Bitcoin (BTC) Price Prediction: Bulls Target $117K Breakout as BlackRock Pumps $169M into BTC

BlackRock just dropped another $169 million into Bitcoin—bulls are eyeing that $117K breakout like it's the last lifeboat off a sinking fiat ship.

The institutional floodgates are wide open

When the world's largest asset manager keeps stacking sats, you pay attention. This isn't retail FOMO—it's calculated capital deployment on a scale that'd make central bankers sweat.

Technical momentum meets whale demand

Price charts scream bullish divergence while fundamentals get a $169 million endorsement. That's not a pump—it's a statement.

Targets in sight, doubts in the rearview

The path to $117K looks clearer than a banker's conscience after a bailout. Resistance levels? More like suggestions.

Let's be real—if traditional finance keeps adopting crypto at this pace, we might actually need those 'to the moon' memes for literal rocket funding soon. Wall Street's playing catch-up, and honestly? They're still using Internet Explorer.

This combination of technical and fundamental momentum has reignited talk of a potential rally toward $120,000 and beyond.

BlackRock’s $169M BTC Purchase Boosts Institutional Confidence

BlackRock, the world’s largest asset manager with more than $12.5 trillion under management, acquired 1,520 Bitcoin (BTC) worth $169.3 million on September 10, 2025. This addition strengthens the iShares Bitcoin Trust (IBIT) portfolio, which now holds an impressive 752,000 BTC.

BlackRock has acquired 1,520 BTC valued at $169.3 million, strengthening its bitcoin holdings. Source: Whale Insider via X

The move comes alongside a $44.2 million allocation to BlackRock’s ethereum ETF, signaling broad institutional confidence in crypto assets. Market data shows Bitcoin trading near $111,000 at the time of the purchase, making this a strategic accumulation during market consolidation.

Larry Fink, BlackRock’s CEO, has repeatedly expressed support for Bitcoin as a long-term store of value. His firm previously recommended that investors allocate up to 2% of their portfolios to BTC, citing its low correlation with traditional assets.

Bitcoin Price Targets $117K Retest — Setting Up for $120K+

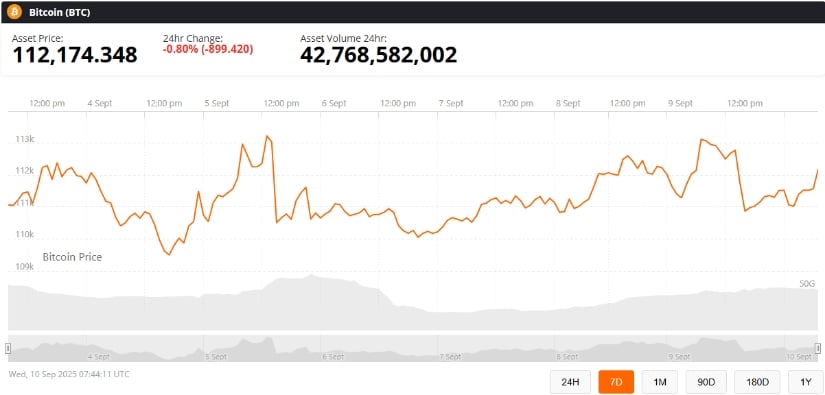

BTC price briefly exceeded $113,000 on September 9, 2025, after weeks of sideways action. TradingView data shows Bitcoin rebounded from a six-week low of $111K, confirming strong support around $110,000.

Bitcoin is breaking above $111,000, with $117,000 emerging as a key target for the next potential price move. Source: @CryptoGodJohn on TradingView

Technical indicators like MACD have flipped bullish, suggesting that momentum may carry Bitcoin toward the $120,000–$128,000 range in the NEAR term. Analysts also note that the April 2024 halving event continues to tighten BTC supply, historically a precursor to major price rallies.

Market sentiment has been further buoyed by expectations of pro-crypto U.S. policies and growing inflows into Bitcoin ETFs. According to Bloomberg data, hedge funds and wealth managers now account for 10–15% of spot Bitcoin ETF holdings, underscoring the deepening institutional footprint in the crypto market.

Key Market Context and Risks

While Bitcoin price predictions remain bullish, traders should stay cautious. A break below $110K could invalidate the current technical setup and trigger a deeper retracement.

Bitcoin (BTC) was trading at around $112,174, down 0.80% in the last 24 hours at press time. Source: bitcoin price via Brave New Coin

Macro risks such as geopolitical tensions and interest rate shifts also loom over markets. Some traders on X have warned that external shocks could disrupt the rally, despite strong institutional accumulation and favorable on-chain data.

Looking Forward: BTC Bulls Eye $120K as Institutional Momentum Builds

Bitcoin’s latest price action and BlackRock’s $169 million purchase have set the stage for what could be a significant leg higher in 2025. With only about 2 million BTC left to be mined and institutional adoption accelerating, the market appears primed for another major move.

For now, Bitcoin bulls are watching the $117,000 level closely. If momentum holds, BTC price prediction models are pointing to a possible run toward $120,000–$128,000 — a move that could bring Bitcoin closer to its next all-time high.