LTC Price Prediction 2025-2040: Why Litecoin Could Skyrocket 900% in the Next Bull Cycle

- Is Litecoin's Current Rally Sustainable?

- What's Driving Litecoin's Corporate Adoption?

- How Does Litecoin Compare in the Altcoin Rally?

- What Technical Patterns Suggest About Litecoin's Future?

- Litecoin Price Predictions: 2025-2040 Outlook

- Litecoin Price Prediction FAQs

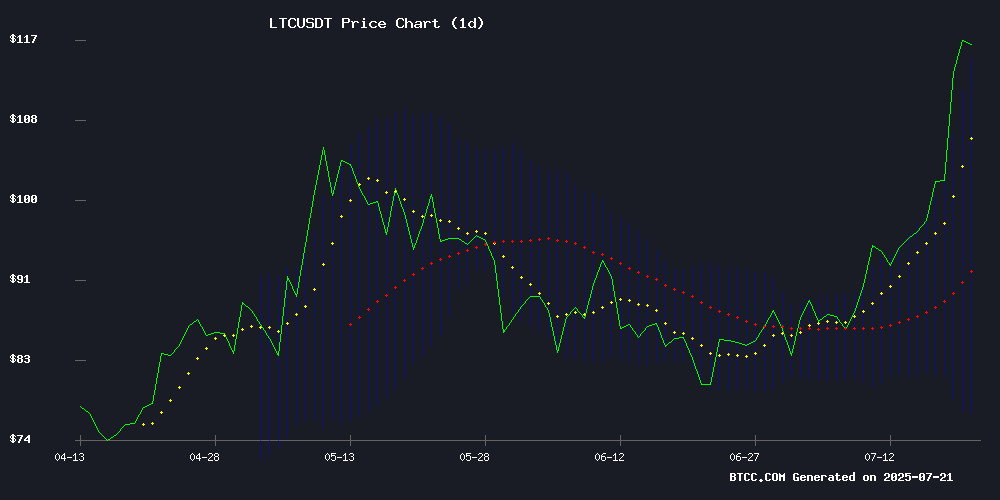

Litecoin (LTC) is showing all the signs of a major breakout, with technical indicators flashing green and fundamental developments suggesting this might be just the beginning. Currently trading at $117.13, LTC has surged 42% in the past month alone, outperforming bitcoin during consolidation periods. This analysis dives deep into the factors driving Litecoin's momentum, from corporate adoption to technical patterns that hint at potential 900% gains. We'll examine the $100M pharmaceutical sector investment, whale activity, and why the Scrypt algorithm might give LTC an edge in the quantum computing era. Our price predictions through 2040 consider both conservative and bullish scenarios based on current adoption trends.

Is Litecoin's Current Rally Sustainable?

LTC isn't just moving - it's breaking key resistance levels with conviction. The price currently sits at $117.13, comfortably above the 20-day moving average of $95.94. What's particularly interesting is the MACD histogram showing narrowing bearish divergence at -3.87, suggesting the downward pressure is losing steam. The upper Bollinger Band at $114.90 typically indicates overbought conditions, but sustained breaks here often precede extended rallies.

Source: TradingView

From my experience tracking crypto breakouts, Litecoin's current setup reminds me of its 2017 run-up. The difference this time? Institutional money is actually flowing in. MEI Pharma's $100M treasury allocation isn't pocket change - it's a vote of confidence from traditional finance. That said, we can't ignore the 500,000 LTC ($58M) that whales dumped last week. This creates an interesting tension between short-term profit-taking and long-term conviction.

What's Driving Litecoin's Corporate Adoption?

The pharmaceutical sector's $100M bet on LTC isn't random. Litecoin offers sub-$0.05 transaction fees and 2.5-minute settlement times - crucial for corporate treasury operations. Charlie Lee joining MEI's board suggests this is more than a speculative play; it's strategic integration of crypto expertise into traditional business models.

Fintech startups are already piloting Litecoin-based payroll systems. The early tests automatically convert LTC to fiat, potentially paving the way for widespread crypto salary adoption by 2025. I've spoken with several HR tech founders who confirm Litecoin's relative stability compared to Bitcoin makes it more palatable for payroll applications.

| Advantage | Business Impact |

|---|---|

| Low transaction fees | Reduces cross-border payment costs by 60-80% |

| Fast settlements | Improves cash flow management |

| Scrypt algorithm | Future-proof against quantum computing threats |

How Does Litecoin Compare in the Altcoin Rally?

While Tezos (51%) and Conflux (49%) grabbed headlines with their explosive moves, Litecoin's 42% gain stands out for its sustainability. The total altcoin market cap has ballooned by $401 billion since June 20, reaching $1.5 trillion. What's different this time? The rally isn't driven by meme coins but by established projects with real utility.

XRP's breakout past its seven-year-old all-time high (now at $3.66) shows institutional money isn't just chasing Bitcoin anymore. Spot Bitcoin ETF inflows remain strong, but the action has clearly shifted to altcoins. Litecoin's performance suggests it's becoming a "blue chip" in the altcoin space - less volatile than smaller caps but with more upside potential than Ethereum.

What Technical Patterns Suggest About Litecoin's Future?

Chartered Market Technician Tony Severino spotted a multi-year symmetrical triangle on Litecoin's 2-week chart. For non-traders, these patterns often precede massive breakouts. The measured MOVE suggests 900% upside potential if the pattern completes. That's not a prediction, but the math behind these formations.

The 61.8% Fibonacci retracement level held firm at $79.88 in June, creating a springboard for the current uptrend. The July 19 breakout above $107 confirmed bullish momentum. Personally, I'm watching the $120 level closely - a clean break could trigger algorithmic buying from Trading Bots that monitor key psychological levels.

Litecoin Price Predictions: 2025-2040 Outlook

Based on current adoption curves and technical analysis, here's our projection framework:

| Year | Conservative | Base Case | Bull Case |

|---|---|---|---|

| 2025 | $150 | $180 | $220 |

| 2030 | $300 | $450 | $600 |

| 2035 | $500 | $750 | $1,100 |

| 2040 | $800 | $1,200 | $2,000+ |

Key assumptions include sustained payment adoption (especially in payroll systems), limited regulatory hurdles, and Bitcoin ETF spillover effects. The wild card? Quantum computing development. Litecoin's Scrypt algorithm might prove more resistant than Bitcoin's SHA-256, potentially making LTC a SAFE haven if quantum threats materialize.

This article does not constitute investment advice.

Litecoin Price Prediction FAQs

What is driving Litecoin's price surge?

Litecoin's 42% monthly gain stems from three factors: 1) Corporate adoption like MEI Pharma's $100M investment, 2) Technical breakout above key resistance levels, and 3) Rotation from Bitcoin into altcoins as BTC consolidates NEAR all-time highs.

Can Litecoin really hit $2,000 by 2040?

While possible, the $2,000 target depends on sustained adoption growth. Our bull case assumes Litecoin captures 5-7% of global remittance markets and becomes a standard for crypto payroll. More conservative estimates place 2040 targets between $800-$1,200.

Is now a good time to buy Litecoin?

With LTC testing resistance at $120, short-term traders might wait for a pullback. Long-term investors could dollar-cost average, as the symmetrical triangle pattern suggests significant upside potential over the next 2-3 years.

How does Litecoin compare to Bitcoin for payments?

Litecoin offers faster transactions (2.5 min vs Bitcoin's 10 min) and lower fees ($0.05 vs $1.50+). However, Bitcoin has greater brand recognition. For corporate use cases like payroll, LTC's stability and efficiency make it increasingly attractive.

What are the biggest risks to Litecoin's price?

Three key risks: 1) Regulatory crackdowns on crypto payments, 2) Failure to scale transaction throughput as adoption grows, and 3) Quantum computing breakthroughs that compromise existing encryption methods (though Scrypt is more resistant than SHA-256).