Chainlink Primed for Explosive Growth as Liquidity Floodgates Open

Market forces align for Chainlink's next bull run—just as Wall Street 'discovers' crypto again.

Liquidity tsunami fuels LINK momentum

The oracle network's token shows classic accumulation patterns as institutional money circles. Whispers of new partnerships suggest real-world adoption might finally match the hype.

Technical breakout imminent?

Traders eye key resistance levels after weeks of consolidation. A clean break could send LINK racing toward uncharted territory—assuming the usual suspects don't dump at the first sign of life.

Another day, another crypto narrative. But this time, the smart money might actually be paying attention.

This upward trend reflects the asset’s resilience, especially after testing key support levels, with the price recently breaking past a critical resistance point. As the market searches for reliable altcoins, its long-term potential remains robust, positioning it for significant gains in the months ahead.

Despite a recent short-term price drop from $23 to $21.69, the asset remains a top contender for a bullish rally. Analyst Bull Bear Spot links the upward momentum to rising liquidity, particularly the correlation with M2 Global Money Supply. With the market actively engaged and price fluctuations continuing, it is poised for a breakout, making it an altcoin to watch.

Breakout Pattern and Strong Upward Momentum

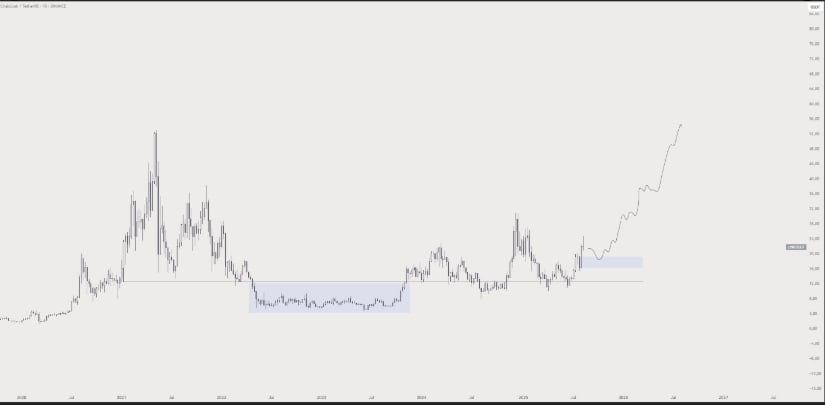

Analyst Inmortal has observed a strong breakout pattern forming on its chart, signaling the potential for further upward movement. After a consolidation phase, the price has started to rise, reflecting a period of resilience. The movement above key support levels suggests that chainlink may be poised for a significant rally in the coming months.

Source:x

This trend is driven by solid technical factors, with the token showing strong potential to outpace other altcoins. Analysts have highlighted that the token’s current price action is supported by the strength of the breakout, indicating that the market may favor it soon. If the price continues to hold above critical support levels, it is expected to set the stage for further gains in the coming weeks.

Liquidity Dynamics Fuel Chainlink Positive Outlook

Analysts point to the rising market liquidity as a key factor in the current price trajectory. The chart shared by analyst Bull Bear Spot illustrates the correlation between its price movements and the M2 Global Money Supply. This relationship suggests that the increasing liquidity in the market is fueling the asset’s upward momentum, with a potential for a price surge.

Source:x

The analyst believes that the current liquidity levels may be driving the accumulation phase for Chainlink, setting the stage for further price growth. As liquidity continues to rise, there is a growing sense of bullish sentiment among market participants, which could push the price higher. The token’s performance during this accumulation phase points to the likelihood of a breakout, as increased liquidity often fuels positive price movements.

Short-Term Price Correction Does Not Deter Market Interest

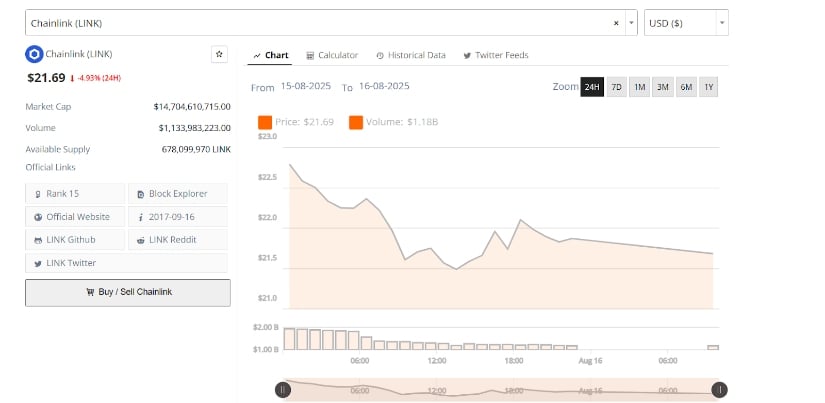

Despite the overall positive outlook, the token has recently faced a short-term dip. Over a 24-hour period, the price dropped from approximately $23 to $21.69, marking a 4.93% loss. This decline occurred after reaching a peak earlier in the day, where it faced downward pressure around the $22 range. The market volume during this period shows considerable trading activity, suggesting ongoing market interest despite the price correction.

LINKUSDT 24-Hr Chart | Source: BraveNewCoin

The dip is seen as part of a normal market correction, with price fluctuations reflecting active engagement from traders. Although there was a brief pullback, the market has continued to show interest, and the trading volume suggests that participants are keeping a close eye on potential price movements. The short-term decline does not seem to have diminished the long-term potential, with many expecting a return to upward momentum once the price stabilizes.

Key Support Levels and Future Price Projections

The next few price movements will likely determine whether this level will hold as support or if further declines will occur. If it manages to maintain its position above the $21 range, there is potential for further price gains as traders expect the token to resume its upward trajectory.

Market analysts are optimistic about its future performance, with predictions suggesting that the price could rise significantly in the coming months. The current market liquidity and technical structure are expected to play a crucial role in driving this momentum forward. If it continues to break past resistance levels and hold steady at key support points, it could see substantial gains in the NEAR future.