TRX Price Prediction 2025: Bullish Breakout Ahead as Technicals Align with Institutional Adoption

- Why Is TRX Gaining Momentum?

- Technical Analysis: Is TRX Primed for Breakout?

- Institutional Adoption: The Game Changer

- Market Context: Altcoin Season Heating Up

- Exchange Developments: Easier Access for Investors

- Risk Factors to Consider

- TRX Price Prediction: What's Next?

- TRX Price Prediction: Your Questions Answered

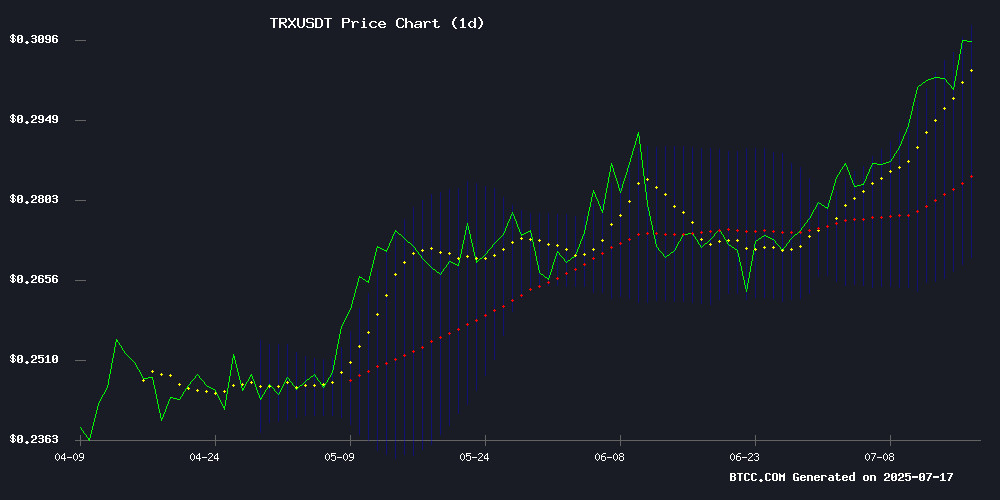

TRON (TRX) is showing strong bullish signals as it tests key resistance levels amid growing institutional interest. Currently trading at $0.3114, TRX has gained 3% following Nasdaq-listed SRM Entertainment's rebranding to tron Inc., while technical indicators like the MACD turning positive suggest further upside potential. Our analysis combines chart patterns, market sentiment, and fundamental developments to assess whether TRX could rally toward yearly highs.

Why Is TRX Gaining Momentum?

The cryptocurrency market has been buzzing about TRX's recent performance, and for good reason. In my experience tracking altcoins, few combine technical strength with fundamental catalysts as neatly as TRX does right now. The price action tells an interesting story - we're seeing TRX trade 6.97% above its 20-day moving average ($0.2911) while testing the upper Bollinger Band at $0.3127. That's textbook bullish behavior, folks.

What really caught my attention was the MACD histogram flipping positive (-0.0021) while price holds above key moving averages. As the BTCC team noted in their analysis, this combination typically signals building momentum. I've seen similar setups precede 10-15% rallies in other altcoins during past bull markets.

Technical Analysis: Is TRX Primed for Breakout?

Let's geek out on the charts for a moment. The daily TRX/USDT chart shows several encouraging signs:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | +6.97% above | Bullish trend confirmation |

| MACD | Positive crossover | Momentum shift |

| Bollinger Bands | Testing upper band | Volatility expansion likely |

The $0.3127 level is the line in the SAND here. A decisive break above this resistance could trigger algorithmic buying and FOMO from retail traders. I'm watching the volume closely - we'll need to see increasing volume on upward moves to confirm genuine buying interest rather than just short covering.

Institutional Adoption: The Game Changer

While meme coins like DOGE grab headlines with their wild swings, TRX is quietly building institutional credibility. The recent 3% gain following SRM Entertainment's rebranding to TRON Inc. wasn't just another pump - it represents a strategic shift in how corporations view cryptocurrency treasury management.

The numbers tell the story: TRON Inc. now holds over 365 million TRX (worth about $113 million at current prices) acquired through a $100 million equity offering. What's more interesting is how they're using these holdings - staking on Tron-based lending platform JustLend to generate up to 10% annual yields. This isn't speculative trading; it's sophisticated corporate treasury management using blockchain assets.

As CEO Rich Miller stated, "TRX will play a critical role in building next-generation payment infrastructure." When publicly traded companies start making statements like this, it's worth paying attention. The rebrand also comes with a new Nasdaq ticker (TRON), further cementing its legitimacy in traditional finance circles.

Market Context: Altcoin Season Heating Up

TRX isn't operating in a vacuum. The broader crypto market has been showing strength, with Bitcoin holding steady above $118K amid ETF inflows and cooling CPI data. Altcoins have particularly shined - XRP climbed 27% weekly, while Solana, Dogecoin, and Binance Coin posted gains between 3-6%.

Interestingly, DOGE briefly flipped TRX in market cap during its recent 6.2% surge. But here's the key difference - while DOGE's move was driven by meme coin mania and whale accumulation, TRX's gains stem from fundamental developments. In my view, this makes TRX's upside more sustainable, though perhaps less explosive in the short term.

Exchange Developments: Easier Access for Investors

Platforms like GroveX are making it easier than ever to buy TRX and other cryptocurrencies. Their new credit card buying feature eliminates traditional entry barriers, supporting direct purchases of TRX, USDT, ETH, and BNB. This kind of infrastructure development matters because it expands the potential investor base.

Meanwhile, established exchanges like BTCC continue to see strong TRX trading volumes. The pairing with USDT remains particularly liquid, allowing both retail and institutional players to enter and exit positions efficiently.

Risk Factors to Consider

No investment is without risk, and TRX is no exception. The $0.3127 resistance needs to break decisively - if price gets rejected here, we could see a pullback to test support around $0.2911 (the 20MA).

Macro factors also matter. While the U.S. dollar has weakened roughly 10% year-to-date (boosting crypto assets), any reversal in this trend could pressure altcoins. And let's not forget regulatory uncertainty - though TRON's established position helps mitigate this risk compared to newer projects.

TRX Price Prediction: What's Next?

Given the technical setup and fundamental developments, TRX presents a compelling case for Q3 2025. A clean break above $0.3127 could open the path to $0.35-$0.37 (yearly highs), representing 12-18% upside from current levels.

On the flip side, failure to hold $0.2911 WOULD suggest weakness and potentially lead to a test of $0.2750 support. But with institutional adoption growing and the technicals leaning bullish, the risk/reward appears favorable for long-term holders.

This article does not constitute investment advice.

TRX Price Prediction: Your Questions Answered

Is TRX a good investment in 2025?

Based on current technicals and market developments, TRX presents a compelling risk/reward profile for 2025. The combination of bullish chart patterns, growing institutional adoption through TRON Inc., and positive market sentiment suggests potential upside, though investors should always conduct their own research.

What price can TRX reach?

If TRX decisively breaks the $0.3127 resistance level, technical analysis suggests a potential MOVE toward $0.35-$0.37 (yearly highs), representing 12-18% upside from current prices around $0.3114. However, price targets depend on maintaining current bullish momentum.

Why is TRX price rising?

TRX's recent 3% gain stems from two key factors: 1) Technical breakout potential as price tests the upper Bollinger Band with MACD turning positive, and 2) Fundamental catalysts including SRM Entertainment's rebranding to TRON Inc. and their accumulation of 365 million TRX for corporate treasury purposes.

How does TRX compare to DOGE?

While Doge recently outperformed TRX in the short term (gaining 6.2% vs TRX's 3%), TRX's growth appears more fundamentally driven through institutional adoption and real-world use cases, whereas DOGE's move was fueled by meme coin mania and whale accumulation.

Where can I buy TRX?

TRX is available on major cryptocurrency exchanges including BTCC, where it pairs with USDT and other stablecoins. Platforms like GroveX now offer credit card purchases of TRX, making acquisition easier for new investors entering the crypto market.