Fed Vice Chair Endorses Staff Crypto Holdings as Maxi Doge Surges - Regulatory Waters Tested

Federal Reserve leadership just dropped a bombshell endorsement—staff can now hold cryptocurrencies while Maxi Doge rockets upward. Talk about timing.

Policy Shift or Pandora's Box?

The Vice Chair's stance throws traditional finance compliance into a blender. No more hiding crypto portfolios under regulatory mattresses—Fed employees get the green light as meme coins defy gravity. Banking traditionalists are clutching pearls while blockchain natives cheer the normalization.

Meme Coins Eat Boring Policy for Breakfast

Maxi Doge's pump isn't just noise—it's a middle finger to slow-moving institutional adoption. While suits debate ethics, retail traders are racking up gains that outpace their annual bonuses. The irony? Regulators approving crypto ownership while watching assets they barely understand moon uncontrollably.

Finance's hypocrisy has never been more transparent—they'll regulate your crypto while quietly adding it to their own balance sheets. Welcome to the new era of 'do as I say, not as I trade.'

By framing crypto ownership as a path to better-informed regulation, Bowman has suggested a more practical, hands-on approach to policymaking. The stance comes as the Fed weighs in on how tokenization and blockchain could reduce frictions in financial markets, cutting costs and widening access.

And while Bowman was talking policy, the timing couldn’t be better for traders. Meme coins like Maxi Doge ($MAXI) are already gaining a lot of attention, and even just a hint of regulatory easing can throw extra fuel on the fire.

Bowman’s Call for ‘Practical Exposure’ to Crypto

At the Wyoming Blockchain Symposium, Bowman laid out her case for loosening internal Fed rules to let staff hold ‘de minimis [insignificant] amounts of crypto.’

![]()

@CryptosR_Us on X

Her argument was simple: regulators can’t fully grasp the asset class if they’ve never used it. By gaining ‘practical exposure,’ staff WOULD better understand how crypto works in practice, not just on paper.

Bowman also pointed to tokenization’s potential to cut costs and remove friction in capital markets, streamlining ownership transfers and expanding access.

‘We stand at a crossroads: we can either seize the opportunity to shape the future or risk being left behind.’

—Michelle Bowman, Federal Reserve Vice Chair for Supervision

Bowman framed the moment as a fork in the road, saying the US stands at a tipping point where updated legal frameworks could allow a broader range of blockchain-based activities.

Why It Matters for Regulation and Markets

Analysts say Bowman’s remarks shouldn’t be dismissed as industry talk. They hint at a potential inflection point in U.S. policy.

Vincent Liu, CIO at Kronos Research, called it a sign the Fed is moving from caution to curiosity. Attorney Andrew Rossow went further, arguing the speech represents an inflection point in US supervision that challenges the very logic of how financial oversight is carried out.

But not all reactions were upbeat. Critics warned that allowing regulators to directly hold crypto could erode impartiality and public trust, drawing comparisons to past financial debacles from Enron to FTX.

Against the backdrop of Trump’s ongoing push to reshape the Fed, Bowman’s idea adds a fresh LAYER of tension to the regulatory debate.For markets, though, even cautious Optimism from the Fed can lift sentiment. History shows that softer regulatory tones have sparked retail belief, most visibly in meme coin rallies like $DOGE and $SHIB. When institutions acknowledge crypto, it validates the narrative, and that tends to ripple outward into meme coin hype cycles.

Meme coins, after all, thrive on cultural timing as much as fundamentals. With Bowman’s comments fueling conversation about a more open regulatory stance, appetite for high-risk, high-reward tokens is climbing again.

That’s where Maxi DOGE ($MAXI) is finding its moment, riding both market speculation and the meme-fueled energy that has always defined the sector.

Maxi Doge ($MAXI): Meme Coin Muscle in 2025

If $DOGE is the friendly neighborhood Shiba, Maxi Doge ($MAXI) is his over-the-top, gym-rat cousin.

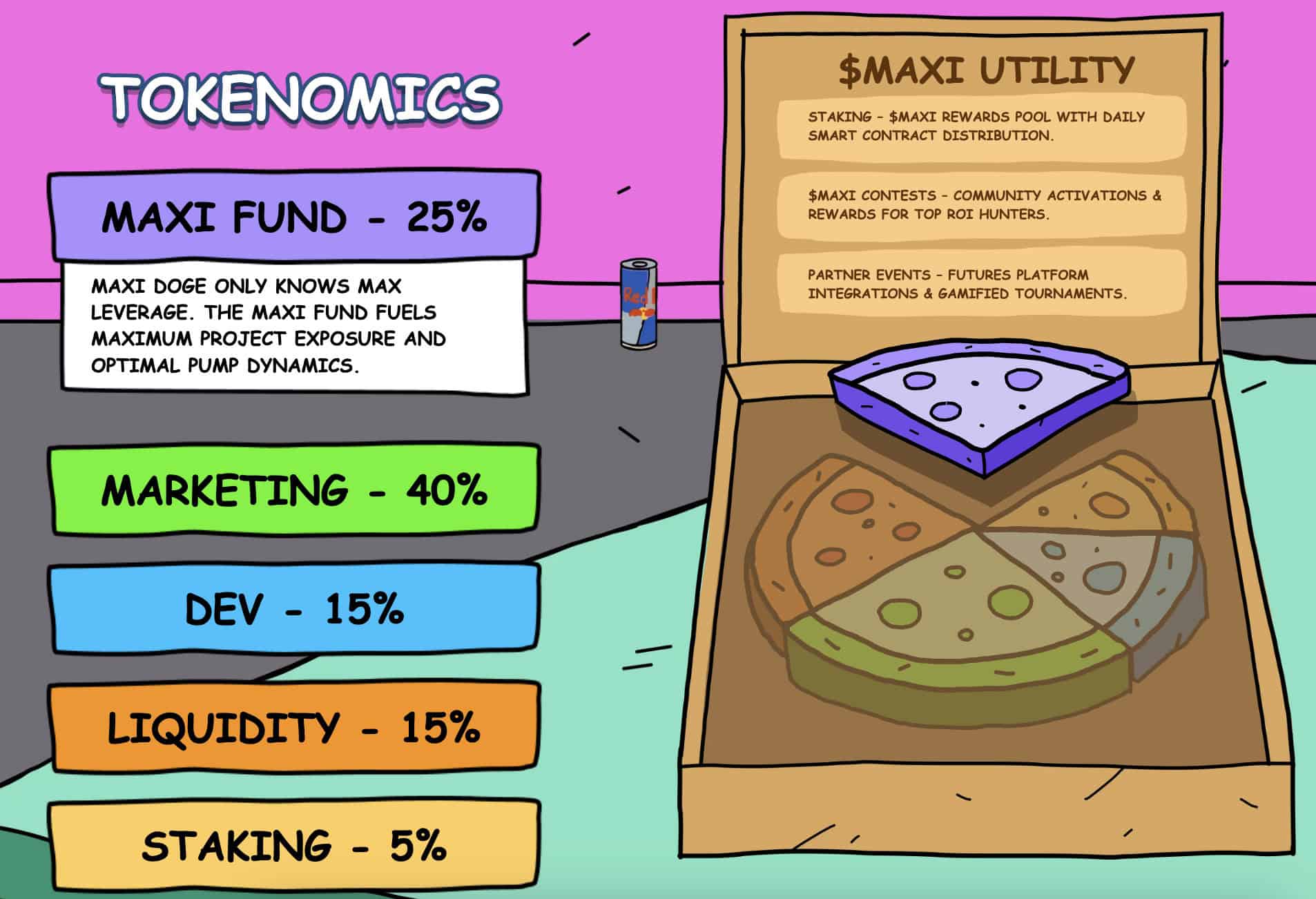

$MAXI is a satirical, body-building Doge who trades on 1000x leverage and never skips leg day. The branding is absurd by design, leaning into trader humor and the kind of self-aware meme culture that often drives viral traction.The numbers suggest the gag is landing. Maxi Doge has already raised more than $1.28M+ in its presale, with tokens priced at just $0.000253. A hefty 226% staking APY adds another draw for anyone looking to earn while they await launch.

Like $DOGE and $SHIB in their early days, $MAXI is light on utility for now. But the roadmap teases potential futures and leverage-trading tie-ins that align neatly with the project’s high-octane aesthetic.

For many, that’s part of the appeal. It’s a lifestyle token that reflects the bullish, caffeine-fueled mindset of 2025’s meme coin cycle.With regulatory conversations shifting and retail sentiment heating up, the timing of Maxi Doge’s presale feels anything but accidental.

Final Thoughts – From Fed Signals to Meme Coin Cycles

The Fed’s softer tone on crypto marks more than just a policy shift. It shows building momentum outside of institutional corridors.

When regulators hint at openness, retail traders tend to follow, and meme coins often ride that wave hardest. Maxi Doge ($MAXI) is a good example: part satire, part speculation, part cultural phenomenon built for this moment.

Remember, though, this is not financial advice. Always do your own research before investing.