🚀 Ethereum (ETH) Price Prediction: Bulls Charge Toward $12K as ETH Shatters $4,300 Barrier!

Ethereum’s relentless rally leaves skeptics scrambling—again.

### The $4,300 Breakthrough: Just the Start?

ETH punched through $4,300 like a bull through a paper wall. Traders who dismissed this as another 'crypto hype cycle' are now recalculating their life choices. The path to $12K? Clearer than a banker’s conscience during a bull market.

### Why This Rally Isn’t Your 2021 Redux

No meme-coins, no leverage apocalypses—just institutional money quietly stacking ETH while retail debates 'top signals.' Layer-2 adoption’s exploding, DeFi’s rebuilt smarter, and the Merge? Ancient history. This isn’t speculation—it’s infrastructure.

### The Cynic’s Corner: Wall Street Will Ruin It

Sure, BlackRock’s ETH ETF will 'democratize access' (read: extract fees until the next crash). But for now? The smart money’s riding the wave—right until they dump it on the little guy.

The rally has analysts debating whether this could be the launchpad for a historic push toward $12,000.

Market Overview: ETH Breaks Key Resistance

Ethereum (ETH) has climbed over 19% in the past week, liquidating more than $200 million in Leveraged short positions. In the last 24 hours alone, ETH gained 7.5%, briefly trading above $4,300 before consolidating near $4,250.

Ethereum is approaching a critical 4-year resistance level, signaling a potential rally that could push prices toward $12,000. Source: @DeFiTracer via X

This surge has outpaced Bitcoin’s 3% weekly increase, widening ETH’s market dominance and pushing the total crypto market capitalization closer to $4 trillion. Popular on-chain analyst Tracer told followers on X that Ethereum is “about to break 4-year resistance” and that “$12,000 is not just a dream anymore.

Institutional Demand and Whale Accumulation

The latest rally is being driven by large-scale buying from both institutional investors and whales. Data from The Boss shows that SharpLink Gaming increased its ETH holdings to $2.12 billion after a major purchase on August 8.

SharpLink Gaming adds $85M in ETH, total holdings now $2.12B, signaling rising institutional interest. Source: The Boss via X

Whale activity has intensified, with a notable $40.5 million over-the-counter acquisition of 10,400 ETH in recent days. Standard Chartered’s Geoffrey Kendrick predicts that corporate treasuries could eventually hold 10% of Ethereum’s total supply — a shift that could rival the impact of spot ETFs.

Spot ETH ETFs themselves are enjoying unprecedented demand, posting twelve consecutive weeks of inflows totaling over $5 billion in July. On August 9 alone, ETH ETF inflows hit $461 million, according to analyst Ted.

Technical Analysis: Room for Growth

From a technical analysis perspective, ethereum has cleared multiple resistance levels. After rebounding from strong support at $3,470, ETH broke above the $4,193 Fibonacci 1.618 extension — a level often associated with accelerated price moves.

ETH hits new highs, hinting at a big breakout, but buying now could be risky—explore other ETH ecosystem opportunities. Source: @CryptoMichNL via X

The Relative Strength Index (RSI) currently stands at 68.8, just below overbought territory, leaving room for further upside. The “three WHITE soldiers” candlestick pattern since August 5 signals persistent buying pressure, while the MACD remains strongly positive.

Key short-term price levels to watch:

- Immediate resistance: $4,391 and $4,532

- Extended upside targets: $4,712 and $4,868 (ATH)

- Support zones: $4,193–$4,150, then $3,470

Fundamental Catalysts: ETF and Layer 2 Growth

Improving regulatory sentiment has also boosted Ethereum’s outlook. The SEC recently clarified that liquid staking does not violate securities laws, paving the way for potential staking-inclusive ETH ETFs from BlackRock, Fidelity, and Bitwise.

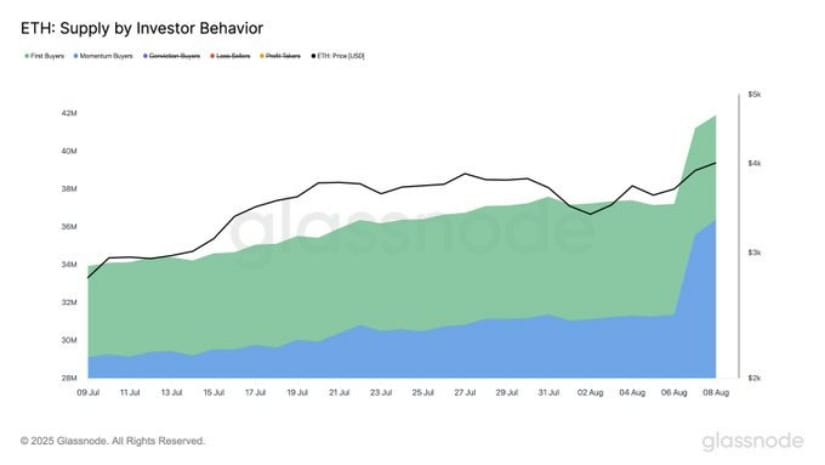

ETH sees a surge in new and momentum buyers, showing strong fresh demand and renewed interest from existing holders. Source: @glassnode via X

At the ecosystem level, Ethereum Layer 2 growth continues to accelerate, with rising transaction volumes on Arbitrum, Optimism, and zkSync. These scalability solutions are attracting new DeFi projects and NFT marketplaces, adding fresh demand for ETH.

Outlook: Can Ethereum Reach $12K?

While some analysts warn of potential retracement after such a rapid climb, the overall sentiment remains bullish. On-chain trends, ETF momentum, and macro breakout patterns all point toward continued gains.

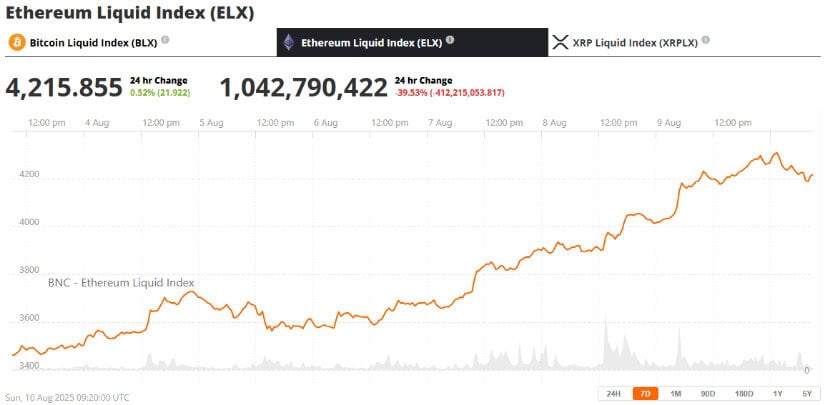

Ethereum (ETH) was trading at around $4,215, up 0.52% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Analyst Rekt Capital estimates Ethereum is only “50–60% through its macro uptrend,” leaving plenty of room for upside. If current momentum holds, ETH could challenge its all-time high of $4,868 in the coming weeks and potentially target $5,000 — with the more ambitious $12,000 forecast no longer seeming out of reach.