TRX Price Prediction 2025: Technical Strength Meets Regulatory Tailwinds for Potential Breakout

- What Does TRX's Technical Setup Reveal?

- How Are Regulatory Developments Impacting TRX?

- Where Does TRX Fit in the Current Altcoin Market?

- Key TRX Metrics to Watch

- Is Now a Good Time to Invest in TRX?

- TRX Price Prediction: Frequently Asked Questions

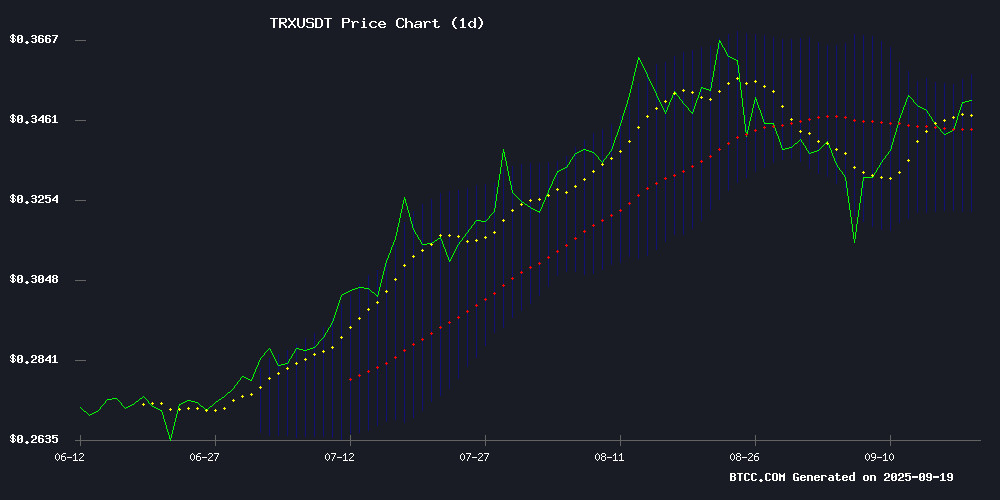

As we approach Q4 2025, TRX (Tron) presents an intriguing investment case combining technical bullishness with improving regulatory clarity. Currently trading at $0.3454, TRX shows strong technical indicators including position above its 20-day moving average ($0.3398) and approaching its upper Bollinger Band ($0.3571). Meanwhile, recent political developments questioning the SEC's handling of Justin Sun's case and Tron's Nasdaq ambitions create fundamental tailwinds. This analysis examines TRX's current technical setup, regulatory landscape, and market positioning to help investors evaluate its potential.

What Does TRX's Technical Setup Reveal?

TRX's current technical indicators paint a cautiously optimistic picture. The cryptocurrency sits comfortably above its 20-day moving average, typically a bullish signal for short-term momentum traders. The Bollinger Bands configuration suggests potential upside to $0.3571 if current momentum holds, with solid support at $0.3226 should market sentiment shift.

The MACD histogram reading of -0.005312 shows some short-term bearish pressure, but the signal line at 0.003200 indicates underlying strength. "This mixed signal suggests we might see some consolidation before the next potential move," notes the BTCC research team. "Traders should watch for MACD convergence as a potential entry signal."

Source: TradingView

How Are Regulatory Developments Impacting TRX?

The regulatory landscape for TRX has become particularly interesting in September 2025. Senator Jeff Merkley and Representative Sean Casten recently demanded explanations from the SEC regarding its dismissal of enforcement actions against tron founder Justin Sun. Their September 17 letter raises questions about potential political influences during the previous administration.

This political scrutiny comes as TRON explores a potential Nasdaq listing, which WOULD mark a significant milestone for the project's institutional acceptance. While the SEC's 2023 lawsuit alleging market manipulation remains a concern, the current political attention could accelerate regulatory clarity - typically positive for cryptocurrency valuations.

Where Does TRX Fit in the Current Altcoin Market?

The broader altcoin market shows signs of heating up in late 2025, with Bitcoin's dominance declining 12% since June. Analyst Ito Shimotsuma recently highlighted a rare "death cross" in bitcoin dominance, a pattern that historically preceded altcoin rallies in 2016 and 2021.

TRX currently trails leading altcoins like Hyperliquid (HYPE) and Binance Coin (BNB) in year-to-date performance, but its combination of technical strength and improving fundamentals suggests potential for catch-up. The cryptocurrency sits about 15% below its yearly high, compared to 8% for Ethereum and 6% for iFinex's LEO token.

Key TRX Metrics to Watch

| Metric | Value | Signal |

|---|---|---|

| Current Price | $0.3454 | Neutral |

| 20-Day MA | $0.3398 | Bullish |

| Bollinger Upper Band | $0.3571 | Resistance |

| Bollinger Lower Band | $0.3226 | Support |

| MACD Histogram | -0.005312 | Caution |

Is Now a Good Time to Invest in TRX?

For risk-tolerant investors, TRX presents an interesting opportunity in September 2025. The technical setup suggests potential upside, particularly if the price can break through the $0.3571 resistance level. Meanwhile, the evolving regulatory situation could remove significant uncertainty that has weighed on TRX's valuation.

However, the negative MACD histogram suggests some caution may be warranted in the very short term. Dollar-cost averaging or waiting for a pullback to the $0.3226 support level might provide better risk-reward entry points for long-term investors.

This article does not constitute investment advice. Cryptocurrency investments carry substantial risk.

TRX Price Prediction: Frequently Asked Questions

What is the current TRX price prediction for 2025?

Based on current technical indicators and market conditions, TRX shows potential to test its yearly highs around $0.40 by year-end 2025 if current momentum continues and regulatory developments remain favorable.

Is TRX a good long-term investment?

TRX's long-term potential depends heavily on Tron's ability to execute its Nasdaq ambitions and navigate regulatory challenges. The project's strong developer community and existing adoption provide fundamental support, but investors should monitor regulatory developments closely.

What are the key support and resistance levels for TRX?

Key support sits at $0.3226 (Bollinger lower band) and $0.30 (psychological level). Resistance levels to watch include $0.3571 (upper Bollinger band) and $0.40 (yearly high).

How do TRX's technicals compare to other altcoins?

TRX shows stronger technicals than many mid-cap altcoins, with its position above the 20-day MA and approaching upper Bollinger Band suggesting relative strength. However, it trails leading altcoins like BNB and ETH in year-to-date performance.

What exchange offers the best TRX trading options?

BTCC provides competitive TRX trading with DEEP liquidity and advanced charting tools. Other major exchanges like Binance and OKX also offer robust TRX trading pairs.