Dogwifhat (WIF) Hits a Wall: Can the Memecoin Break Through Resistance Amid Market Turmoil?

Dogwifhat (WIF) bulls are running into a brick wall—again. The memecoin’s latest rally just got rejected at a key resistance level, leaving traders wondering if it’s got the legs to push higher or if it’s just another hype-fueled dead cat bounce.

Market sentiment’s flipping faster than a crypto influencer’s allegiance. With volatility spiking and liquidity thinning, WIF’s next move could hinge on whether the ‘greater fools’ show up or finally run out of steam.

Here’s the kicker: even if WIF breaks out, it’s still just a dog with a hat in a market that rewards utility about as much as Wall Street rewards honesty.

As Bitcoin dominance rises, altcoins like WIF experience broader market pressure, which could lead to further downside movement. However, if they successfully flip this resistance into support, they could trigger a 15%+ upward move, drawing investor interest.

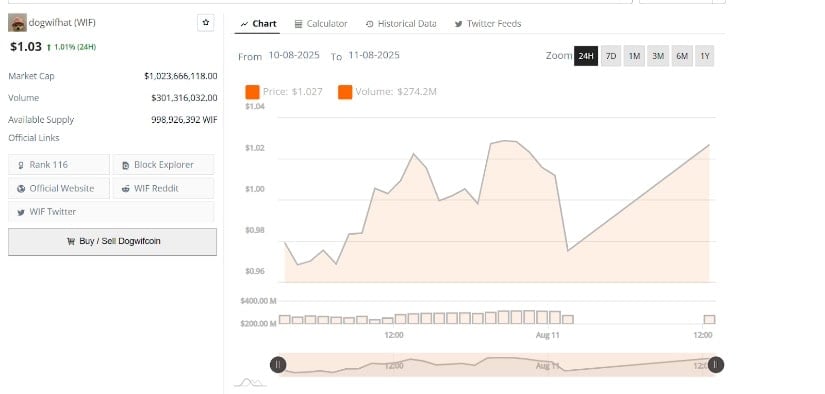

In the last 24 hours, the cryptocurrency saw an intraday rally, reaching $1.04 before slightly retracing. With a significant trading volume of $301.3 million, this volatility offers short-term opportunities. Traders will closely monitor the $1.03 level to gauge whether it can sustain its momentum or face a reversal.

WIF Price Struggles to Break $1.03 Resistance

Over the past 24 hours, it experienced notable price fluctuations, beginning the day at approximately $1.00. A brief upward surge pushed the price to $1.04, which was followed by a retracement.

This increase, though substantial, was short-lived, with the asset failing to maintain momentum above the $1.03 resistance level. The market struggled to maintain upward pressure, with price action moving within a narrow range post-surge.

Source: BraveNewCoin

The $1.03 resistance level is key, as it aligns with the 1D 200EMA, a critical technical indicator for traders. The failure to break through this level suggests that buying pressure has weakened. Despite two attempts to reclaim this level, the price of the coin was rejected, reinforcing the notion that the asset is encountering difficulty pushing higher in the NEAR term.

Market Sentiment and Bitcoin Dominance

The weakness in the memecoin price action is not isolated to this asset alone, as broader market conditions for altcoins show signs of strain. bitcoin dominance ($BTC.D) has recently seen a bounce, leading to a shift in market sentiment.

This rebound in Bitcoin dominance typically results in capital flowing away from altcoins, causing their performance to deteriorate. With Bitcoin consolidating or rising, altcoins often struggle to maintain momentum, and WIF has proven to be no exception.

Source:X

The market’s increasing preference for Bitcoin during periods of dominance is evident, as traders gravitate towards the stability offered by the leading cryptocurrency. This trend has placed additional pressure on altcoins like WIF, as investors tend to favor Bitcoin in uncertain or consolidating market conditions. The result is a weaker performance from altcoins, which must contend with reduced capital inflows.

Resistance at Key Technical Levels

The technical setup indicates the importance of the $1.03 resistance level, which aligns with the 1D 200EMA as stated by the analyst. The 200EMA is widely regarded as a pivotal level for assessing market sentiment and trend direction. For WIF, this resistance level has become a point of contention, with the price failing to break above it on two separate occasions.

Source:X

If it can successfully flip the $1.03 resistance into support, it could signal the continuation of its bullish momentum. A breakout above this level could trigger further upside, potentially leading to a 15% or more rally. However, the repeated failure to break through this resistance suggests that the momentum remains weak, with the asset struggling to maintain its bullish trajectory.

Market Activity and Volume Trends

Along with the price movements, trading volume has also shown signs of increased activity. The 24-hour trading volume has surged to approximately $301.3 million, reflecting heightened investor interest.

This uptick in volume corresponds with the price spike earlier in the day, indicating that buying pressure briefly intensified. However, the subsequent retracement in price highlights the challenges in maintaining sustained buying interest at higher price levels.

The market cap stands at $1.02 billion, suggesting that the asset still holds relevance among traders. Despite the challenges faced at the $1.03 resistance, the significant market cap indicates potential for future price movements, particularly if the asset can find support and push past the resistance.