Whales Go Wild: Bitcoin Season Ignites as 18,996 Wallets Now Hold 100+ BTC

Bitcoin's bull run just got a steroid injection from deep-pocketed investors. The number of wallets holding at least 100 BTC has surged to 18,996—a clear signal that crypto's big players are doubling down.

When whales move, markets ripple. This isn't your grandma's 'buy the dip' strategy—it's institutional-grade accumulation. And while retail traders chase memecoins, the smart money's parking itself in digital gold.

Wall Street analysts scrambling to explain the rally? Cue the 'store of value' PowerPoint decks. Meanwhile, Bitcoin keeps doing what it does best: ignoring doubters and printing new believers.

This is a new all-time high, according to Bitcoin Magazine Pro, surpassing the previous record of 18,544, which dates back to February 26, 2017.

The surge in whale activity pushed bitcoin close to $120K, only 3% from its latest ATH of $123K recorded in July of this year.

At the time of writing this article, Bitcoin is still hovering around the $120K mark, suggesting a consolidation phase that could precede the next bull run. And that could also mean great things for Bitcoin Hyper ($HYPER).

The Factors Behind Bitcoin’s Historic Performance

The sudden Bitcoin whale accumulation isn’t the cause behind Bitcoin’s chart performance, but it is a symptom. The real catalysts include economic and legislative factors, with Trump’s GENIUS Act being the most important one.

The GENIUS Act creates a stronger and clearer regulatory framework for stablecoin issuers, adding legitimacy to the cryptosphere and essentially turning crypto mainstream.The increased trust in the crypto market that comes with the GENIUS Act translates to higher investor confidence, with Michael Saylor’s Strategy leading the pack by a wide margin.

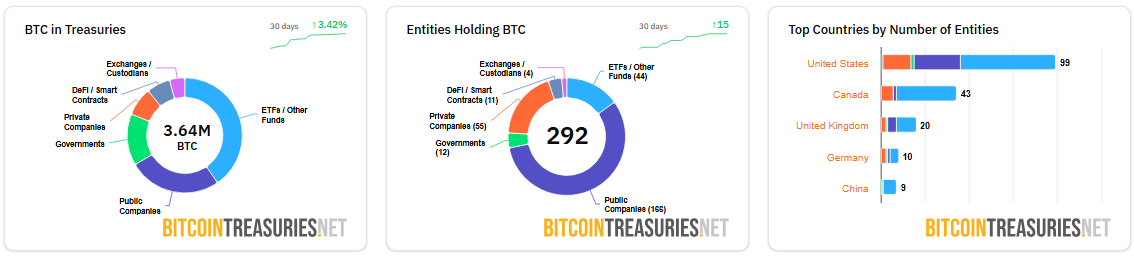

Strategy’s Bitcoin reserve is currently at 628,946 $BTC, valued at $75B+. It occupies the first spot on a list of 292 public companies, the top 100 of which hold 951,875 $BTC.

According to Bitcoin Treasuries, 3.64M Bitcoins are already in treasuries across multiple sectors, including governments, private companies, exchanges, and smart contracts.

Source: BitcoinTreasuries.net

Trump’s pro-crypto regulatory measures, including the latest executive order, which allows cryptos into 401(k) retirement plans, along with the increase in institutional investments, have made Bitcoin less volatile with time.

According to CoinGlass data, Bitcoin’s volatility decreases as its price increases, with the discrepancy reaching an all-time high in 2025.

Source: CoinGlass

All these factors have raised investor confidence in Bitcoin’s future, with companies like Bullish, backed by billionaire Peter Thiel, planning a $4.82B valuation at their next IPO, with a target of $990M.

If successful, some of the proceeds will go into $USD-backed stablecoins.

All these developments create the image of a bullish Bitcoin that appears to only be going up. In this pro-crypto context, expect projects like Bitcoin Hyper to fire up soon.

How Bitcoin Hyper ($HYPER) Pushes Bitcoin’s Performance Into the Stratosphere

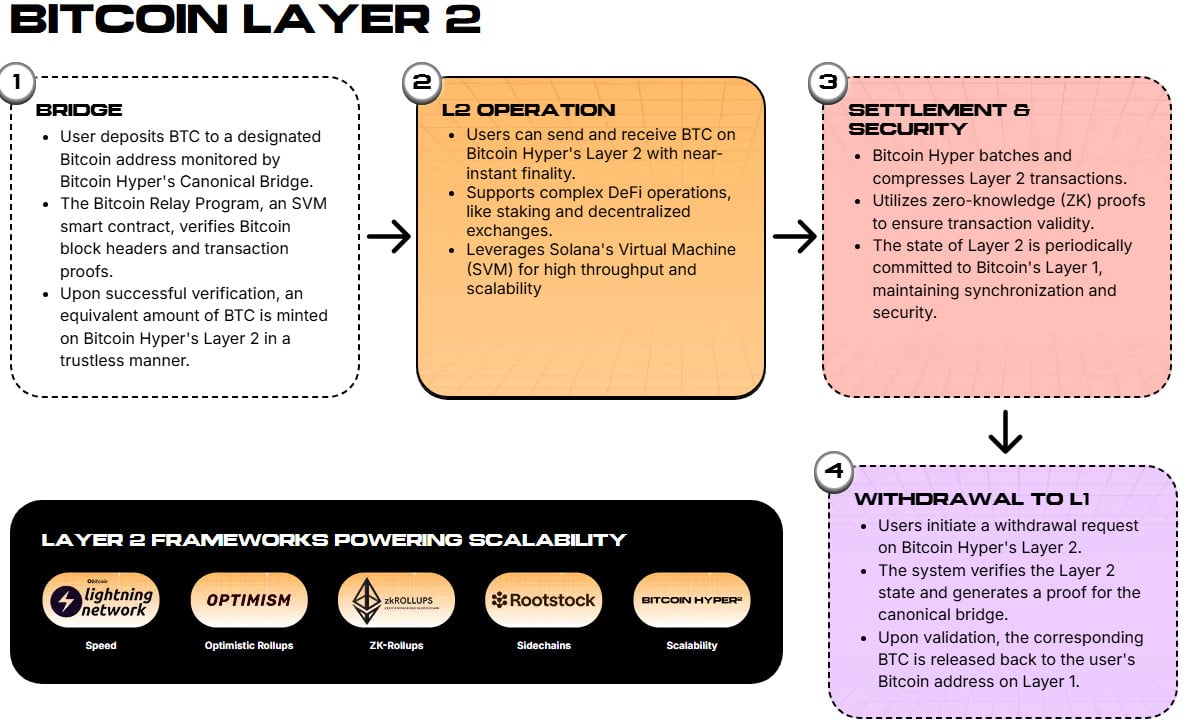

Bitcoin Hyper ($HYPER) is Bitcoin’s long-awaited official Layer-2 upgrade that aims to push Bitcoin’s performance to Solana-grade numbers.

Currently, Bitcoin’s transactions-per-second (TPS) hard cap is seven, far below modern industry standards. Hyper aims to change that with the help of the Canonical Bridge.

The Canonical Bridge keeps track of Bitcoin’s Layer-1 transactions and mints the same number of $BTC into Hyper’s Layer-2. The wrapped $BTC are usable within Layer-2 or withdrawn back to Bitcoin’s native network at any time.

The Canonical Bridge uses the Bitcoin Relay Program to confirm the transaction details, delivering near-instant finality and pushing Bitcoin’s performance past anything previously thought possible.

The Solana VIRTUAL Machine (SVM) integration is another vital addition to the ecosystem, ensuring low latency and lightning-fast execution of smart contracts and DeFi apps.

These tools unlock Bitcoin’s potential and plan to bring the network’s performance to Solana’s level. For a clearer perspective, Solana’s maximum theoretical TPS is 65K, compared to Bitcoin’s seven.

Since it started in May, $HYPER’s presale just broke the $9M threshold, turning it into one of 2025’s fastest-growing presales.If you want to invest, this may be the perfect time, given that $HYPER trades for the low presale price of $0.012675.

This turns $HYPER into a potentially massive investment opportunity, given the presale performance and accounting for the project’s scope and possibilities. Based on these factors, our analysts expect $HYPER to reach a $0.2 price tag in 2025 post-launch.

By 2030, following successful implementation and mainstream adoption, $HYPER could easily push to $1.2 or higher, for a growth of 9,367%.

If you want to FOMO-invest and diversify your portfolio with Bitcoin Hyper, go to the presale page and get your $HYPER today.

Will Bitcoin Touch on Another ATH?

Based on the chart momentum built by the rampant whale investments, Trump’s 401(k) executive order, and the increase in institutional adoption, it’s SAFE to say that we’re looking at an imminent ATH.

Bitcoin can only go up at this point and will take Bitcoin Hyper ($HYPER). This is already happening, given the presale’s recent meteoric rise.

As always, though, don’t take this as financial advice. Always do your own research (DYOR) and invest wisely.