Bitcoin Price Forecast 2025-2040: Expert Analysis & Market Projections

- Where Is Bitcoin Price Headed in 2025?

- What's Driving Bitcoin's Price Action?

- Long-Term Bitcoin Price Projections

- Frequently Asked Questions

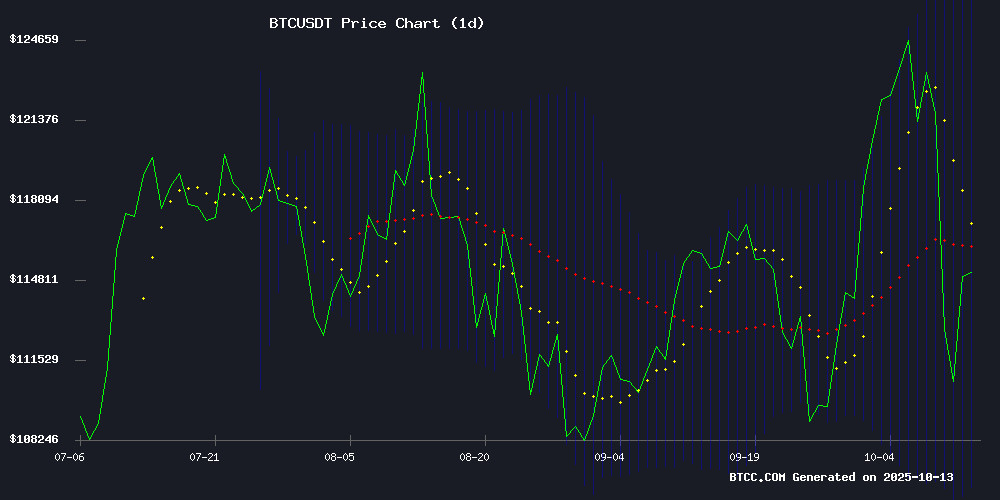

As we navigate October 2025, bitcoin continues to dominate crypto discussions with its volatile yet promising trajectory. Our comprehensive analysis combines technical indicators, institutional movements, and macroeconomic factors to project BTC's potential price path through 2040. From the current consolidation below $115,000 to potential million-dollar valuations, we break down the key drivers that could shape Bitcoin's future.

Where Is Bitcoin Price Headed in 2025?

According to TradingView data, Bitcoin currently trades at $114,202.38, caught between critical technical levels. The 20-day moving average at $116,644.25 acts as resistance, while the lower Bollinger Band at $106,199.71 provides support. This creates what analysts call a "compression zone" - where breakout potential builds with each passing day.

The BTCC research team notes several conflicting signals:

- Bearish: MACD shows negative momentum at -3,882.03

- Neutral: Price sits mid-channel in Bollinger Bands

- Bullish: Institutional buying continues despite volatility

What's Driving Bitcoin's Price Action?

Technical Factors

The $114,300 level has become this quarter's most watched price point. Five times since July, this level flipped from resistance to support, creating what chartists call a "validation zone." A sustained break above could trigger algorithmic buying toward $117,300.

Institutional Activity

MARA Holdings made waves last week with a 400 BTC ($46.29M) purchase, continuing their accumulation strategy. Blockchain analysts note this follows their pattern of buying during pullbacks - a sign of long-term conviction.

Regulatory Developments

The Bitcoin Core v30 update controversy highlights the ongoing tension between innovation and stability in crypto. While the expanded OP_RETURN capacity enables new functionality, critics worry about blockchain bloat.

Long-Term Bitcoin Price Projections

| Year | Price Range | Key Drivers |

|---|---|---|

| 2025 | $90,000 - $140,000 | ETF flows, halving effects, regulatory clarity |

| 2030 | $250,000 - $500,000 | Institutional adoption, global payment integration |

| 2035 | $800,000 - $1,500,000 | Network effects, store-of-value dominance |

| 2040 | $1,500,000 - $3,000,000+ | Potential global reserve asset status |

Frequently Asked Questions

What's the most realistic Bitcoin price for 2025?

Given current technicals and fundamentals, our analysis suggests Bitcoin will likely trade between $90,000-$140,000 through 2025. The wide range accounts for potential macroeconomic shocks versus accelerated adoption scenarios.

Could Bitcoin really hit $1 million by 2035?

While speculative, the $1 million target becomes plausible if Bitcoin captures just 10-15% of the global store-of-value market. The fixed supply of 21 million coins creates natural scarcity as adoption grows.

How does the Bitcoin Core update affect price?

The v30 update's long-term impact remains unclear. While technical upgrades typically support prices, the expanded OP_RETURN functionality has divided the community, potentially creating short-term uncertainty.