Dogwifhat Price Signals Cautious Recovery as Market Steadies Near $0.82 - Here’s What Traders Need to Watch

Dogwifhat claws back from recent losses as the meme token finds tentative footing above key support levels.

Market Resilience Tested

The WIF rebound pushes toward the $0.82 threshold—traders eye this zone as critical for sustaining momentum. Breaking through could signal renewed bullish interest, while rejection might trigger another leg down.

Volume tells the real story behind the price action. Spot activity remains subdued compared to last month's frenzy—because nothing says 'healthy market' like traders cautiously dipping toes instead of diving headfirst into leveraged positions.

Memecoins continue defying traditional valuation models, proving once again that in crypto, narrative often trumps fundamentals. Whether this recovery holds depends less on technicals and more on whether Twitter stays interested past next week.

Market watchers note that the token is showing resilience around the $0.80–$0.83 zone, where both buying and selling pressures are active. With liquidity building and indicators stabilizing, the token is at a critical stage where the next MOVE could define its short-term trajectory.

Technical structure and consolidation outlook

According to data highlighted by Open Interest, WIF is maintaining support NEAR $0.81 while struggling to break through $0.83 resistance. Price action showed repeated retests of this ceiling, with each rejection underscoring the weight of selling pressure in the near term. Despite this, the coin has consistently found buyers willing to defend dips toward $0.80, forming a base that steadies sentiment.

Source: Open Interest

Another observation was the tightening of intraday ranges, as swings between highs and lows narrowed with each session. This reflects reduced volatility and signals that the token is entering a consolidation phase. Such setups often precede decisive moves, with liquidity gathering at key levels before momentum shifts.

The projected outlook suggested the coin could continue oscillating in this band until stronger forces emerge. If support at $0.80 holds, the accumulation pattern may serve as a launchpad for recovery. However, failure to sustain these levels risks exposing the token to sharper declines toward deeper support zones.

Market activity and liquidity trends

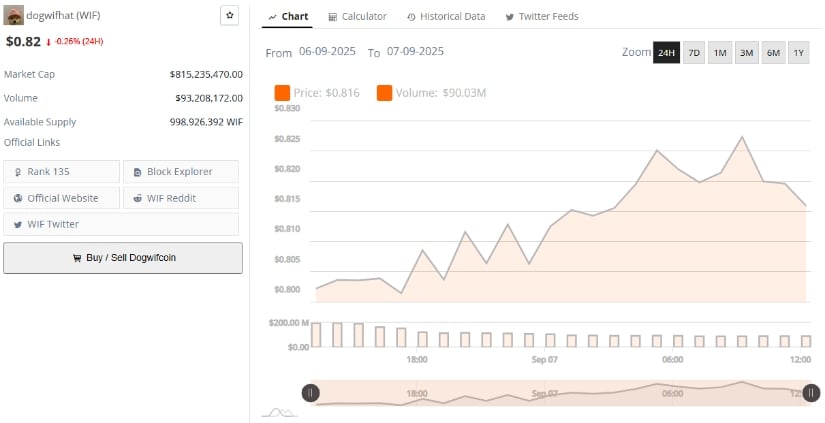

On one hand, the BraveNewCoin data chart reflected the token trading at $0.82 after dipping slightly from earlier highs of $0.83. In the same 24-hour period, the coin recorded a low of $0.81, highlighting stability despite selling pressure. With a market capitalization of $815 million, WIF remains within the top 150 digital assets by size.

Source: BraveNewCoin

Trading activity provided further insights, as daily volume reached nearly $93 million, showcasing active participation. This steady turnover indicates ongoing interest from both retail and larger market players. The liquidity profile shows that the crypto continues to attract consistent attention even while trading within a compressed range.

The available supply of nearly 1 billion tokens reinforced its standing in the market. This figure, combined with stable capitalization and turnover, suggested that the asset maintains maturity in its trading structure. Together, these elements underscore the balance between demand and supply, keeping price action relatively contained.

Indicators and momentum signals

At the time of writing, WIF was valued at $0.82, reflecting mild intraday losses from its $0.83 peak. The RSI reading of 46.78 pointed to neutral momentum, suggesting neither overbought nor oversold conditions. This balanced reading implied that the market retains flexibility for directional moves in either direction.

Source: TradingView

Momentum indicators provided additional context, with the MACD histogram registering a positive value of 0.005. Both the MACD and Signal lines hovered close to zero, signaling a possible crossover and early hints of bullish reversal. These patterns highlighted that momentum, though modest, may be shifting in favor of buyers.

Whale positioning also added weight to the analysis, as larger holders appeared to accumulate at support zones. Such activity often lays the groundwork for extended moves once broader market sentiment aligns. If this quiet build-up continues, it could provide the base for the coin to challenge higher resistance levels, particularly toward the $0.90 to $1.00 range.