BNB Holds Critical Support: $1,000 Breakout Imminent as Binance’s Token Shows Strength

BNB defies market turbulence, clinging to crucial support levels as traders eye the psychological $1,000 barrier.

Technical Standoff

The Binance token consolidates at make-or-break territory—holding above key support could trigger the next major rally. Every dip gets bought while resistance levels show weakening sell pressure.

Market Mechanics

Volume patterns suggest accumulation happening beneath the surface. Whales aren't selling—they're repositioning for what comes next. The $1,000 target isn't just technical; it's becoming a self-fulfilling prophecy among institutional players.

Broader Context

While traditional finance debates rate cuts, crypto assets like BNB bypass conventional wisdom entirely. The token's performance continues mocking skeptics who still think blockchain is just for buying questionable NFTs.

Final Take

Watch the support hold—break that $1,000 ceiling and this becomes an entirely different game. Sometimes the market does exactly what it's supposed to do, just to annoy the fund managers who spent millions on forecasting models.

Now, the token is at a standstill, consolidating at a key price level that could determine its next big move. Traders are watching closely as the market decides whether bulls have the strength to push higher. The outcome here could set the tone for the asset’s next major rally.

BNB’s $845 Consolidation is a Key Test for the Next Leg Up

In a recent X post, analyst crypto Tony highlighted the importance of the $845 level, noting that holding this support could open the door to a rally toward $1,000. On the weekly chart, this level stands out as a former resistance that has now turned into support for a bullish structure, provided it continues to hold.

The consolidation above $845 is viewed as a healthy pause after the rapid surge, giving the market time to reset before attempting the next breakout.

Source: X

The cryptocurrency’s recent performance has followed a clear “stair-step” pattern. Breakouts above $680 and $740 were each followed by consolidation, after which buyers returned with renewed strength. This consistent behavior suggests that the market remains firmly in bullish control. Should $845 remain intact, the next technical target sits around $1,000, a major psychological and resistance milestone for traders.

Market at Large: Steady Price Action Near Key Zone

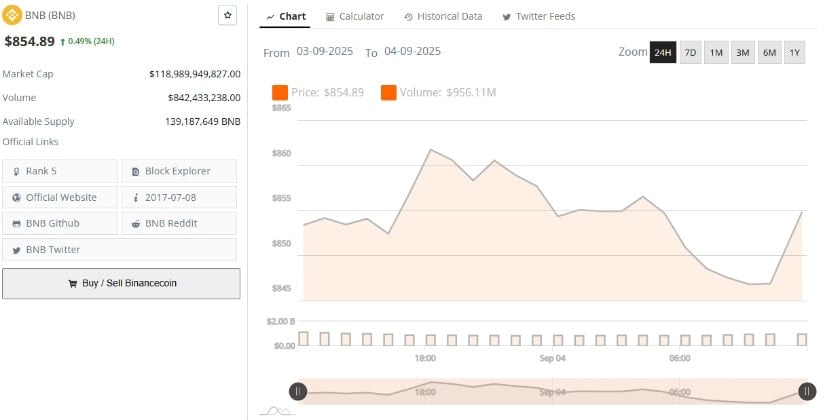

Additionally, the latest BraveNewCoin data shows Binance Coin trading at $854.89, reflecting a modest 0.49% increase over the past 24 hours. The market cap stands at approximately $118.98 billion, positioning the token firmly within the top five digital assets by size.

Trading volume recorded at $842 million highlights steady liquidity in the market, with over 139 million tokens in circulating supply. This stable FLOW of activity demonstrates that the memecoin continues to attract consistent participation from holders across the Binance ecosystem, reinforcing its role as a core utility token.

Source: BraveNewCoin

Recent price movements follow a pattern of upward spikes tempered by mild corrections, signaling active buyer absorption of dips and balanced participant dynamics.

Consolidation within this range suggests the market is stabilizing, with potential to push past recent highs if momentum holds. A decline below the key support zone could open the way for further tests of foundational price levels.

Technical Signals Show Consolidation with Bullish Indicators

On the other hand, Technical analysis highlights that momentum indicators have softened slightly but remain positive on a broader scale. The MACD indicates a pullback in momentum but shows signs that buyers still maintain influence. Meanwhile, capital Flow metrics support ongoing demand, albeit at a cautious pace.

Source: TradingView

Price action hovering NEAR the upper bands of volatility suggests a preparatory phase preceding a decisive move. Holding key support levels will be essential for maintaining the integrity of the longer-term uptrend. Should the market sustain volume and momentum, a renewed rally toward resistance targets is a plausible next step.