MicroStrategy's monthly purchases dropped from 134,000 BTC to 3,700 BTC |

| Bank Liquidity Surge | $30.4 trillion flowing into banking systems could divert capital from crypto |

| Technical Resistance | $118,800 level proving difficult to break decisively |

The Path to $200,000: Key Levels to Watch

Based on current technicals and market conditions, reaching $200,000 WOULD require Bitcoin to overcome several critical levels:

| Target | Required Gain | Key Factors |

|---|---|---|

| $125,000 | +6% | Break above Bollinger upper band |

| $150,000 | +27% | Previous ATH consolidation |

| $200,000 | +70% | Macro adoption acceleration |

Frequently Asked Questions

What's driving Bitcoin's current price movement?

The combination of Fed rate cuts, institutional ETF adoption, and strong accumulation by long-term holders is creating a perfect storm for Bitcoin's price appreciation. The cryptocurrency has shown remarkable resilience, quickly rebounding from brief pullbacks.

How reliable are the technical indicators for Bitcoin?

The weekly Stochastic RSI has crossed into bullish territory, a pattern that historically preceded significant rallies. However, technical indicators should always be considered alongside fundamental factors and market sentiment.

Is corporate demand for Bitcoin decreasing?

While corporate holdings reached 1 million BTC this year, the pace of accumulation has slowed. MicroStrategy's monthly purchases dropped dramatically, suggesting corporations are taking a more measured approach to Bitcoin acquisition.

What role does mining difficulty play in Bitcoin's price?

The upcoming difficulty adjustment (projected to increase 4.9% to 142.7 trillion) demonstrates strong network fundamentals. Historically, rising difficulty correlates with long-term price appreciation as it indicates miner commitment.

How likely is Bitcoin to reach $200,000 in 2025?

While possible, it would require sustained momentum above $120,000, continued institutional adoption, and favorable macroeconomic conditions. The BTCC research team suggests $200K is achievable but not guaranteed in this cycle.