Bitcoin Price Prediction 2025: Can BTC Hit $150K as Institutional Demand Surges?

- BTC Technical Analysis: Bullish Signals Above Key Moving Averages

- Institutional Activity Creates Market Tug-of-War

- Key Factors Influencing Bitcoin's Price Trajectory

- Macroeconomic Factors and Bitcoin's Outlook

- Security Concerns and Technological Developments

- Price Projections and Key Levels to Watch

- Bitcoin Price Prediction 2025: Your Questions Answered

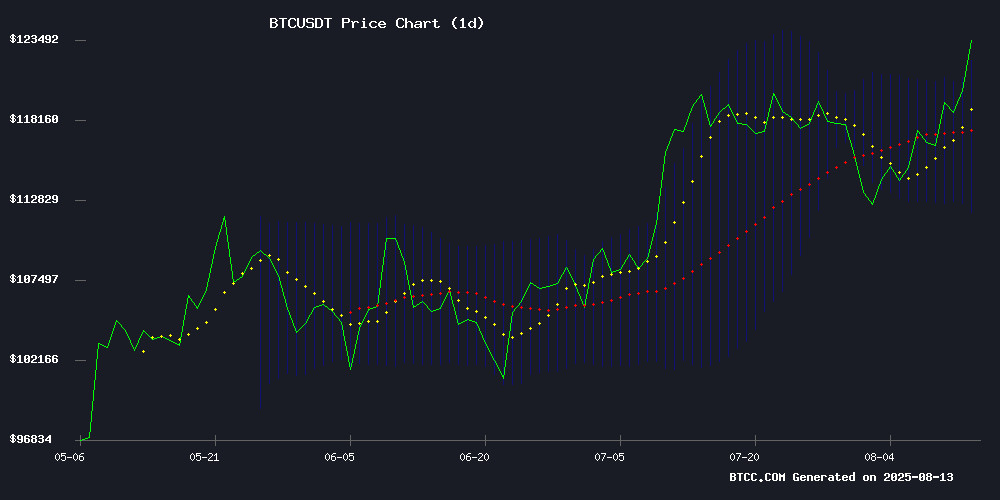

As Bitcoin hovers around $119,000 in August 2025, analysts are debating whether the cryptocurrency can reach $150,000 by year-end. The BTCC research team examines key technical indicators, institutional activity, and market sentiment driving BTC's price action. With major players like Ark Invest and Nasdaq-listed firms making bold moves, we break down the factors that could propel Bitcoin to new highs or trigger a correction.

BTC Technical Analysis: Bullish Signals Above Key Moving Averages

Bitcoin currently trades comfortably above its 20-day moving average of $116,835, establishing a bullish foundation according to TradingView data. The MACD histogram shows short-term consolidation at -139.03, but the narrowing gap between the MACD line (1,294.44) and signal line (1,433.47) suggests potential momentum reversal. Bollinger Bands indicate strong buying interest as price approaches the upper band at $121,114.

Institutional Activity Creates Market Tug-of-War

The market faces competing forces between institutional accumulation and retail profit-taking. Ark Invest's expanded Block position and a Nasdaq firm's $760 million bid tease contrast with Odin.fun withdrawals and miner distributions to exchanges. "Liquidity constraints at these price levels may amplify volatility," notes a BTCC market analyst.

Key Factors Influencing Bitcoin's Price Trajectory

Resistance at $122K Tests Market Momentum

Bitcoin's rally stalled NEAR $122,000 resistance, with the cryptocurrency now trading around $119,053. This follows a week of aggressive price discovery that saw BTC reclaim historic highs. Binance's trading volume reportedly doubled all other exchanges combined during earlier 2024 peaks, raising questions about market depth.

Ark Invest Doubles Down on Block's Bitcoin Strategy

Ark Invest's ETFs acquired 262,463 Block Inc. shares this week despite the stock dipping to $73.03. The buying spree signals confidence in Block's bitcoin-integrated payment ecosystem through its Cash App platform.

Nasdaq Firm's $760M Bitcoin Purchase Countdown

Nakamoto CEO David Bailey created market buzz with a planned $760 million BTC purchase executed in one bid. The public countdown and adjusted figures from an initial $1 billion claim have sparked debate about institutional trading strategies.

Long-Term Holder Behavior Shifts Market Dynamics

Bitcoin's long-term holders show a -21.5K BTC outflow at cycle lows, diverging from historical patterns. The gradual distribution suggests a healthier foundation for potential $120K breakout compared to previous bull markets.

Miner Movements Hint at Potential Correction

Increased bitcoin miner transfers to Binance, including transactions exceeding 10,000 BTC, historically precede short-term downside volatility as miners capitalize on peak prices.

Macroeconomic Factors and Bitcoin's Outlook

July's CPI report showed 0.2% monthly inflation (2.7% annual), reinforcing expectations for a September Fed rate cut. Bitcoin rose 1.02% to $119,745 following the news, facing resistance near $117,335 Fibonacci level.

Security Concerns and Technological Developments

Recent quantum computing breakthroughs raised concerns about blockchain encryption, but Google expert Graham Cooke asserts Bitcoin's cryptographic strength remains secure against current quantum capabilities.

Price Projections and Key Levels to Watch

The BTCC research team outlines three scenarios for Bitcoin's price trajectory:

| Scenario | Price Trigger | Target |

|---|---|---|

| Bullish | Close above $122K | $150K |

| Neutral | $116K-$122K range | $130K |

| Bearish | Break below $112.5K | $105K |

Catalysts include institutional bids (>$760M), reduced miner selling pressure, and resolution of US government Bitcoin holdings speculation. This article does not constitute investment advice.

Bitcoin Price Prediction 2025: Your Questions Answered

What's driving Bitcoin's price movement in August 2025?

The current price action reflects a tug-of-war between institutional accumulation and retail profit-taking, with technical indicators suggesting potential for both continuation and correction.

How reliable are the $150K price predictions?

While some analysts project $150K by Q4 2025, this depends on Bitcoin holding key support levels and institutional demand sustaining current momentum.

Should investors be concerned about miner movements?

Increased miner transfers to exchanges historically precede short-term volatility, but don't necessarily indicate long-term trend reversals.

How significant are institutional Bitcoin purchases?

Large institutional bids like the $760M purchase signal growing mainstream adoption but can also create short-term price distortions.

What's the most important level to watch?

The $116K-$122K range will be critical - a breakout above could target $150K, while failure to hold $116K may signal deeper correction.