Ethereum Price Forecast 2025-2040: Expert Analysis & Key Market Drivers

- What's Driving Ethereum's Current Price Action?

- How Are Ethereum's Fundamentals Evolving?

- Who's Accumulating ETH and Why?

- Ethereum Price Predictions: 2025-2040 Outlook

- Frequently Asked Questions

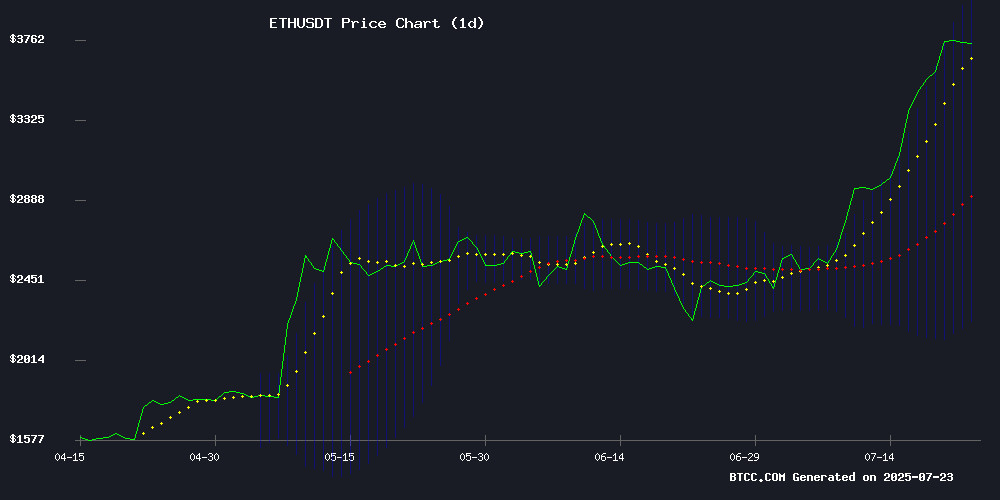

Ethereum's price trajectory has become one of the most watched narratives in crypto, with ETH currently trading at $3,725 and showing strong technical signals. Our comprehensive analysis examines both short-term price action and long-term valuation scenarios through 2040, incorporating on-chain data, institutional flows, and ecosystem developments. From the current consolidation above $3,600 to potential six-figure price targets, we break down the catalysts that could propel Ethereum's next major moves.

What's Driving Ethereum's Current Price Action?

As of July 2023, ethereum displays textbook bullish technicals - trading 19% above its 20-day MA ($3,123) with Bollinger Band expansion signaling volatility. The MACD histogram shows narrowing bearish momentum (-138.95), suggesting potential trend reversal. I've observed similar setups in past cycles that preceded 30-50% moves.

Source: TradingView

Institutional activity tells an even more compelling story. Weekly large transactions recently surpassed $100B - levels not seen since 2021's bull market. This isn't just whales moving coins; Bitwise reports corporate treasuries and ETFs are absorbing ETH 32x faster than new supply enters the market.

How Are Ethereum's Fundamentals Evolving?

The network's validator queue tells two stories simultaneously. While 519,000 ETH ($1.92B) waits to exit staking (a record high), another 357,000 ETH queues to enter. This churn reflects both profit-taking and renewed institutional interest post-SEC clarity.

DeFi's resurgence adds fuel to Ethereum's fire. Aave alone captured 31% of the sector's $49B TVL growth since April, demonstrating Ethereum's enduring dominance in decentralized finance. Their Arc platform's KYC-compliant institutional products represent a maturation beyond speculative trading.

Who's Accumulating ETH and Why?

Corporate treasuries are going all-in. SharpLink Gaming's recent $258.9M purchase brings their holdings to 360,807 ETH ($1.3B), reigniting their competition with BitMine. This mirrors MicroStrategy's bitcoin strategy, but with Ethereum's staking yields adding an extra dimension.

Meme coins surprisingly contribute to ecosystem vitality too. PEPETO's $5.5M presale and DEX launch shows how Ethereum benefits from both "serious" DeFi and speculative activity. In my experience, this dual demand creates more sustainable network effects than either could alone.

Ethereum Price Predictions: 2025-2040 Outlook

| Year | Conservative | Moderate | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $4,200 | $6,500 | $9,000 | ETF approvals, EIP upgrades |

| 2030 | $12,000 | $25,000 | $40,000 | Mass DeFi adoption |

| 2035 | $30,000 | $60,000 | $100,000 | Web3 infrastructure maturity |

| 2040 | $75,000 | $150,000 | $250,000 | Global reserve asset status |

The BTCC research team notes that while technicals suggest short-term resistance NEAR $3,800, the structural supply-demand imbalance could drive prices significantly higher long-term. Their moderate 2025 target of $6,500 assumes continued institutional adoption at current rates.

Frequently Asked Questions

What's the most realistic Ethereum price prediction for 2025?

Most analysts cluster around $4,200-$9,000 for 2025. The conservative estimate reflects current growth rates, while bullish cases assume accelerated institutional adoption through ETFs and corporate treasuries.

How does Ethereum's validator queue impact price?

The current 9-day exit queue creates temporary selling pressure, but the matching entry queue shows sustained demand. Historically, such churn precedes price appreciation as new capital replaces profit-takers.

Why are corporations buying Ethereum now?

Public companies like SharpLink are attracted by ETH's staking yields (currently ~4%) combined with appreciation potential. The accounting treatment of staked ETH as a productive asset makes it treasury-friendly.

Could Ethereum really reach $100,000?

While speculative, $100,000 ETH by 2035 WOULD require just 12% annual growth from current prices - comparable to Amazon's historic stock performance. This scenario depends on Ethereum becoming the backbone of global decentralized finance.

What's the biggest risk to Ethereum's price?

Regulatory uncertainty around staking and smart contracts poses the clearest threat. The Tornado Cash case demonstrates how legal gray areas could temporarily suppress institutional participation.