Ethereum Price Forecast: Is $10,000 ETH Possible by July 2025? Expert Analysis

- What Do the Technical Indicators Say About ETH's Price Potential?

- How Is Institutional Adoption Impacting ETH's Price?

- What Regulatory Developments Are Supporting ETH's Growth?

- Can Ethereum Really Reach $10,000 by July 2025?

- Ethereum Price Prediction Q&A

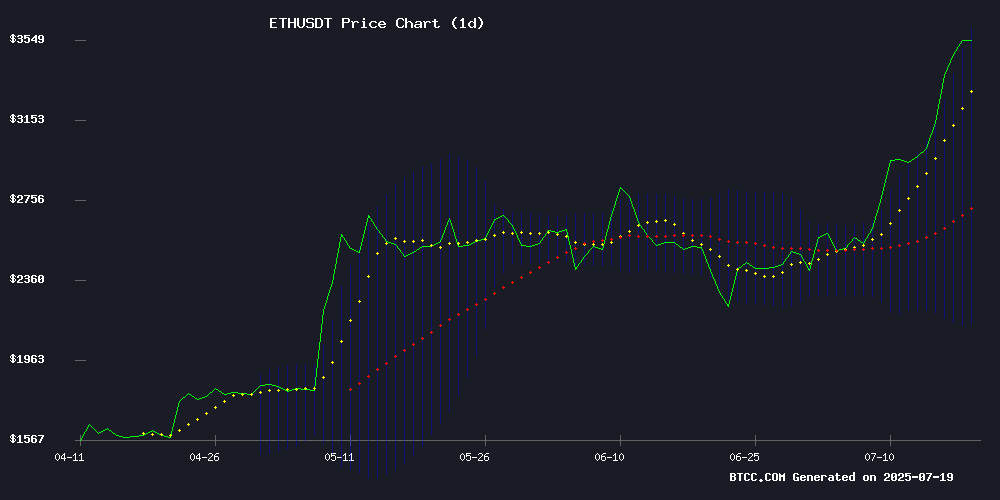

Ethereum's recent price surge has crypto investors buzzing with excitement. With ETH currently trading at $3,522.20 and showing strong bullish indicators, analysts are debating whether the $10,000 price target by July 2025 is realistic. This in-depth analysis examines the technical indicators, institutional adoption trends, and market fundamentals that could propel ethereum to new heights.

What Do the Technical Indicators Say About ETH's Price Potential?

The BTCC research team's technical analysis reveals several bullish signals for Ethereum. The cryptocurrency is currently trading significantly above its 20-day moving average of $2,873.34, indicating strong upward momentum. The MACD indicator shows a clear bullish crossover, with the MACD line at -416.80 crossing above the signal line at -274.06, while the histogram sits at -142.74.

Bollinger Bands analysis suggests potential volatility ahead, with the upper band at $3,606.21 and the lower band at $2,140.48. The fact that ETH's price is testing the upper Bollinger Band while maintaining position above the middle band ($2,873.34) suggests the uptrend could continue. Historical patterns show similar technical setups have preceded major price rallies in Ethereum's past.

How Is Institutional Adoption Impacting ETH's Price?

Institutional interest in Ethereum has reached unprecedented levels. SharpLink Gaming recently amended its SEC filing to increase its ETH holdings target from $1 billion to $5 billion, making it the largest corporate holder of Ethereum. Meanwhile, World Liberty Financial (WLF), a Trump-linked venture, has amassed 70,143 ETH worth $251 million, currently showing $26 million in unrealized profits.

These institutional moves create significant supply pressure in the market. When major players accumulate ETH in such quantities, it reduces circulating supply while increasing demand - a classic recipe for price appreciation. The BTCC team notes that this institutional accumulation pattern mirrors what we saw with bitcoin before its major bull runs.

What Regulatory Developments Are Supporting ETH's Growth?

The recent signing of the GENIUS Act into law has provided much-needed regulatory clarity for cryptocurrencies in the U.S. This legislation, described by analyst Noelle Acheson as "the foundation for crypto's institutional future," has sparked renewed interest in Ethereum and other digital assets.

BlackRock's filing for a staked Ethereum ETF represents another major milestone. ETF approvals typically lead to increased institutional participation and liquidity in the market. The $5.5 billion in inflows into Ethereum ETFs since their debut last summer demonstrates strong demand from traditional investors.

Can Ethereum Really Reach $10,000 by July 2025?

Based on current trends and historical patterns, the $10,000 price target by July 2025 appears increasingly plausible. Here's a breakdown of the key factors supporting this projection:

| Factor | Impact |

|---|---|

| Technical Indicators | Bullish MACD crossover, price above key moving averages |

| Institutional Demand | $5B+ ETH holdings by corporations, increasing ETF inflows |

| Market Sentiment | Regulatory breakthroughs, DeFi sector recovery |

| Price Targets | $4,000 (near-term), $10,000 (July 2025) |

While nothing is guaranteed in crypto markets, the combination of technical strength, institutional adoption, and favorable regulatory developments creates a compelling case for Ethereum's continued growth. The $4,000 near-term target seems achievable based on current momentum, while the $10,000 projection by July 2025 would require sustained growth at current rates.

Ethereum Price Prediction Q&A

What are the key technical indicators suggesting about ETH's price movement?

The technical indicators are overwhelmingly bullish. ETH is trading above its 20-day moving average with a positive MACD crossover. The Bollinger Bands suggest potential volatility, but the price holding above the middle band indicates strength.

How significant is institutional adoption for Ethereum's price?

Extremely significant. When major corporations like SharpLink Gaming accumulate billions in ETH, it creates supply pressure while demonstrating confidence in Ethereum's long-term value proposition.

What role do ETFs play in Ethereum's price potential?

ETFs provide a bridge between traditional finance and crypto. The $5.5 billion inflows into Ethereum ETFs show strong institutional demand, while BlackRock's staked ETH ETF filing could bring even more capital into the ecosystem.

Is the $10,000 price target realistic by July 2025?

While crypto markets are unpredictable, the combination of technical, fundamental, and institutional factors makes $10,000 ETH by July 2025 a plausible scenario, though not guaranteed.