🚀 Ethereum (ETH) Price Surge: $3B ETF Inflows Propel ETH Toward $4,800 Breakout in August

Ethereum’s rally isn’t just hype—it’s fueled by cold, hard cash. With $3 billion flooding into ETH ETFs this month, the smart-money crowd is betting big on a breakout.

### The ETF Effect: Institutional Demand Goes Crypto-Native

Wall Street’s latest love affair with crypto isn’t Bitcoin—it’s Ethereum’s turn. The $3 billion influx suggests traders are positioning for what comes after the SEC’s rubber stamp.

### Technicals Scream Bullish

That $4,800 price target? It’s not just hopium. The charts show ETH clearing key resistance levels like a hot knife through butter—no fancy “Web3 adoption metrics” required.

### The Cynic’s Corner

Let’s be real: half these ETF buyers probably still think ‘gas fees’ refer to their Tesla’s charging bill. But money talks—even when it doesn’t understand the tech.

Bottom line: Ethereum’s not waiting for retail FOMO. The big players are already in—and they’re pushing for record highs.

This sudden influx of capital has pushed ethereum closer to reclaiming its multi-year highs. As institutional investors embrace regulated ETF products, the question now is whether ETH will power through resistance or face renewed selling pressure.

ETH Price Action Overview

Ethereum (ETH) is showing strong bullish sentiment in mid-August, supported by an out-of-this-world surge in spot Ether ETF demand. In the first couple of weeks of the month alone, net inflows have exceeded $3 billion, one of the strongest monthly results ever for ETH ETFs.

Ethereum rebounds from $4,466, charging toward $4,800 as traders eye dips for buying opportunities. Source: @TedPillows via X

Daily inflows have been in excess of $700 million, hitting session highs of over $1 billion. Such persistent injection of capital has pushed overall net assets across ETH ETFs to record highs, which remains a clear signal of a turning point in investor appetite for regulated exposure to Ethereum.

Price action illustrates this liquidity surge. ETH has appreciated nearly 20% in the last week, touching a high of $4,765—its most recent three-year+ high—and is now nearing the significant $4,800 resistance point, just shy of its $4,891 all-time record high seen in November 2021. Market participants are holding back and watching whether this level is going to be a breakdown point or create short-term profit-taking.

Technical Insight: Nearing Breakout Territory

Price action shows ETH trading in a well-established bull channel, holding above key support levels and short-term moving averages. A decisive break above $4,870 will provoke an advance towards $4,950–$5,000. Failure to break higher will see a short-term dip back towards $4,720 or deeper support at $4,504.

Ethereum rides a bullish channel, driven by $3B weekly ETF inflows, corporate buying, and record staking, targeting $4,870–$5,000 while key supports remain intact. Source: @AkaBull_ via X

Momentum gauges such as the RSI remain in bullish territory without overbought levels, and the MACD shows sustained buying pressure. Bollinger Bands are also expanding, suggesting an expansion phase conducive to buyers.

Institutional Catalysts in Play

Institutional investors are increasingly coming into ETH in their portfolios, adding to the upward momentum of price. Top market players have increased holdings, creating steady accumulation. This action, combined with historical ETF inflows, is keeping sell-side pressure at bay and supporting a possible breakout above recent highs.

Total Ethereum Spot ETF Net Inflow chart: SoSoValue

Optimists see the medium-term horizon, with Ethereum jumping to $7,500 by year-end if ETF demand, staking growth, and regulatory clarity all remain on course.

ETFs Fueling the Momentum

Spot Ether ETFs have seen sustained investor interest since launch, with August shaping up to be one of their strongest months yet. Inflows have averaged hundreds of millions of dollars daily, with peak days surpassing the billion-dollar mark.

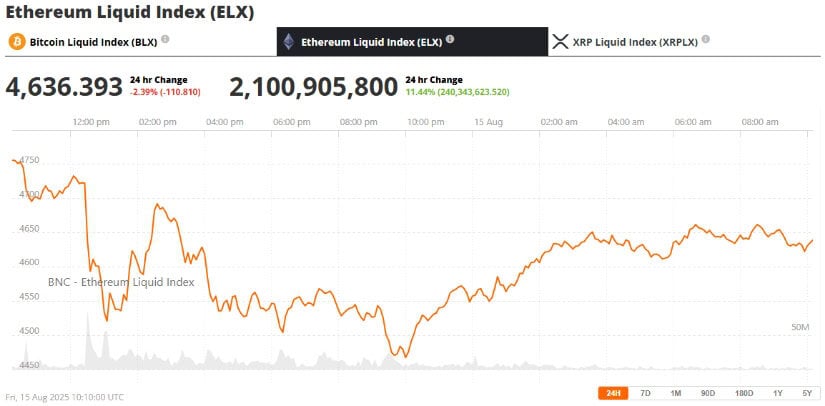

Ethereum (ETH) was trading at around $4,636, down 2.39% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Total net assets across these ETFs have climbed to new records, reflecting a shift toward regulated investment channels for crypto exposure. Flagship products from leading asset managers are dominating inflows, underscoring growing trust in Ethereum as an institutional asset.

Ecosystem Tailwinds: Tech Upgrades & Altseason

Ethereum’s recent network upgrade has improved scalability and reduced LAYER 2 gas fees, boosting its appeal for developers and users. This is accompanied by growing total value locked (TVL) on top Layer 2 protocols such as Arbitrum, Optimism, and zkSync.

Alongside, the overall altcoin market is gaining traction with Ethereum as a stalwart in today’s rally. Growing adoption of decentralized applications, tokenized assets, and staking rewards are adding to the bullish sentiment.

Short-Term Outlook & Price Projection

Short term, Ethereum’s price will be set by whether it will be able to convincingly MOVE through $4,800–$4,870. Assuming momentum maintains and ETF inflows remain strong, a move into the $5,000 zone is expected.

ETH pulls back into the $4,466–$4,504 demand zone for a smart-money liquidity reload, eyeing bullish targets at $4,800–$4,870 and $5,000, while key levels guide trade setups. Source: SCALPER-Clinton on TradingView

Medium-term forecasts see the potential for Ethereum to target $6,000–$7,500 on the back of favorable macro conditions, ongoing institutional participation, and ongoing ecosystem growth. Conversely, macroeconomic shocks or regulation reversals might trigger normalization cycles into the $4,500 area.

Final Thoughts

Ethereum is close to all-time highs, driven by record ETF inflows and a technicaly bullish setup. With institutional demand, ecosystem upgrades, and sentiment all agreeing, ETH will have a high likelihood of breaking out above $4,800 and looking to make new highs.

Investors should nevertheless remain wary of short-term volatility as the market tests this critical level.