🚨 Bitcoin (BTC) Crashes Below $118K: Inflation Fears Trigger $1B Liquidation Bloodbath

Bitcoin's throne wobbles as macro tremors hit crypto markets.

The selloff spiral: BTC nosedived past $118K—its sharpest drop since the 2024 halving—as inflation data spooked traders into dumping risk assets. Over $1B in long positions got liquidated faster than a DeFi rug pull.

Liquidation carnage: Leveraged bulls got steamrolled when BTC breached key support levels. CEX order books showed panic selling at levels not seen since the Mt. Gox repayments chaos.

Silver lining? OGs are stacking sats during the dip—because nothing makes crypto bros happier than 'buying the fear' (until the next -20% leg down). Meanwhile, Wall Street hedgies are probably shorting with both hands while telling clients to 'HODL for the long term.'

The steep decline came after Bitcoin’s recent rally to multi-month highs, raising questions over whether the bull run can sustain its momentum.

The sudden market turbulence reflects a broader risk-off sentiment, with both traditional and digital asset traders reacting to fresh U.S. inflation data. While Bitcoin had been trading steadily above key resistance earlier in the week, the sell-off underscores how sensitive the market remains to macroeconomic shifts.

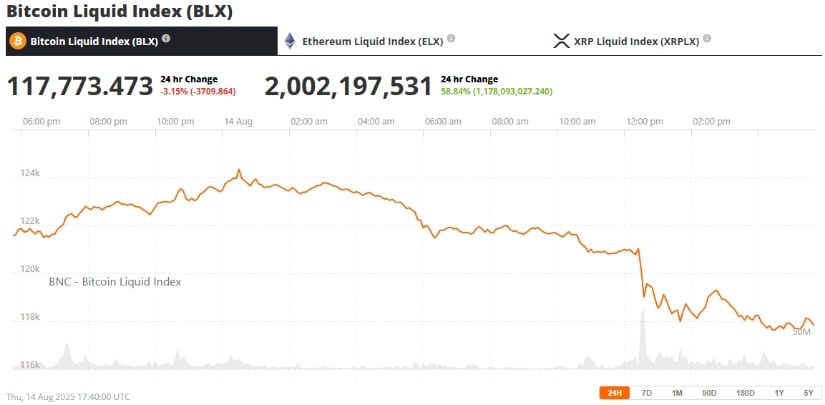

Bitcoin’s Sharp Price Reversal Below $118K

Bitcoin’s price tumbled during early Thursday trading, declining from highs of nearly $122,000 to lows of sub-$118,000 within hours. The action was among the most precipitous intraday reversals of recent weeks and saw bitcoin lose over $4,000 in value. Analysts point out that the $118,000 level had been serving as a near-term support, and its breach was a solidly bullish warning sign.

Bitcoin (BTC) was trading at around $117,773, down 3.15% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Trading volume volatility deepened during the fall, reflecting panic-selling pressure among institutional and retail investors. Several Leveraged longs were surprised, and in the process, they set off a series of forced liquidations at various exchanges. This gave more fuel to the fall, accelerating the velocity and depth of Bitcoin’s fall.

Inflation Data Sparks Risk-Off Sentiment

The price fall overlapped with the release of hotter-than-expected U.S. inflation data, which reignited fears that the Federal Reserve will keep interest rates higher for a longer period. Higher inflation readings have a deflationary impact on risk asset demand, such as cryptocurrencies, as investors pre-empt tighter monetary conditions by rebalancing portfolios.

The July U.S. Producer Price Index ROSE +0.9% monthly and +3.3% annually, reducing market expectations for a September Federal Reserve rate cut. Source: @xCryptoBro via X

For Bitcoin, in turn, long one of the darlings of inflation-hedge speculation, the reaction was a reminder that short-term price action is still heavily linked to macro sentiment. While characters like Mike Alfred are optimistic on Bitcoin’s store-of-value argument with inflation pressures increasing, short-term speculators appear more worried about the prospect of closing liquidity and reduced speculative inflows.

$1 Billion in Liquidations Rattles the Market

Figures from cryptocurrency analytics firms showed that more than $1 billion of leveraged positions were unwound during the first 24 hours of the drop. The majority of these were long wagers on additional gains, which clearly show how sentiment can change so rapidly in this current environment.

Over 218,000 traders were liquidated in the crypto markets, resulting in total losses of approximately $1 billion. Source: Grey BTC via X

Mass liquidations usually lead to wild price swings, as order books get flooded with automatic selling orders. The domino effect will likely push more panic selling, especially from margin traders. The recent wipeout is a grim reminder of the risk of impulsive margin trading in volatile markets like Bitcoin.

What’s Next for Bitcoin? Key Levels to Watch

Despite the steep decline, there are still some analysts optimistic about Bitcoin’s medium-term outlook. The $115,000–$118,000 region is now under scrutiny as a potential accumulation area, and a robust regain of $120,000 may revive bullish pressure. If the buyers return, Bitcoin can test its recent highs above $122,000 within a couple of weeks.

BTCUSD faces pressure, with key support at $117K, $115.5K, and $114K, while a close above $121K could restore bullish momentum. Source: Luke_Edward on TradingView

However, a fall below $115,000 might open the door to further corrections down towards the $110,000 psychological level. The traders will be keeping an eye on the next releases of economic data, as macro trends still occupy the focal point of Bitcoin’s short-term price action.