Cardano Price Prediction: ADA Eyes $1 Breakout as Golden Cross Ignites Bullish Momentum

Cardano's technical setup flashes its most bullish signal in months as the golden cross pattern emerges—traders are positioning for a potential surge toward the psychological $1 barrier.

The 50-day moving average sliced through the 200-day like a hot knife through butter, triggering algorithmic buying programs across major exchanges. Volume patterns suggest institutional accumulation happening beneath the radar.

Market Structure Shift

ADA's consolidation phase appears to be breaking—price action cleared key resistance levels that had contained movement since the last cycle peak. Options flow shows heavy call buying at the $1 strike for September expiration.

On-chain metrics support the technical breakout. Active addresses hit a 90-day high while exchange reserves continue draining—classic supply squeeze dynamics in motion. Staking yields remain attractive enough to keep weak hands from panic selling.

Of course, traditional finance pundits will call this another 'speculative bubble' while quietly loading their own bags through offshore vehicles. The pattern's familiar by now.

Next major resistance sits at $1.20 if momentum holds. Break that, and we're likely testing the all-time high zone. Just remember—in crypto, golden crosses work until they don't.

Cardano price is finally showing signs of strength as a golden cross takes shape on its chart. This rare technical event, where the 50-day moving average climbs above the 200-day, has historically marked the start of longer bullish phases. Combined with a breakout from a bullish wedge, ADA is signaling that its trend may be shifting decisively in favor of buyers.

Golden Cross Formation Strengthens Cardano’s Price Prediction

Analyst The Long Investor points out that Cardano’s price chart just confirmed a golden cross, a technical event where long-term trend strength flips in favor of the bulls. This signal coincides with the breakout from a double bullish wedge, creating a rare alignment of technicals that suggests momentum is beginning to transition into a sustained upward phase.

Cardano confirms a golden cross alongside a bullish wedge breakout, signaling strong upside momentum ahead. Source: The Long Investor via X

The confluence of the golden cross with this wedge breakout gives Cardano a strong technical foundation heading into the weeks ahead. Historically, such setups have paved the way for multi-month expansions, especially when supported by steady volume and higher low formations. If ADA can hold its breakout and build above the $0.85 to $0.90 zone, the probability of reclaiming $1.00 and extending towards $2.00 grows significantly stronger.

Cardano Chart Tightens Ahead of Potential Breakout

ADA’s price continues to compress inside a symmetrical triangle, with buyers holding the rising support trendline while sellers defend the ceiling NEAR $0.98. The setup shows volume tapering off as the apex approaches, a signal that a breakout decision is getting closer. The presence of the 50-day moving average just below adds further strength to the $0.89 support zone, reinforcing it as the key level to watch.

ADA consolidates inside a tightening triangle pattern, with traders eyeing a breakout above $0.98 as momentum builds. Source: Sssebi via X

As momentum builds, a clean move above $0.98 could clear the way towards $1.05 to $1.10, while losing $0.89 risks inviting a sharper retrace into prior demand zones. Analyst Sssebi notes that when such patterns appear alongside recent bullish triggers like the golden cross, the odds typically favor an upward resolution. If ADA Cardano price maintains its structure, this consolidation could provide the foundation for a strong leg higher through August.

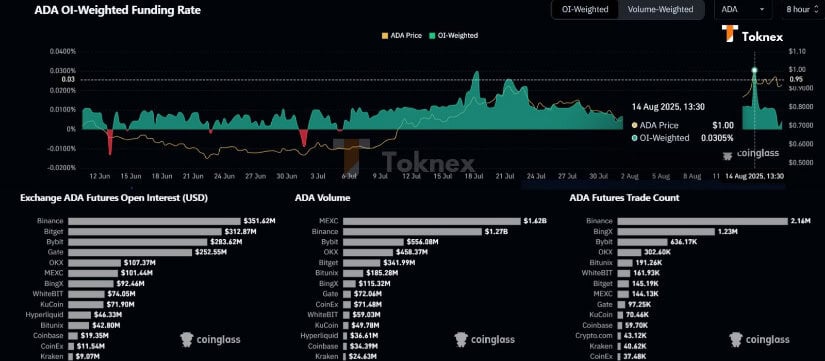

Cardano Open Interest and Funding Rates Support Bullish Case

Fresh derivatives data from Toknex highlights how ADA’s futures positioning is beginning to align with its bullish technical backdrop. Open interest across major exchanges now sits comfortably above $1.0B, with Binance and Bybit leading the flow. Alongside this, funding rates remain positive but not overheated, showing that traders are leaning bullish without extreme leverage in play. This type of balance often creates room for sustainable rallies, particularly when spot market participation and on-chain metrics are showing strength.

Cardano futures open interest climbs past $1B with rising spot volumes, reinforcing bullish momentum near the $1 resistance. Source: Toknex via X

On-chain volume trends add weight to the picture, with ADA futures trade counts crossing 2.1M and spot volumes on MEXC and Binance surging past $1.7B combined. This rise in activity coincides with ADA pressing against key resistance near $1.00, while market watchers note that $1.01 and $1.15 remain the next checkpoints.

Cardano Whale Accumulation Reaches Multi-Month High

Fresh data from Mintern shows whale activity in ADA climbing to its strongest levels in months, even after recent market pullbacks. Large holders have continued to accumulate, signaling confidence that extends beyond short-term volatility.

Cardano whale accumulation hits multi-month highs, signaling renewed confidence from large holders despite recent volatility. Source: Mintern via X

This consistent buildup suggests that whales are positioning for the next expansion phase, using dips as opportunities to increase exposure. When such activity aligns with technical improvements like the golden cross seen earlier, it often provides a powerful base for broader market moves.

ADA Dominance Holds Key Levels As Bulls Reset

The latest dominance chart highlights ADA’s steady climb, with cardano holding firm above the 0.85% mark. The structure reflects resilience, as dominance continues to trend upward alongside the 50-day moving average, a sign that Cardano is gradually carving out more space in the broader crypto market. The volume and RSI base suggest consolidation before the next leg, giving bulls a chance to reset without breaking structure.

Cardano dominance holds above 0.85%, with a bullish structure suggesting room for further market expansion. Source: Sssebi via X

Sssebi points out that this setup looks increasingly bullish as dominance stabilizes at higher lows, creating a foundation for further expansion. If Cardano maintains this trajectory, growing dominance could amplify price momentum once key resistance levels are cleared.

Final Thoughts: Will Cardano’s Momentum Hold?

Cardano’s price chart is now at a point where excitement and caution meet. The golden cross, rising dominance, and whale accumulation give bulls plenty to cheer about, but the price still needs to prove it can hold above the $0.90 zone. Breaking through $1 with real conviction could flip sentiment across the market, setting ADA up for a stronger recovery phase.

For now, the balance between patient consolidation and sudden breakout is in play. If momentum carries, the MOVE could extend towards $1.15 and beyond.