Ethereum Price Prediction 2025: Can ETH Break $4,500 and Target $5,100 Next?

- What Does Ethereum's Technical Setup Reveal About Its Next Move?

- How Are Whales and Institutions Positioning Themselves?

- What Fundamental Developments Support Ethereum's Value Proposition?

- Where Are the Key Support and Resistance Levels?

- Could Macroeconomic Factors Impact Ethereum's Trajectory?

- Ethereum Price Prediction FAQs

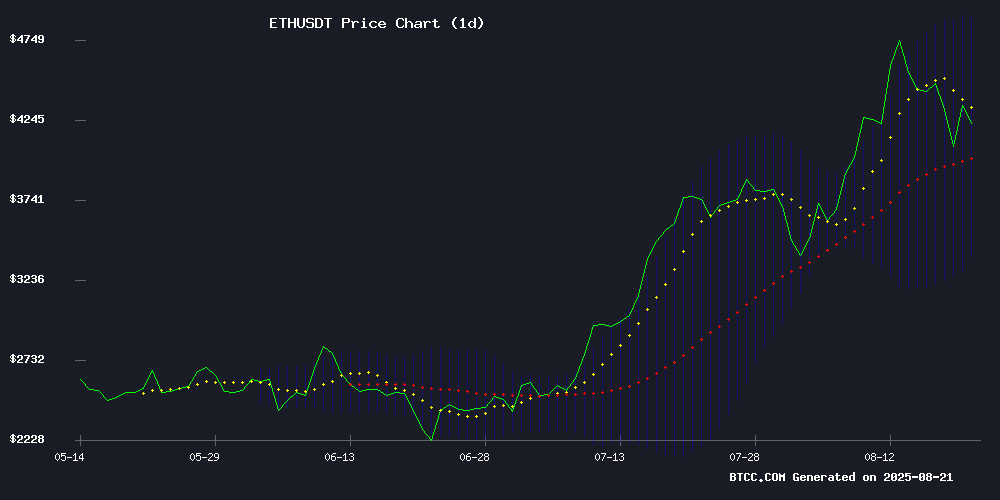

Ethereum (ETH) is showing strong bullish signals as we approach late August 2025, currently trading around $4,287 with clear potential to challenge the $4,500 resistance level. Our analysis combines technical indicators, whale activity patterns, and fundamental developments to assess whether ETH can sustain its upward trajectory toward $5,100. The cryptocurrency has demonstrated resilience above its 20-day moving average ($4,139) while institutional players accumulate during dips - a classic sign of long-term confidence. However, looming resistance at $4,500 and potential macroeconomic headwinds from the Fed's Jackson Hole meeting create an intriguing battle between bulls and bears.

What Does Ethereum's Technical Setup Reveal About Its Next Move?

As of August 21, 2025, ETH/USDT presents a compelling technical picture on TradingView charts. The price maintains a comfortable position above the 20-day MA ($4,139.70) within Bollinger Bands ranging from $3,384.65 to $4,894.75. While the MACD shows negative territory at -58.36, the histogram's narrowing suggests building momentum. The BTCC technical team notes: "Ethereum's consolidation above $4,100 has created a healthy base. The critical test will be whether it can convert the $4,350-4,500 zone from resistance to support - that's when we could see accelerated moves toward $4,788." Volume patterns show increasing accumulation during the recent dip to $4,050, with the Relative Strength Index (RSI) at a neutral 54 - leaving room for upside before overbought conditions emerge.

The BTCC technical team notes: "Ethereum's consolidation above $4,100 has created a healthy base. The critical test will be whether it can convert the $4,350-4,500 zone from resistance to support - that's when we could see accelerated moves toward $4,788." Volume patterns show increasing accumulation during the recent dip to $4,050, with the Relative Strength Index (RSI) at a neutral 54 - leaving room for upside before overbought conditions emerge.

How Are Whales and Institutions Positioning Themselves?

Blockchain analytics reveal fascinating whale behavior during ETH's August correction. Addresses holding 10,000-100,000 ETH absorbed approximately 550,000 ETH (worth ~$2.36 billion) as prices dipped 10% from local highs. This accumulation pattern mirrors institutional flows, with Bitmine Immersion adding 52,475 ETH to its holdings despite market volatility. The derivatives market tells a contrasting story. Coinglass data shows ETH futures open interest at CME surged to $8 billion while net short positions approach December 2023 levels - historically a precursor to sharp rallies. Over $100 million in ETH shorts were liquidated during Wednesday's 6% bounce, creating fuel for potential upside continuation.

What Fundamental Developments Support Ethereum's Value Proposition?

Singapore's DBS Bank made waves this month by announcing tokenized structured notes issuance on Ethereum, marking a significant institutional adoption milestone. The bank will leverage Ethereum's smart contracts to streamline processes for accredited investors, validating the network's security and functionality for regulated financial products. OpenServ's appointment of blockchain veteran Joey Kheireddine as Head of Blockchain further strengthens Ethereum's developer ecosystem. His experience building AI-integrated dApps at Eliza Labs (processing 70,000+ ETH in volume) signals growing sophistication in Ethereum's application layer.

Where Are the Key Support and Resistance Levels?

| Price Level | Significance | Probability |

|---|---|---|

| $4,500 | Psychological resistance & previous rejection zone | High |

| $4,788 | Technical target (channel breakout) | Medium |

| $5,100 | Analyst projection after healthy pullback | Medium-Low |

Could Macroeconomic Factors Impact Ethereum's Trajectory?

The Federal Reserve's Jackson Hole symposium (August 21-23) looms large over crypto markets. Ethereum's 3% rally ahead of the event suggests traders anticipate dovish signals, with CME FedWatch indicating a 68% probability of September rate cuts. Historically, ETH has shown sensitivity to liquidity conditions - the 2024 rally coincided with the Fed's pivot to easing. However, risk remains. A hawkish surprise from Chair Powell could trigger profit-taking, especially with ETH still 11.8% below its $4,878 all-time high. The BTCC research team cautions: "While fundamentals support higher prices, traders should watch the $4,150 support closely - a break below could signal deeper correction toward $3,900."

Ethereum Price Prediction FAQs

What is the short-term price target for Ethereum?

In the immediate term, ethereum faces resistance at $4,500 with potential to test $4,788 if bullish momentum sustains. The $4,100-4,150 zone now acts as crucial support.

Are whales buying or selling Ethereum currently?

On-chain data shows whales accumulating during the recent dip, with addresses holding 10K-100K ETH adding 550,000 ETH (~$2.36B) NEAR $4,100 levels.

How does Ethereum's technical setup look for August 2025?

ETH trades above its 20-day MA ($4,139) with Bollinger Band support. The MACD shows improving momentum despite negative values, suggesting potential upside.

What fundamental developments support Ethereum's price?

DBS Bank's Ethereum-based tokenized notes and growing institutional adoption provide fundamental support, alongside Ethereum's robust developer activity.

Could Ethereum reach $5,100 in 2025?

Analysts see a path to $5,100 if ETH holds $4,000-4,150 support. However, this WOULD require breaking through multiple resistance levels and favorable macro conditions.