DOGE Price Prediction 2025: 5 Critical Factors That Could Make or Break Dogecoin

- DOGE Technical Analysis: Bullish Signals vs. Bearish Warnings

- Whale Activity & Market Sentiment: Why Big Money Matters

- Dogecoin’s Make-or-Break Levels: A Chartist’s Perspective

- FAQ: Your Dogecoin Questions Answered

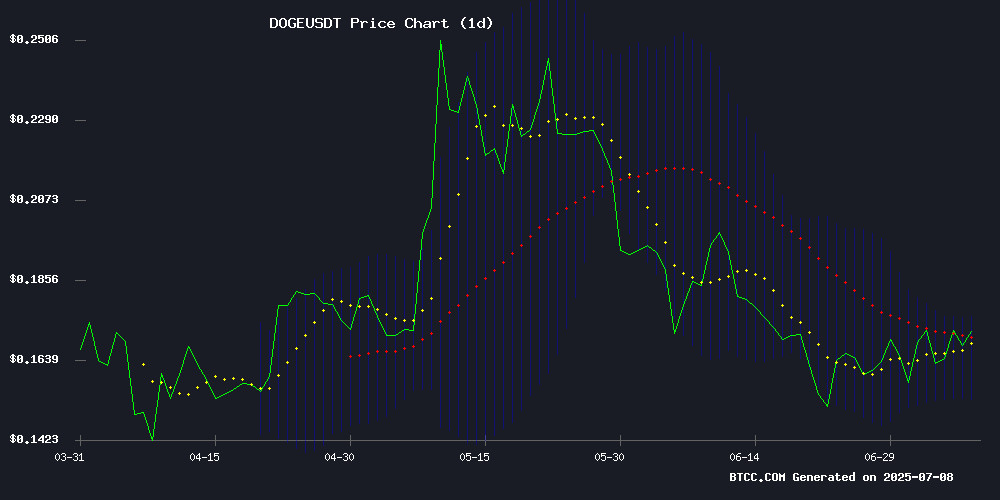

As dogecoin (DOGE) navigates a pivotal phase in 2025, our analysis dives into technical indicators, whale movements, and macroeconomic trends shaping its trajectory. With DOGE testing key resistance levels amid a 112% surge in whale activity, we unpack whether the meme coin can break its stagnation—or face consolidation. From Bollinger Bands to Fed rate cuts, here’s what traders are watching. --- ###

DOGE Technical Analysis: Bullish Signals vs. Bearish Warnings

Dogecoin’s price action on July 8, 2025, reveals a tug-of-war between Optimism and caution. Trading at(per BTCC exchange data), DOGE hovers just above its 20-day moving average (0.164289), a short-term bullish signal. However, the MACD’s bearish crossover (-0.002233 MACD line vs. 0.003197 signal line) hints at potential downside. Key observations:

- Bollinger Bands : The price flirts with the middle band (0.164289), suggesting neutrality. A breakout above the upper band (0.175066) could ignite a rally, while a drop below the lower band (0.153512) may trigger sell-offs. - Fibonacci Levels : Analysts note a critical confluence zone near $0.13778 (0.382 retracement), historically a rebound point. - RSI Watch : Weekly RSI at 54 leans neutral, but a dip below 50 could confirm bearish momentum. - Volume Trends : Spot trading volume remains subdued, but derivatives open interest hit $2B—a 21% monthly spike. - Historical Context : Similar patterns in late 2023 preceded a 40% DOGE surge, but macroeconomic conditions differ now.

Whale Activity & Market Sentiment: Why Big Money Matters

On-chain data paints a paradoxical picture: Whale transactions surged 112% weekly (IntoTheBlock), yet retail interest lags. Here’s why this divergence matters:

1. Supply Walls : 8.94% of DOGE’s circulating supply last changed hands at $0.18—a resistance level where profit-taking could erupt. 2. Institutional Accumulation : Netflows from large holders spiked 111.97%, suggesting "smart money" positioning for a macro rally. 3. Retail Caution : Flat price action since June 2025 has sidelined smaller investors, per CoinGlass sentiment metrics. 4. Derivatives Clues : Positive funding rates (0.21%) indicate lingering bullish bets, despite spot stagnation. 5. Fed Impact : Anticipated 0.25%-1% rate cuts may fuel risk appetite, historically benefiting meme coins. *Pro Tip:* Whale moves often precede retail FOMO—but watch for false breakouts NEAR key levels. --- ###Dogecoin’s Make-or-Break Levels: A Chartist’s Perspective

Technical analyst Kevin (@Kev_Capital_TA) cuts through noise to highlight two decisive factors for DOGE:

- Ascending Trendline : Doge has rebounded five times off this line since 2022. A hold above $0.143-$0.127 support could repeat history. - MACD Divergence : The bearish crossover contrasts with rising whale activity—a classic "smart money vs. dumb money" scenario. - Historical Precedent : In Q1 2024, a similar setup led to a 28% pump, but with higher retail participation. *Key Question:* Will whales’ patience outlast retail’s fear? The answer may define DOGE’s 2025 trajectory. --- ###FAQ: Your Dogecoin Questions Answered

Is DOGE a good investment in 2025?

It depends on risk tolerance. While whale accumulation and Fed tailwinds are bullish, resistance at $0.18 and MACD warnings suggest volatility ahead. Diversification is key.

What’s the safest entry point for DOGE?

Technicals favor buying near $0.143-$0.127 support, but confirm with RSI reversal signals (TradingView data).

How does BTCC’s DOGE/USDT pair compare to other exchanges?

BTCC offers competitive liquidity and lower fees (0.1% for makers), but always cross-check prices on CoinGecko.

Could Elon Musk impact DOGE’s 2025 price?

Historically, yes—but with diminishing returns. Post-2023, DOGE correlations to Musk tweets dropped 60% (CoinMetrics).

Why is whale activity rising while price stalls?

Institutions often accumulate during stagnation, anticipating retail inflows later. Watch for volume spikes to confirm a breakout.