Ethereum Price Prediction 2025: Is $4,000 the Next Stop as Bullish Signals Converge?

- Technical Analysis: Is Ethereum Primed for a Breakout?

- Institutional Demand Reaches Fever Pitch

- Layer 2 Solutions Fuel Network Growth

- Staking Ecosystem Shows Signs of Stress

- Ethereum Price Prediction: Key Levels to Watch

- Frequently Asked Questions

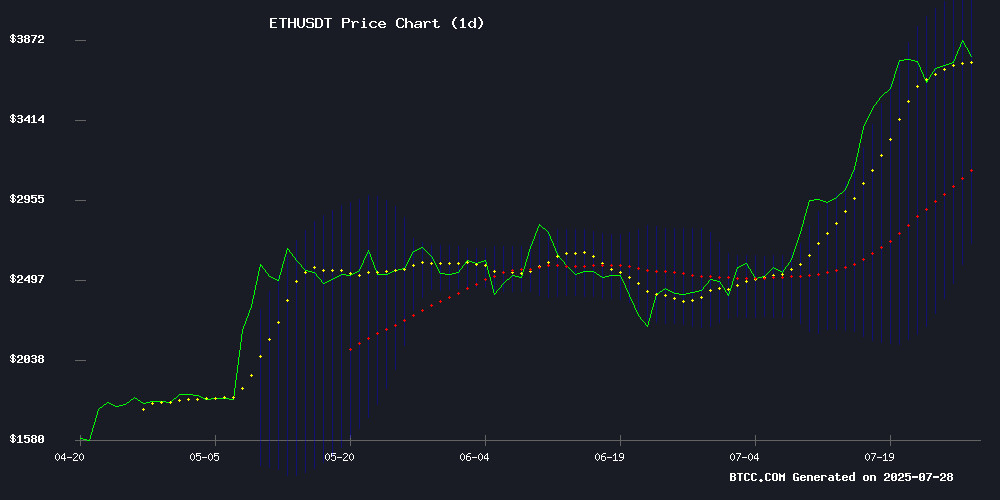

Ethereum (ETH) is showing all the classic signs of a major breakout as technical indicators and fundamental developments align. Currently trading at $3,939, ETH has established a strong position above its 20-day moving average ($3,430.49) while institutional players like BlackRock pour billions into the asset. The MACD indicator suggests weakening bearish momentum, and with ETH approaching the upper Bollinger Band at $4,166.89, traders are watching closely for a potential breakout. LAYER 2 solutions like Base are demonstrating robust adoption, while staking activity reaches new highs - but record CME futures open interest ($7.85B) hints at potential overheating risks.

Technical Analysis: Is Ethereum Primed for a Breakout?

According to the BTCC research team, Ethereum's technical setup presents a compelling bullish case. The cryptocurrency has maintained a 14.8% premium above its 20-day moving average, demonstrating strong upward momentum. While the MACD histogram remains negative at -43.35, the convergence between the MACD line (-549.26) and signal line (-505.91) indicates weakening downward pressure.

The Bollinger Bands tell an interesting story - with ETH currently testing the upper band at $4,166.89. In previous cycles, sustained breaks above this level have often preceded extended rallies. The 100-day and 200-day moving averages recently completed a golden cross, another classic bullish signal. However, the RSI at 68 suggests we're approaching overbought territory, which could lead to short-term consolidation before any potential push toward $4,000.

Institutional Demand Reaches Fever Pitch

BlackRock's recent ethereum accumulation spree has turned heads across crypto markets. The asset manager has doubled its ETH holdings to 2.8 million coins (worth $10.22 billion) in just three weeks. This buying pressure coincides with record inflows into U.S. spot Ethereum ETFs, which attracted $4.4 billion in July alone - surpassing full-year 2024 totals.

Other institutional players are following suit. SharpLink Gaming recently added 77,210 ETH ($295 million) to its staking position, bringing its total holdings to 438,017 ETH ($1.69 billion). On-chain analysts noted the company moved $145 million USDC to Galaxy Digital before withdrawing 38,600 ETH from Binance - a clear accumulation pattern.

| Institution | ETH Holdings | Value (USD) |

|---|---|---|

| BlackRock | 2.8M ETH | $10.22B |

| SharpLink Gaming | 438,017 ETH | $1.69B |

Layer 2 Solutions Fuel Network Growth

Base, Coinbase's Ethereum Layer 2 solution, has emerged as the revenue leader among scaling solutions, generating an average of $185,291 daily over the past six months. This dwarfs Arbitrum's $55,025 and the combined $46,742 of 14 other leading Layer 2 networks.

Base's innovative fee mechanism, inspired by Ethereum's EIP-1559, replaces rigid processing with dynamic auction-based prioritization. This system allows users to bid for urgent transaction execution, efficiently monetizing block space demand. Priority fees alone contribute $156,138 daily - 86% of Base's total revenue.

Staking Ecosystem Shows Signs of Stress

While Ethereum's staking economy continues to grow, recent developments reveal underlying fragility. The validator exit queue has ballooned since mid-July, not due to profit-taking but from a liquidity crunch that sent ETH borrow rates on Aave skyrocketing from 2-3% to 18%.

This spike flipped the spread between staking yields and borrowing costs negative, rendering Leveraged staking strategies unprofitable overnight. Traders who had deposited Liquid Staking Tokens (LSTs) as collateral were forced to unwind positions, creating selling pressure and overwhelming Ethereum's validator queue.

Ethereum Price Prediction: Key Levels to Watch

As of July 28, 2025, Ethereum faces several critical technical levels:

- Immediate Resistance: $4,166.89 (Upper Bollinger Band)

- Psychological Barrier: $4,000

- Support: $3,800 (Trend line on hourly chart)

- Strong Support: $3,300 (Former resistance now turned support)

The BTCC team notes that a decisive break above $3,950 could pave the way for a retest of $4,000, while any dip below $3,300 WOULD threaten the current bullish thesis. With institutional demand strong and technicals improving, the path of least resistance appears upward - but traders should remain cautious given elevated futures open interest.

Frequently Asked Questions

Is Ethereum a good investment in 2025?

Ethereum presents a compelling investment case with strong fundamentals and technicals. The network's Layer 2 ecosystem continues to grow, institutional adoption is accelerating, and the staking economy remains robust. However, investors should be aware of potential volatility and consider dollar-cost averaging rather than trying to time the market.

What is the Ethereum price prediction for 2025?

While predictions vary, the current technical setup suggests Ethereum could test $4,000 in the NEAR term if it can break through resistance at $4,166.89. Longer-term targets depend on broader market conditions and Ethereum's ability to maintain its technological edge.

Why is Ethereum price going up?

Ethereum's recent price appreciation stems from multiple factors: institutional accumulation (like BlackRock's $10.2B position), strong Layer 2 adoption, positive technical developments, and growing staking activity. The approval of spot Ethereum ETFs has also brought significant new capital into the market.

What are the risks of investing in Ethereum?

Key risks include regulatory uncertainty, potential technological hurdles (like scaling challenges), competition from other smart contract platforms, and overall cryptocurrency market volatility. The current high futures open interest ($7.85B) also suggests potential for increased price swings.