XRP Price Prediction 2025: October Breakout Brewing as Critical Technical Patterns Emerge

- Why Is XRP Testing Critical Support Levels?

- What Are the Key Factors Driving XRP's Price Action?

- How Are Whales and Institutions Positioning Themselves?

- What Technical Levels Should Traders Watch?

- How Could New Developments Like mXRP Impact Price?

- What Are Realistic Price Targets for October 2025?

- XRP Price Prediction: Frequently Asked Questions

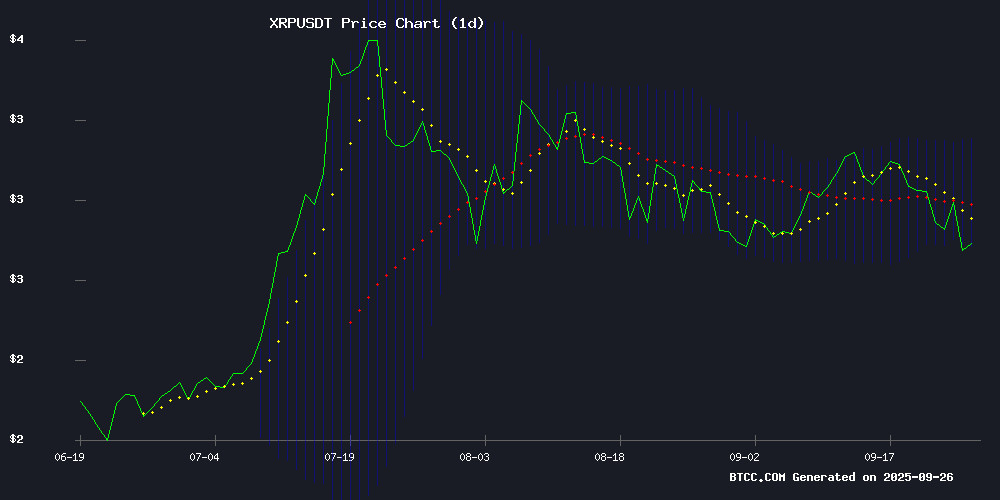

XRP stands at a pivotal moment in September 2025, with technical indicators and fundamental developments converging to create what could be the most explosive setup since its 2021 bull run. Currently testing crucial support at $2.75, the digital asset shows all the classic signs of a coiled spring - Bollinger Band compression, MACD divergence, and a textbook falling wedge pattern that historically precedes major breakouts. Meanwhile, Ripple's institutional partnerships with financial giants like BlackRock and VanEck through Securitize integration provide fundamental fuel for what analysts predict could be an October surge. This DEEP dive examines whether XRP is primed for liftoff or facing another false dawn.

Why Is XRP Testing Critical Support Levels?

As of September 26, 2025, XRP finds itself in a make-or-break technical position. The price currently hovers at $2.7596, just above the lower Bollinger Band support at $2.7556. What makes this particularly interesting is the bullish MACD divergence developing despite the price sitting below the 20-day moving average ($2.9652). This classic "hidden bullish" setup often signals accumulation by smart money before a reversal.

Source: TradingView

The BTCC technical analysis team notes that XRP has formed what appears to be a perfect Fibonacci retracement bounce at the 0.5 level ($2.79), with the 0.382 level ($3.00) now serving as critical overhead resistance. "We're seeing textbook technical behavior here," notes BTCC's lead analyst. "The $2.75-$2.80 zone has become a battleground between bulls and bears, with the MACD histogram at +0.0702 suggesting underlying strength despite the surface-level bearishness."

What Are the Key Factors Driving XRP's Price Action?

Several fundamental and technical catalysts are currently influencing XRP's trajectory:

| Factor | Impact | Details |

|---|---|---|

| Institutional Partnerships | Strong Positive | Ripple's integration with BlackRock/VanEck via Securitize |

| Technical Patterns | Moderate Positive | Falling wedge with October breakout potential |

| Market Sentiment | Mixed | 78% long positions on Binance vs. NVT ratio warning |

| Macro Conditions | Negative | Fed rate uncertainty creating crypto headwinds |

The most intriguing development comes from Ripple's partnership with Securitize to integrate its RLUSD stablecoin with BlackRock's $BUIDL and VanEck's $VBILL tokenized funds. This institutional adoption represents a fundamental shift in how traditional finance views XRP's underlying technology. As Jack McDonald, Ripple's SVP of Stablecoins, put it: "We're bridging the gap between tokenized traditional assets and crypto liquidity in ways that weren't possible just two years ago."

How Are Whales and Institutions Positioning Themselves?

Blockchain analytics reveal fascinating on-chain activity that suggests big players are accumulating at current levels. A jaw-dropping 20 million XRP ($58 million) transfer from Upbit to an unknown wallet on September 24 sparked intense speculation about institutional accumulation. Such moves typically indicate long-term holding strategies rather than short-term trading.

Derivatives data tells a more nuanced story. Binance's XRP perpetual swaps show a staggering 78% long positions versus just 22% shorts - an extreme skew that often precedes volatility. The Network Value to Transactions (NVT) ratio's 197% spike simultaneously flashes warning signs about potential overvaluation. This creates what traders call a "pick your poison" scenario - either the whale accumulation proves prescient, or the Leveraged longs face a painful squeeze.

What Technical Levels Should Traders Watch?

The technical setup presents clear lines in the SAND for both bulls and bears:

- Immediate Support: $2.7556 (Lower Bollinger Band)

- Critical Support: $2.79 (0.5 Fibonacci)

- Breakout Level: $2.97 (Wave 1 bottom)

- Bullish Confirmation: $3.00 (0.382 Fibonacci)

- Bearish Breakdown: $2.58 (Next major support)

Prominent analyst Dark Defender has been particularly vocal about the falling wedge pattern developing since July, noting that "October could mark the culmination of this compression phase." Historical data shows such wedges often resolve with violent breakouts - XRP's 650% surge in Q4 2020 emerged from a similar setup.

How Could New Developments Like mXRP Impact Price?

The September 25 launch of mXRP - the first liquid staking token for XRP - introduces novel utility to the ecosystem. Created by Midas in collaboration with Axelar, mXRP allows holders to earn 8-10% APY through DeFi strategies without selling their positions. The entire 5 million XRP mint cap was filled within four hours, demonstrating strong demand.

Flare Networks' FXRP launch similarly enables XRP holders to participate in DeFi without liquidation. As Hugo Philion of Flare noted, "This is just the beginning of community-driven adoption - institutional interest typically follows at the $100M threshold." These developments fundamentally alter XRP's value proposition by adding yield-generating capabilities to what was traditionally just a payments token.

What Are Realistic Price Targets for October 2025?

Based on current technicals and fundamentals, analysts project the following scenarios:

| Timeframe | Conservative Target | Bullish Target | Key Levels |

|---|---|---|---|

| Short-term (1-2 weeks) | $3.10-$3.30 | $3.50-$3.70 | Resistance: $3.17 |

| Medium-term (1-2 months) | $3.80-$4.20 | $4.50-$5.00 | Breaking $3.50 crucial |

The BTCC research team emphasizes that $3.50 represents a critical "bull/bear separator" - a sustained break above this level could open the path to $4.50-$5.00, especially if October's seasonal crypto strength materializes alongside institutional inflows into the newly approved XRP ETFs.

XRP Price Prediction: Frequently Asked Questions

Is XRP a good investment for October 2025?

XRP presents an intriguing risk/reward proposition heading into October. The technical setup suggests breakout potential, while fundamental developments like institutional partnerships provide real-world utility. However, traders should remain cautious about overall crypto market conditions and Fed policy.

What is the most important level to watch for XRP?

The $2.79 Fibonacci support and $3.00 resistance form the critical zone. A daily close above $3.00 WOULD confirm bullish momentum, while losing $2.79 could trigger a test of $2.58 support.

How do BlackRock and VanEck affect XRP's price?

Their tokenized fund integration with Ripple's RLUSD stablecoin represents growing institutional adoption, which could drive long-term demand. However, the price impact may be gradual rather than immediate.

What makes October special for XRP?

October has historically been a strong month for crypto markets. Combined with XRP's technical patterns reaching maturation, this creates potential for outsized moves.

Should I be concerned about the high NVT ratio?

The elevated NVT suggests caution is warranted, as it indicates network value may be outpacing transaction volume. This often precedes corrections unless volume picks up substantially.