FLOKI Crypto News: Bull Run Setup Targets $0.00011 in Next Breakout

FLOKI's chart patterns scream breakout potential—traders eyeing that elusive $0.00011 target as momentum builds.

Technical indicators align: bullish divergences, rising volume, and clean support bounces. The meme coin refuses to die quietly.

Market sentiment shifts—retail piling in, whales accumulating. Even traditional finance guys are sneaking glances between spreadsheet cells.

Risk remains: volatility could shred weak hands. But for those riding the wave, the setup looks cleaner than a banker's conscience—wait, scratch that last part.

Next resistance? Watch the $0.00011 level. Break that, and things get spicy. Fail, and well—another day in crypto paradise.

Analysts are closely watching how the token behaves around key resistance and support levels, with technical indicators showing a gradual shift toward bullish sentiment. Momentum has been building over the past several sessions, and the setup suggests the crypto may be preparing for another leg higher if conditions align.

Market Structure Highlights Bullish PotentialIn a recent X post, analyst Phoenix highlighted that FLOKI has established a solid bullish market structure based on the 4-hour chart. The token recently rallied but encountered resistance near the 200 EMA, where selling pressure intensified and temporarily capped gains. Despite this, the broader structure remains positive, as the crypto continues to hold above strong support levels.

FLOKIUSD 4Hr Chart | Source: X

The 100 EMA is serving as a reliable floor, having stabilized price during earlier pullbacks around the 0.00009420 mark. This level, combined with a shelf between 0.00009265 and 0.00009420, reflects consistent buying interest that is cushioning declines.

Analysts suggest that holding above this range keeps the bullish scenario intact, creating the conditions for another retest of the higher resistance zone.

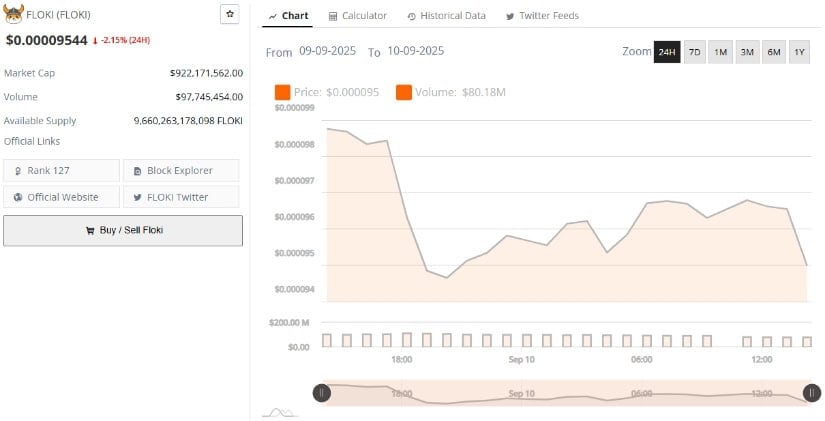

Market Action Shows Tight Fluctuations Amid Active VolumeAdditionally, FLOKI is trading at $0.00009544 at the time of reporting, reflecting a 2.15% decline over the past 24 hours. The token holds a market capitalization of approximately $922 million, placing it among mid-ranked cryptocurrencies at position 127. With a circulating supply exceeding 9.66 trillion tokens, cryptoI’s valuation remains highly sensitive to market activity.

Source: BraveNewCoin

The 24-hour chart shows price movement largely confined to a narrow band between $0.000092 and $0.000098, signaling short-term consolidation. Despite the modest decline, trading volume remains notable at nearly $97.7 million, underscoring continued liquidity in the market. This level of activity suggests that while price pressure has tilted slightly downward, the coin continues to attract significant participation.

Market stability is further emphasized by the consistent intraday trading range, which reflects a balance between buyers and sellers. If trading activity persists at this level, the token could soon test either side of its current range. A sustained push above $0.000098 WOULD hint at recovery momentum, while a slip under $0.000092 could expose the token to deeper retracements.

Indicators Support Potential Upside

On the daily timeframe, FLOKI has recently pushed above the middle line of the Bollinger Bands at 0.00009420, hinting at a tentative shift toward bullish momentum.

The upper band, located NEAR 0.000092, acts as immediate resistance, while the lower band provides reliable support, defining a clear trading range. The narrowing of the bands suggests reduced volatility, often a precursor to stronger price swings.

WIFUSD 1-Day Chart | Source: TradingView

Supporting this view, the Chaikin Money FLOW indicator registers positive at +0.13, confirming that capital inflows are favoring accumulation. This aligns with the broader technical picture, where higher lows and sustained buying activity are reinforcing the bullish case.

Analysts project that if the token clears resistance near the 200 EMA, the path could open toward a continuation of the uptrend with potential to retest higher levels in the sessions ahead.