Cardano’s ADA Targets $1 Milestone as Whales Gobble Up 200M Coins

Whales are betting big on Cardano—again. ADA's price surge toward the psychological $1 barrier comes as large holders accumulate 200 million tokens, signaling bullish conviction.

When the big fish move, retail traders scramble. This time, Cardano's 'smart contract promise' narrative gets another boost—just don't ask about those delayed roadmap updates.

Funny how whale accumulation spikes always precede price pumps. Almost like someone knows something... or just enjoys playing puppetmaster with retail FOMO.

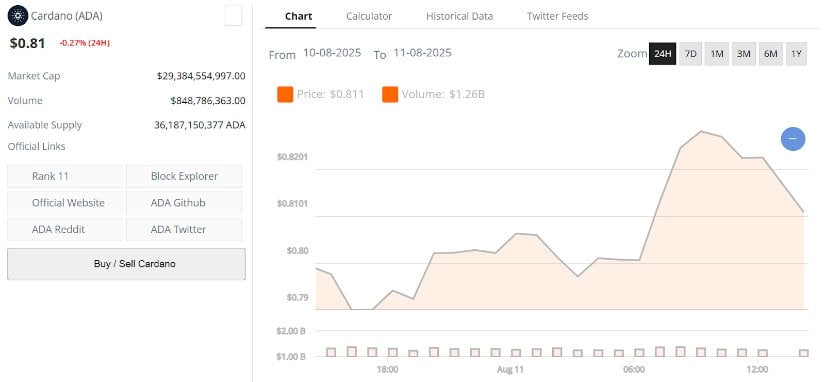

Cardano is holding firm at $0.81, with traders laser-focused on the psychological $1 level that could spark the next big move. Despite a relatively flat 24-hour change, ADA’s resilience in the face of broader market swings has caught the attention of both retail investors and whales. The $0.84 to $0.88 resistance zone stands as the first real test, one that, if broken, could quickly shift momentum and bring fresh buying pressure into play.

Cardano Targets Psychological $1 Mark

Cardano is holding steady at $0.81, down just 0.27% in the past 24 hours, as bulls eye the key psychological $1 level. Analyst JRNY Crypto’s call for a push toward this milestone aligns with ADA’s recent price resilience against any major downside pressure. The $0.84 to $0.88 zone remains the first resistance checkpoint, but a decisive break above could open a clear path towards $1, potentially triggering renewed retail interest and momentum-driven inflows.

Cardano is trading around $0.81, down -0.27% in the last 24 hours. Source: Brave New Coin

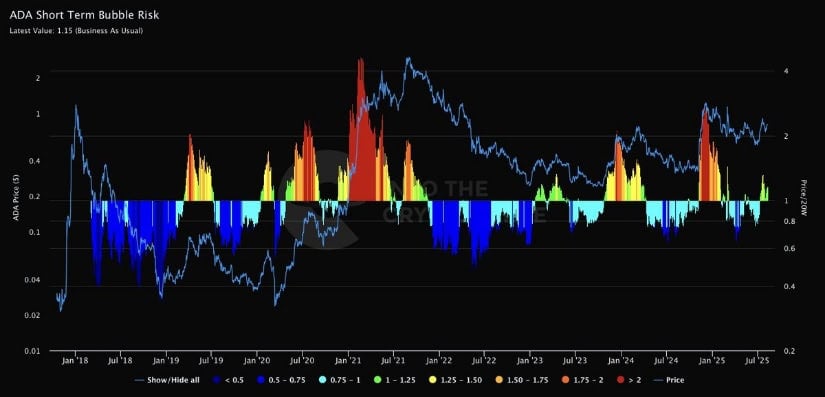

Cardano Bubble Risk Shows Room for Sustainable Upside

On-chain data from Into The Cryptoverse shows Cardano’s short-term bubble risk holding at a moderate level, far from the overheated zones seen during past peaks. While this suggests that speculative excess is still contained, the indicator’s recent uptick hints at a gradual build-up in buying pressure. Historically, ADA has seen stronger momentum phases begin when these readings climb from low-to-mid ranges, indicating that current market activity may be laying the groundwork for the next push higher.

Cardano’s bubble risk remains moderate, signaling room for sustainable upside. Source: Into The Cryptoverse via X

This aligns with ADA’s steady climb toward the $0.84 to $0.88 resistance area, where a breakout could fuel the MOVE towards the $1 mark. With bubble risk readings still well below the red-hot levels that often precede sharp corrections, the market appears to have room to absorb additional demand before sentiment overheats. If this measured increase in on-chain activity continues alongside improving technical structure, bulls could find themselves with a more favorable setup heading into the next leg higher.

Cardano Price Prediction Targets Ascending Trendline Above ATHs

Cardano’s current structure is drawing comparisons to its previous accumulation phases, where extended consolidation was followed by strong impulsive moves towards prior all-time highs. Analyst crypto Dream highlights how ADA’s long-term trendline, stretching back multiple years, remains intact and is now acting as a technical magnet for price. With key resistance at $1.30 serving as the next hurdle, a clean break could confirm the shift from accumulation to expansion, opening the door for a larger trend continuation.

Cardano maintains a multi-year ascending trendline, with $1.30 as the next key hurdle before a potential push towards prior all-time highs. Source: Crypto Dream via X

From an on-chain perspective, the moderate bubble risk readings suggest that the market is still far from overheated conditions, leaving room for sustainable upside. This backdrop, combined with higher lows and strengthening momentum on the weekly chart, points to growing buying pressure without the typical exhaustion signs that precede sharp reversals. If ADA can maintain its climb through the $1 zone and retest higher resistance levels, the path toward revisiting its all-time highs becomes increasingly likely.

Cardano Whale Accumulation Strengthens Bullish Narrative

Fresh on-chain data from analyst Ali Martinez shows whales snapping up over 200 million ADA in just the past 48 hours, a move that reinforces the growing buying pressure. This surge in accumulation comes as ADA continues to hover NEAR the $0.81 level, just shy of the $0.84 to $0.88 resistance. Historically, such concentrated whale activity during consolidation phases has acted as a precursor to stronger directional moves, often tipping the balance in favor of bulls when combined with improving technical structure.

Cardano whales scoop up over 200 million ADA in 48 hours. Source: Ali Martinez via X

The timing of these purchases is notable given ADA’s current setup, which is already aligning with a long-term trendline target above prior all-time highs. With bubble risk readings still comfortably below overheated thresholds, this influx of large-scale buying could provide the additional liquidity needed to sustain an upside breakout.

Cardano Price Analysis

Cardano’s price remains compressed within its largest visible volume cloud on the chart, indicating that neither bulls nor bears have taken decisive control yet. As highlighted by analyst Trend Rider, this zone often acts as a liquidity magnet, requiring a clean breakout before sustained directional momentum can form. The $0.84 to $0.88 range continues to cap upside attempts, while the “ideal buy zone” sits between $0.75 and $0.77, an area that aligns with prior demand and visible range profile support. Until ADA breaks out or retests this lower range, participants appear to be waiting for confirmation before committing heavily.

Cardano consolidates within a major volume cloud, with $0.84–$0.88 as resistance and $0.75–$0.77 as the ideal buy zone. Source: Trend Rider via X

Adding a macro layer, Bitcoin dominance is currently retesting a key support level for the second time, which could dictate the flow of capital toward or away from altcoins like ADA. If BTC dominance rebounds, ADA may remain range-bound; however, a breakdown in dominance could release pressure and allow ADA to challenge its upper resistance levels.

Final Thoughts: Is ADA’s $1 Push Just the Beginning?

With whales ramping up accumulation and on-chain data showing plenty of room before overheating, Cardano’s $1 target looks more like a stepping stone than a ceiling. A clean break above the $0.88 resistance could flip sentiment quickly, bringing fresh inflows and retail interest into the mix. If momentum aligns with the long-term trendline above prior all-time highs, ADA could be setting the stage for a much larger trend expansion.