Avalanche (AVAX) Primed for Explosion: $27 Breakout Targets $36–$38 in Next Rally

Avalanche isn’t just climbing—it’s gearing up for a full-scale breakout. Traders are eyeing the $27 level as the make-or-break moment that could send AVAX rocketing toward $36–$38. Here’s why the smart money’s betting on a surge.

The $27 Trigger Point

Clear the $27 resistance, and AVAX flips from consolidation mode to bull run. Technicals suggest this isn’t just hopium—it’s a textbook breakout setup with historical precedent.

Where the Real Profit Kicks In

Hit $27, and the path opens to $36–$38, a zone where early buyers cash out and latecomers FOMO in (as usual). Watch for volume spikes—noisy Twitter hype means nothing without liquidity backing it.

The Cynical Take

Of course, this all assumes crypto markets still obey logic—a bold assumption after watching ‘fundamentals’ get bulldozed by memecoins for the past three years. But for now, the charts say: AVAX has room to run.

After weeks of steady climbing, AVAX is now circling one of its most important levels. Price action has been shaped by a clean support flip, a solid EMA hold, and rising volume, signs that buyers are quietly gaining ground for a bullish AVAX price prediction.

AVAX Support Flip Strengthens the Bullish Case

AVAX has recently retested a key confluence zone on its daily chart, where the descending trendline and the lower boundary of the bull market support band have now flipped from resistance into support. This structural shift is significant, as prior rejection levels are now acting as the major turnaround levels. The clean retest has so far been met with steady buying interest, hinting that the market may be preparing for a more sustained MOVE higher.

AVAX holds firm after a key support flip, building momentum toward its $56 target. Source: Chris via X

According to analyst Chris, the December 2024 high at $56 stands as the first major target, with the broader trend showing signs of an emerging higher-low structure. Momentum indicators remain in a controlled region, holding ample space for further upside.

EMA Support Holds as AVAX Eyes Move Towards $26

AVAX is now testing a critical short-term support confluence, with price sitting right on the 1D and 1H 200EMA around the $23.30 zone. This level aligns closely with the mid-range structure formed earlier in the month, making it a logical area for buyers to step in. The reaction here will be key, holding above the EMAs could provide the springboard for a push towards the next resistance cluster at $26.

Avalanche AVAX defends its 200EMA support at $23.30, eyeing a potential push toward the $26–$28 zone. Source: AltWolf via X

If the support levels hold, it WOULD further confirm the higher time-frame support flip narrative. This could now potentially accelerate the move towards the $26 to $28 range before confronting more significant resistance zones higher in the region of $50 to $60.

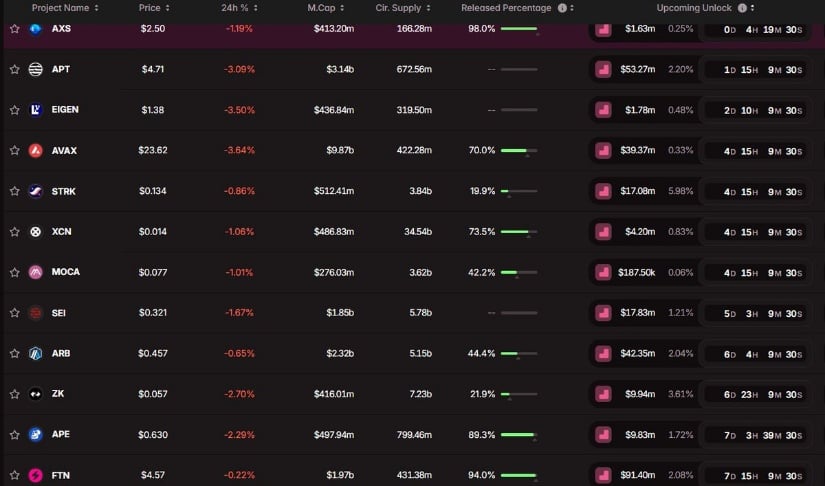

Token Unlock Puts Short-Term Avalanche Outlook to the Test

Despite the constructive technical developments, Avalanche faces a near-term event risk with a $39 million token unlock scheduled in the coming week as shown by thisisksa. Historically, large unlocks can introduce temporary selling pressure as early holders and vested participants gain liquidity, particularly if market sentiment is mixed. While the broader trend remains supportive, the influx of new supply could create short-lived volatility before the market absorbs it.

AVAX braces for a $39M token unlock, testing buyer strength amid short-term volatility risks. Source: thisisksa via X

In the context of the recent EMA and support flip narrative, this unlock doesn’t necessarily derail the bullish case but does call for a measured approach in the short term. If demand stays resilient, any dip sparked by the unlock could be absorbed before price resumes its push towards $26 and beyond.

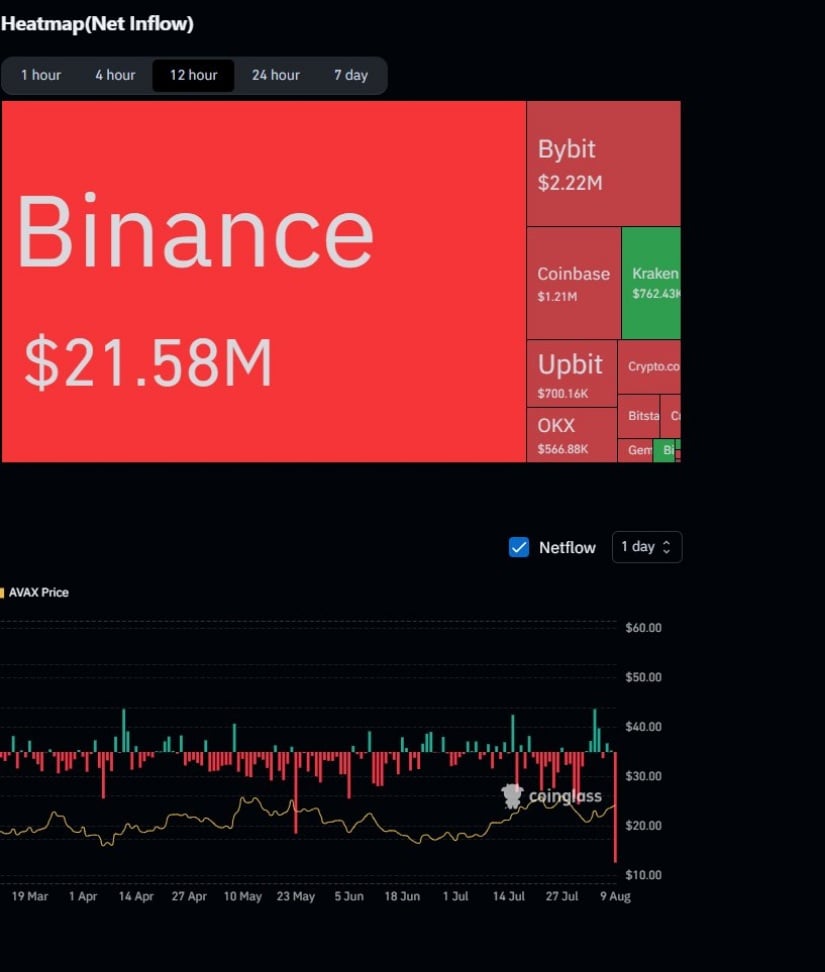

AVAX Withstands One of Its Largest Outflow Events in a Year

AVAX Avalanche saw over $25 million in net outflows from Binance in one of the largest single-day exchange movements for the token in more than a year, highlights newzatemreoruc. Significant outflows of this scale can sometimes signal selling activity, particularly if the tokens are leaving for off-exchange transfers or market sales. While it’s not a definitive bearish trigger on its own, the timing, coming just ahead of the scheduled token unlock, adds a LAYER of caution for the short-term outlook.

Avalanche shrugs off $25M in Binance outflows, holding firm NEAR $25 ahead of its token unlock. Source: newzatemreoruc via X

Even so, AVAX Avalanche price held firm and even pushed towards $25 over the weekend, showing that demand was able to absorb the selling pressure in the immediate aftermath. If the market can withstand outflows of this size without breaking key support, it suggests there may be enough underlying bid strength to handle the upcoming unlock event as well, potentially keeping the broader bullish structure intact.

$27 Level Emerges as AVAX’s Breakout Point

From CW8900’s technical perspective, the $27 resistance zone stands out as a decisive turning point for AVAX. This level coincides with a prior supply block where selling pressure repeatedly capped upside momentum in late July. A clean break above it would not only clear the last major hurdle in the current range but also open the path toward the higher resistance band near $36 to $38. Volume structure from recent sessions shows increasing participation on green candles, hinting that buyers are gradually positioning for this attempt.

Avalanche eyes a decisive breakout above $27, with rising volume hinting at a push toward $36–$38. Source: CW8900 via X

Encouragingly, recent price action has built on the earlier support flip and EMA hold, showing steady higher lows into this resistance. If $27 is breached with sustained volume, it could align short-term momentum with the larger bullish structure.

Final Thoughts: Can AVAX Clear the $27 Hurdle?

AVAX’s recent resilience, holding firm despite a major outflow event and looming token unlock, suggests buyers are still in control of the broader narrative. The higher-low structure, combined with the key support flip and EMA confluence, gives bulls a solid foundation to work from. If momentum continues to build and $27 is cleared with conviction, the path towards $36 to $38 becomes far more achievable, setting the stage for a larger breakout attempt.