Solana Price Prediction: SOL Battles $213 Resistance as Bulls Target $300 Breakout

Solana's momentum hits a critical inflection point as bulls push toward a decisive $300 breakout.

Breaking Through the Ceiling

SOL faces stiff resistance at $213—a level that's become the ultimate litmus test for bullish conviction. Traders watch every tick as the asset struggles to punch through this psychological barrier.

The $300 Horizon

Market optimists eye the $300 threshold, betting that a clean break above resistance could trigger another leg up. No guarantees, of course—because in crypto, even 'sure things' have a habit of surprising everyone except the guys who already sold.

Volume and Volatility

Trading activity spikes each time SOL approaches key levels, signaling either accumulation or distribution. Nobody really knows which until after the fact—typical finance professionals guessing with better charts.

Technical positioning suggests momentum is building, but as always, past performance just means you’re overdue for a correction.

Solana has once again positioned itself at the center of crypto conversations, with its on-chain growth creating steady momentum. From rising real-world asset adoption to expanding stablecoin liquidity, the network continues to strengthen its fundamentals.

At the same time, Solana’s price action is hovering at a make-or-break zone. The $200 level has flipped into a critical support, while resistance NEAR $213 remains the major hurdle before higher targets open up.

Solana’s RWA Growth Reaches New Highs

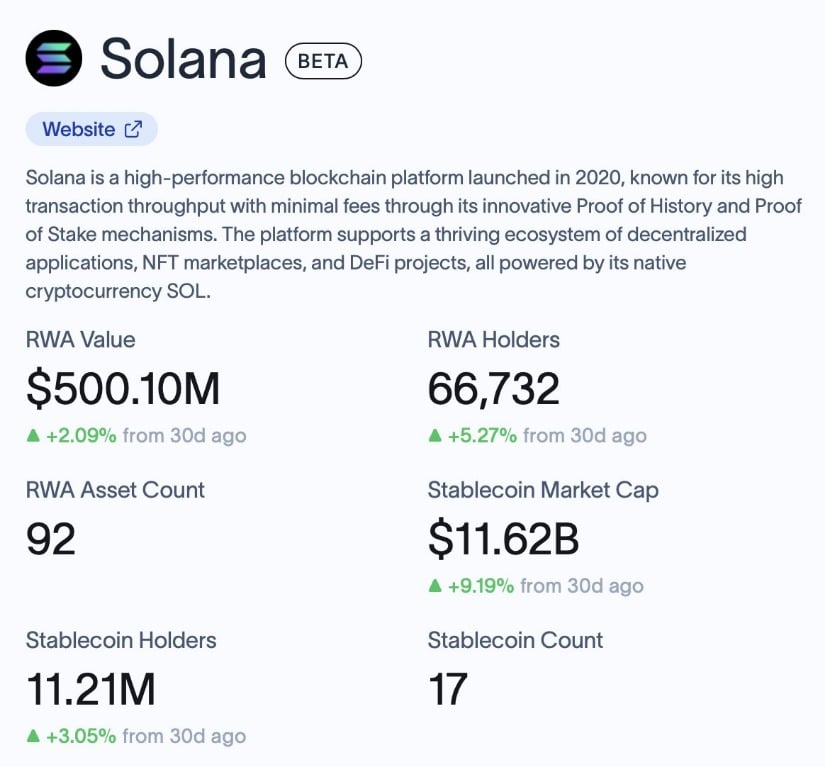

Solana has hit a fresh milestone as tokenized real-world assets (RWAs) on its network surpassed the $500 million mark, according to SolanaFloor. RWA has been one of the biggest themes of 2024 and 2025, drawing strong attention from both institutions and retail. With 92 listed RWA assets and over 66,700 holders, the data signals steady adoption that strengthens Solana’s positioning in the real-world finance narrative.

Solana’s RWA adoption surpasses $500M with 92 listed assets, reinforcing its role in real-world finance. Source: SolanaFloor via X

SolanaFloor points out that alongside the RWA growth, the stablecoin market cap on solana has surged to $11.62 billion, supported by more than 11.2 million holders. This combination of rising RWA adoption and expanding stablecoin liquidity highlights strong on-chain fundamentals. Such consistent on-chain strength could serve as a strong catalyst for Solana’s price outlook.

Solana Defends $200 Support Zone

Solana is battling around the $200 level, a price zone that has flipped from resistance into support. Analyst Lennaert Snyder notes that holding above this region keeps the daily uptrend intact, with $180 serving as the deeper line of defense. The chart outlines how a reclaim of $216 WOULD confirm strength, opening the path toward $238. Beyond that, the previous all-time high comes back into play, making this a decisive stage for SOL’s price trajectory.

Solana holds steady above the $200 support, with $216 eyed as the next breakout trigger. Source: Lennaert Snyder via X

From a structural perspective, Solana continues to build higher lows, maintaining momentum within its broader uptrend. As long as buyers defend the $200 zone, pullbacks can be seen as opportunities rather than weakness. Snyder emphasizes that confirmation above resistance is key before chasing longs, as clean breaks tend to set up sustainable continuation moves. For now, the $180 to $200 range remains the backbone of support guiding SOL’s bullish outlook.

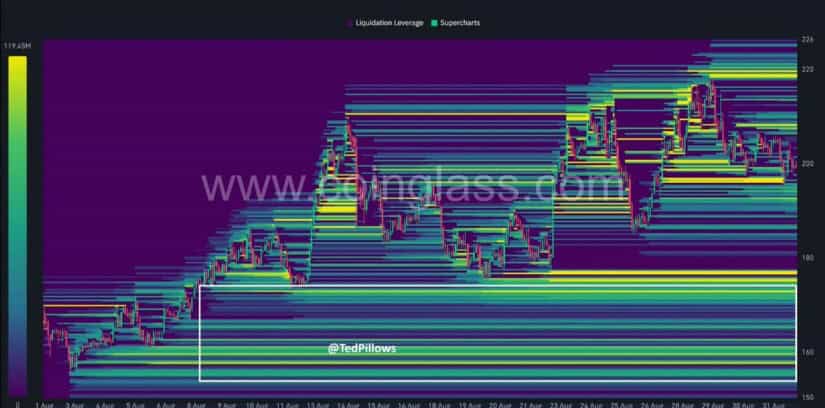

Solana Liquidity Cluster Signals Key Levels

Analyst Ted highlights that Solana is sitting on a notable liquidity cluster between $160 and $180, an area where significant bids and liquidations have stacked up. This zone now acts as a buffer, but also a potential magnet for price if momentum weakens across larger caps like Bitcoin and Ethereum. A sweep into this region during September wouldn’t necessarily mark weakness; it could serve as a reset before buyers step back in.

Solana’s $160–$180 liquidity cluster emerges as a key zone, often acting as a reset before stronger rallies. Source: Ted via X

The chart suggests that any flush into the $160 to $180 band may clear downside liquidity before positioning SOL for its next leg higher. Ted notes that this type of liquidity sweep often precedes stronger rallies, especially if market sentiment stabilizes afterward. With an eye on Q4, a recovery from this range could line up with an eventual push to fresh all-time highs.

Solana Price Prediction: Break Above $213 Opens Path to $300

Solana is hovering near a key inflection point, with analyst Crypto Monkey noting that the $213 level is the major resistance to watch. A clean breakout above this zone would confirm momentum and potentially open the door towards $300. Structurally, the chart shows that SOL Solana price has been carving higher lows on the weekly timeframe.

Solana eyes a breakout above $213, with upside targets stretching toward $238, $260, and $300. Source: Crypto Monkey via X

Above $213, solana price prediction targets $238 and $260, with $300 as the psychological extension. The weekly candles highlight that buyers have defended critical zones, keeping the broader trend intact.

Final Thoughts

Solana’s outlook remains firmly tied to how it handles the $200 to $213 zone. Holding above $200 gives buyers confidence, while a clean breakout over $213 could be the spark that sends SOL towards $238 and beyond. The liquidity clusters between $160 and $180 may still come into play, but these areas look more like potential reset zones than signs of weakness.

The combination of strong on-chain growth, expanding RWA adoption, and increasing stablecoin liquidity continues to provide a solid foundation for its long-term trajectory. If momentum builds in line with these fundamentals, the market may be well-positioned for a bullish solana price prediction.