ETH Price Prediction 2025: Will Ethereum Break Through Key Resistance Levels Amid Market Crosscurrents?

- What's the Current Technical Picture for Ethereum?

- How Are Fundamental Factors Influencing ETH's Price?

- What Recent Events Are Impacting Ethereum's Market?

- Where Could ETH Price Go From Here?

- Ethereum Price Prediction 2025: Q&A

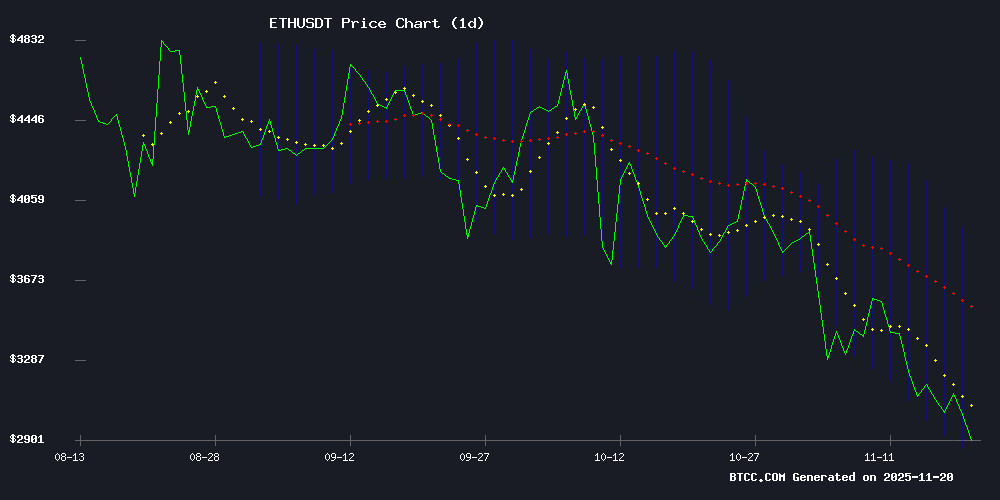

Ethereum finds itself at a critical juncture as we approach the end of 2025, caught between technical resistance and fundamental crosscurrents. Currently trading at $3,029.40 (as of November 20, 2025), ETH shows signs of both weakness and potential - sitting 9.6% below its 20-day moving average while institutional players like Bitmine continue accumulating despite the downturn. This analysis examines the competing forces shaping ETH's price trajectory, from Vitalik Buterin's decentralization warnings to Coinbase's DeFi expansion in Brazil. With MACD showing bearish momentum at -39.47 but exchange reserves dwindling to 15.9 million ETH, the stage is set for potentially volatile price movements in the coming weeks.

What's the Current Technical Picture for Ethereum?

Ethereum's technical setup presents a mixed bag as of November 2025. The BTCC team's analysis reveals ETH trading at $3,029.40, significantly below its 20-day moving average of $3,352.47 - typically a bearish signal. The MACD indicator confirms negative momentum with its -39.47 reading, though the price hovering NEAR the lower Bollinger Band at $2,840.75 suggests we might be approaching oversold territory.

Looking at TradingView data, we see an interesting tension between indicators. While the moving average convergence divergence (MACD) shows bearish momentum, the relative strength index (RSI) at 38 suggests ETH isn't quite in oversold territory yet. This creates what traders call a "wait and see" environment - not clearly bullish or bearish enough to trigger major moves either way.

How Are Fundamental Factors Influencing ETH's Price?

The fundamental landscape for ethereum resembles a tug-of-war between institutional adoption and decentralization concerns. On one side, we have BlackRock and other Wall Street giants now holding nearly 10% of circulating ETH supply through ETFs and corporate treasuries. On the other, Vitalik Buterin warns this institutional flood could erode Ethereum's core values.

Coinbase's expansion of its DeFi Mullet service to Brazil represents another fundamental positive, making onchain trading accessible to retail users. Meanwhile, Bitmine's accumulation of 21,054 ETH during this downturn shows institutional conviction remains strong. It's this push-pull between adoption and ideology that's creating the current market uncertainty.

What Recent Events Are Impacting Ethereum's Market?

Several notable developments are shaping ETH's price action as we approach year-end 2025:

Wallet Breach at Trump-Linked Crypto Project

The security incident affecting World Liberty Financial's wallet infrastructure just before launch highlights ongoing vulnerabilities in crypto ecosystems. While WLFI responded swiftly, the breach of 272 wallets via phishing schemes tied to Ethereum's EIP-7702 upgrade serves as a reminder that security remains a work in progress.

Vitalik's Institutional Warning

Buterin's Devconnect comments about Wall Street's growing ETH holdings (now approaching $18 billion across nine major ETF issuers) raised important questions about Ethereum's future direction. His concern that institutions prioritize "speed and financial optimization" over decentralization resonates with many in the core Ethereum community.

Coinbase's Brazilian DeFi Push

The expansion of Coinbase's DeFi Mullet service following its successful U.S. launch shows growing mainstream demand for simplified onchain trading. By aggregating liquidity from top DEXs while maintaining self-custody, Coinbase is bridging the gap between centralized convenience and decentralized principles.

Bitmine's Strategic Accumulation

Tom Lee's Bitmine continues its contrarian strategy, accumulating ETH during market weakness. Their recent transfer of 21,054 ETH to a new wallet signals confidence in Ethereum's long-term value despite short-term volatility. This institutional accumulation contrasts sharply with retail investors who've largely capitulated during the downturn.

Where Could ETH Price Go From Here?

Based on current technicals and fundamentals, the BTCC team projects several potential scenarios for Ethereum's price trajectory:

| Price Target | Probability | Key Conditions |

|---|---|---|

| $3,400 | Medium | Break above 20-day MA, sustained DeFi growth |

| $3,200 | High | Consolidation above $3,000, reduced regulatory concerns |

| $3,600 | Low | Strong institutional adoption, MACD bullish crossover |

The most likely near-term scenario sees ETH testing the $3,350-$3,400 range (10-12% upside) if it can overcome the 20-day MA resistance. However, failure to hold $3,000 support could see a retest of the lower Bollinger Band around $2,840. The dwindling exchange reserves (down from 27M to 15.9M ETH) suggest any demand resurgence could trigger a sharp MOVE upward due to supply constraints.

Ethereum Price Prediction 2025: Q&A

Is Ethereum currently in a bullish or bearish trend?

As of November 2025, Ethereum shows mixed signals. The price below the 20-day MA and negative MACD suggest bearish momentum, but institutional accumulation and dwindling exchange reserves indicate underlying strength. It's more of a consolidation phase than a clear trend.

What's the significance of ETH trading below its 20-day moving average?

The 20-day MA acts as dynamic resistance when price trades below it. ETH's current 9.6% deficit suggests short-term weakness, but a decisive break above could signal trend reversal. Many traders watch this level closely for directional clues.

How are institutions affecting Ethereum's price?

Institutions bring both liquidity and volatility. Their growing ETH holdings (nearly 10% of supply) provide price support during dips but may also lead to larger swings as they rebalance positions. The tension between their financial priorities and Ethereum's decentralization ethos adds another LAYER of complexity.

What are the key support and resistance levels to watch?

Key support sits at $3,000 (psychological level) and $2,840 (lower Bollinger Band). Resistance appears at $3,352 (20-day MA) and $3,400 (previous swing high). A break above $3,400 could open path to $3,600, while losing $2,840 might trigger further downside.

How does the MACD reading affect ETH's outlook?

The current -39.47 MACD suggests bearish momentum remains intact. Traders typically look for a bullish crossover (MACD line crossing above signal line) to confirm trend reversal potential. Until that occurs, the momentum picture remains cautious.