🚀 Bitcoin (BTC) Rockets Past $118K—Next Stop $131,000? Analysts Bullish on Breakout

Bitcoin just smashed through another psychological barrier—$118,000—and traders are already eyeing the next target. Here’s why $131K could be the next battleground.

The Rally No One Saw Coming (Except the Bulls)

BTC’s latest surge left skeptics scrambling as it cleared $118K with the elegance of a bull in a china shop. Analysts now point to a potential breakout toward $131,000, citing fractal patterns and institutional inflows—or as cynics call it, 'hopium with a spreadsheet.'

Why $131K Isn’t Just a Random Number

Technical charts show a clear resistance-turned-support flip at $118K, and liquidity pools are stacking up near $131K. Meanwhile, Wall Street’s latecomers are still waiting for a 'dip' that never comes—classic.

The Bottom Line

Whether this is the start of a parabolic rally or another fakeout, one thing’s clear: Bitcoin’s playing by its own rules again. Buckle up.

The world’s largest cryptocurrency is gaining traction amid favorable regulatory developments and robust institutional demand. With the 2025 Bitcoin halving on the horizon, market participants are increasingly optimistic about BTC’s near- and long-term outlook.

Market Overview: Bitcoin Technical Analysis Signals Strength

Bitcoin today climbed past the important $118,000 threshold, closing in on its all-time high of $122,838 set in July. BTC remains supported above the 50-day exponential moving average (EMA) NEAR $115,592 and the crucial Fibonacci retracement level at approximately $117,518, establishing a firm base for upward movement.

Bitcoin faces resistance at $120,500, with support at $115,700, while the technical setup suggests a potential upside rally from current levels. Source: FXTradingOnLine on TradingView

Technical indicators such as the Relative Strength Index (RSI), currently near 63, indicate that there is still potential for additional gains before the asset enters overbought territory. The $117,500 to $118,800 price zone has emerged as a vital support area. A strong close above this range could prompt a rapid attempt to retake previous highs.

Institutional activity continues to underpin this technical strength. Publicly traded companies now hold over 628,000 BTC, valued at more than $74 billion. MicroStrategy recently boosted its holdings by over 4,000 BTC. Meanwhile, spot Bitcoin ETFs experienced inflows close to $935 million on August 9, signaling sustained large-scale investor confidence.

Trend and News Factors: Regulatory Tailwinds and the 2025 Halving

Recent regulatory developments have also helped boost Bitcoin’s price momentum. Texas passed legislation to create a state bitcoin reserve, mirroring efforts by El Salvador. Federal bills like the GENIUS Act and the pending CLARITY Act aim to clarify digital asset regulations, potentially defining Bitcoin as a commodity and easing SEC oversight.

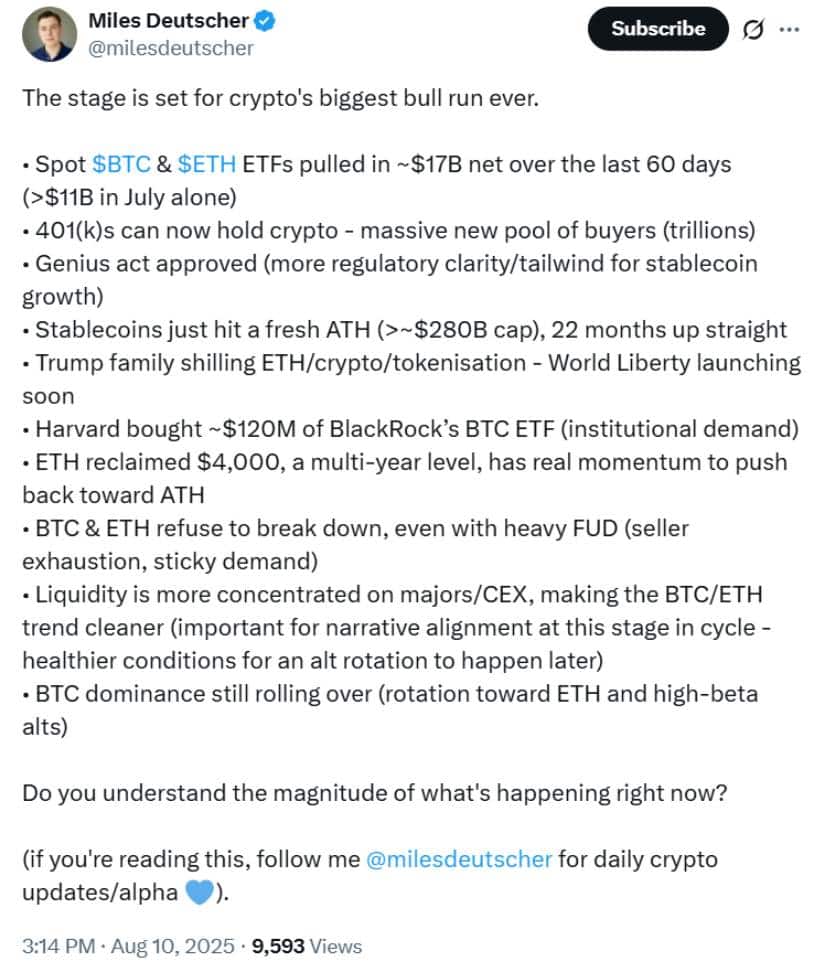

Record ETF inflows, institutional adoption, and resilient market conditions position Bitcoin for what could be the biggest bull run in crypto history. Source: Miles Deutscher via X

Further supporting the outlook, a new rule signed by President TRUMP allows 401(k) retirement plans to include crypto assets, potentially unlocking a fresh wave of investment capital.

Looking ahead, the 2025 Bitcoin halving event remains a critical fundamental driver. Historically, such halvings reduce new supply and have been associated with sustained price increases in the months that follow. This reduction in issuance adds a supply-side catalyst to Bitcoin’s bullish case.

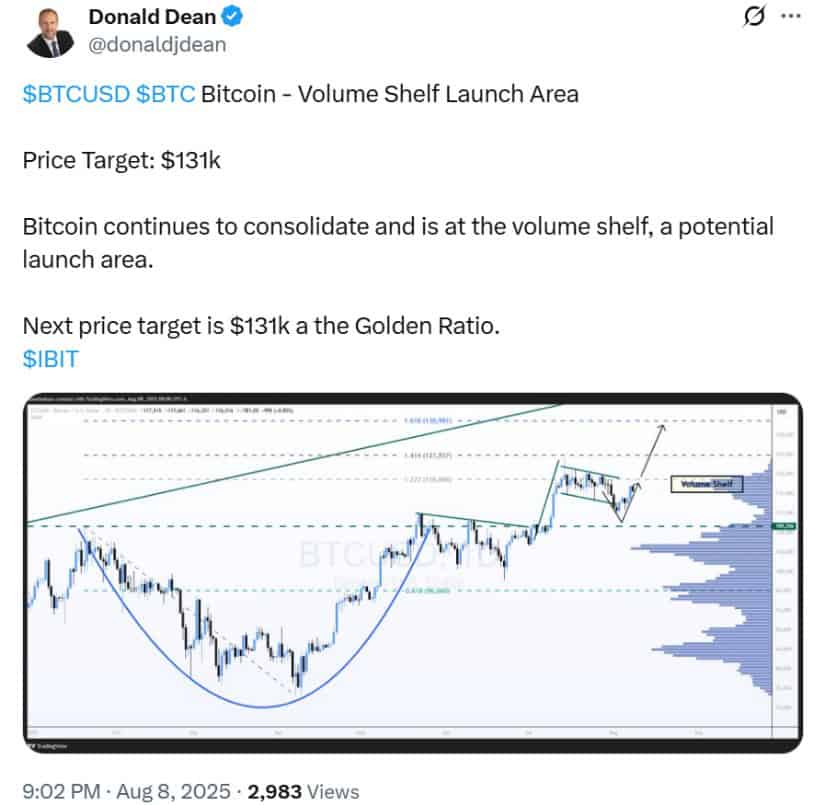

Expert Insights: Analyst Predicts $131,000 Launch from Volume Shelf

Market analyst Donald Dean recently identified a “volume shelf” between $116,000 and $118,000 on Bitcoin’s daily price chart. This volume shelf represents a price level where significant trading activity has previously occurred, often acting as either support or resistance.

Bitcoin is consolidating at a key volume shelf, with the next upside target set at $131K near the Golden Ratio. Source: Donald Dean via X

Dean’s analysis suggests that Bitcoin’s current consolidation in this area could serve as a springboard for a breakout toward the next key technical milestone, the 1.618 Fibonacci extension near $131,000. This level represents a roughly 13% upside from current prices, should BTC maintain support above the volume shelf and gain momentum.

Market sentiment remains generally positive, with the Fear & Greed Index sitting at 67. Nonetheless, some predictions indicate more zigzag trading into a powerful upward push. Price estimates envision short-term price volatility between $112,000 and $117,000.

Looking Ahead: What’s Next for Bitcoin?

The consolidation strength of Bitcoin above $118,000 is a good sign that the bull run of the cryptocurrency is still intact. Such sustained consolidation above this critical level could potentially allow BTC to target the $131,000 breakout level in the short term.

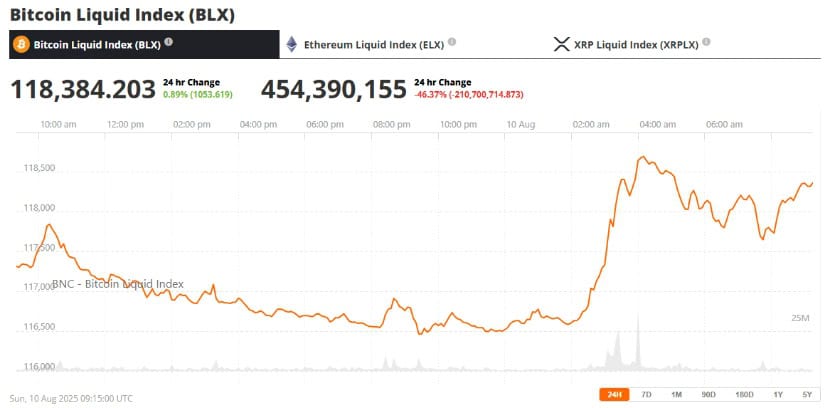

Bitcoin (BTC) was trading at around $118,384, up 0.89% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Institutional adoption continues to grow, Bitcoin ETF news continues to shine a light, and the impending halving event will further limit supply. Together, these are good omens for the long-term future of Bitcoin. Volatility in the markets, naturally enough, is always a matter of concern, emphasizing the need for vigilant observation of key technical levels.

To those tracking Bitcoin news today and seeking answers on why Bitcoin is rising today, the combination of a favorable technical setup as well as fundamental gains suggests that Bitcoin’s current momentum can pick up more pace, potentially translating into new all-time highs by late August or early September.