Ethereum Price Prediction 2025: Will ETH Shatter $5,000 This Month?

- Ethereum Technical Analysis: Is This the Breakout We've Been Waiting For?

- Institutional vs. Retail: Who's Driving ETH's Price Movement?

- Key Factors Influencing Ethereum's Price

- Corporate Ethereum Accumulation Reaches New Highs

- The $1 Billion Lost Wallet: How It Affects ETH's Supply

- Ethereum Price Forecast: Where Could ETH Go Next?

- Ethereum Price Prediction 2025: Your Questions Answered

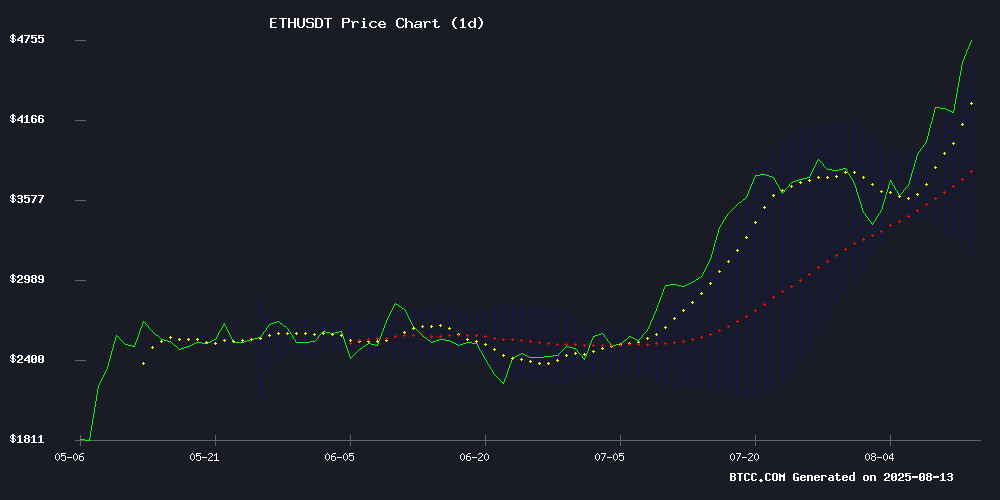

Ethereum (ETH) is making headlines as it approaches its all-time high, currently trading at $4,722.20 with bullish technical indicators and strong institutional support. Standard Chartered recently raised its year-end price target to $7,500, while on-chain data shows significant accumulation by whales and corporations. This analysis examines ETH's potential path to $5,000 and beyond, combining technical patterns, market sentiment, and fundamental developments that could shape Ethereum's price trajectory in August 2025.

Ethereum Technical Analysis: Is This the Breakout We've Been Waiting For?

ETH is currently trading significantly above its 20-day moving average ($3,890.07), showing strong bullish momentum. The MACD histogram displays decreasing bearish momentum (-36.85), while the price sits NEAR the upper Bollinger Band ($4,582.53). "The technical setup suggests ETH is breaking out from its consolidation phase," notes a BTCC analyst. "With price holding above key moving averages and institutional accumulation evident, we could see a test of the $5,000 psychological resistance soon."

Institutional vs. Retail: Who's Driving ETH's Price Movement?

The market shows a fascinating divergence: while institutions like Standard Chartered raise price targets and corporations accumulate ETH, retail traders appear to be taking profits. Santiment data reveals this sentiment gap, with retail Optimism remaining subdued despite the price rally. Historically, such skepticism among retail traders has coincided with sustained rallies, as seen in June and July 2025 before subsequent surges.

Key Factors Influencing Ethereum's Price

Several critical elements are shaping ETH's price action:

| Factor | Bullish Case | Bearish Risk |

|---|---|---|

| Technical Pattern | Elliott Wave continuation | Overbought RSI |

| Institutional Flow | $7,500 price target (StanChart) | Whale selling pressure |

| Market Sentiment | Exchange outflows | Retail profit-taking |

Corporate Ethereum Accumulation Reaches New Highs

Bitmine has become the largest corporate holder of ETH, controlling a record 1.2 million ETH valued at approximately $4.9 billion. This accumulation—from 163,000 ETH to over 1 million in just over a month—reflects growing institutional FOMO ahead of anticipated rate cuts. Bitmine's stock liquidity has also surged, with daily trading volume exceeding $2.2 billion.

The $1 Billion Lost Wallet: How It Affects ETH's Supply

Blockchain analytics firm Arkham Intelligence uncovered that an early ethereum investor has lost access to a wallet containing over $1.1 billion in ETH. This effectively removes these coins from market circulation unless recovered, creating a unique supply dynamic that could support prices.

Ethereum Price Forecast: Where Could ETH Go Next?

Based on current technicals and market sentiment, ETH shows strong potential to challenge its all-time high and potentially reach $5,000-$5,500 in the near term. The $4,700-$5,000 zone will be critical—a clean break above could open the path to $6,000 by year-end, especially if ETF approvals materialize.

This article does not constitute investment advice.

Ethereum Price Prediction 2025: Your Questions Answered

How high could Ethereum go in 2025?

Standard Chartered projects $7,500 by year-end, with technical analysis suggesting $5,000 could be tested in the coming weeks if current momentum continues.

Why is Ethereum price rising?

The rally is driven by institutional accumulation, positive technical patterns, and growing adoption of Ethereum's blockchain for various applications.

Should I buy Ethereum now?

While the technical outlook appears bullish, always conduct your own research and consider your risk tolerance before investing.

What's the biggest risk to Ethereum's price?

Potential risks include regulatory changes, macroeconomic factors affecting crypto markets, and unexpected large sell-offs from early investors.