XRP Price Prediction: $10 Breakout Imminent as Ripple–SEC Lawsuit Reaches Final Resolution

XRP bulls are charging—again. With the Ripple–SEC legal saga now officially over, traders are betting big on a parabolic rally.

Here’s why $10 isn’t just hopium.

The endgame playbook

No more court dates. No more appeals. The regulatory overhang that suppressed XRP’s price for years? Gone. Market mechanics now take center stage.

Liquidity tsunami incoming

Exchanges are already scrambling to relist XRP with full compliance. Institutional money—the kind that avoids legal gray areas—is priming its pumps. Retail FOMO? Just warming up.

Technical breakout confirmed

The charts scream bullish: a multi-year accumulation pattern, clean breakout above $0.60 resistance, and now… a clear runway. History says altcoins rip hardest when regulatory shackles break.

Of course, Wall Street will claim they ‘saw it coming’—right after they finish shorting it. Crypto marches on.

The official closure of the Ripple vs SEC lawsuit has ignited fresh enthusiasm among traders and institutional investors alike. With legal uncertainty behind it, XRP is surging ahead, outperforming the broader crypto market and sparking renewed speculation over whether the token could soon touch the $10 mark.

Lawsuit Ends, Momentum Builds

Ripple and the U.S. Securities and Exchange Commission have officially agreed to end their nearly five-year legal dispute, filing a motion to dismiss all remaining appeals. Ripple’s Chief Legal Officer confirmed that the company can now focus fully on business expansion, signaling a new era for the blockchain payments giant.

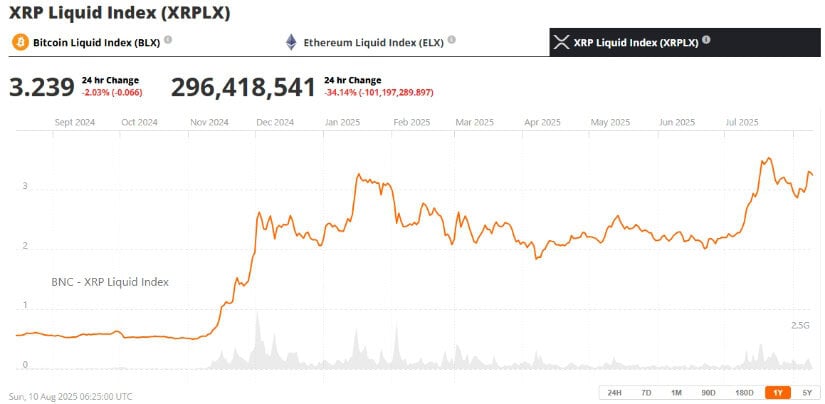

Ripple (XRP) was trading at around $3.239 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

The market response was immediate. XRP jumped over 10% in a single day, trading around $3.33–$3.35, making it the best-performing asset among the top 10 cryptocurrencies. The rally has been fueled not just by relief over the legal outcome, but also by Optimism that institutional adoption could accelerate in the months ahead.

Analysts See Path to $10

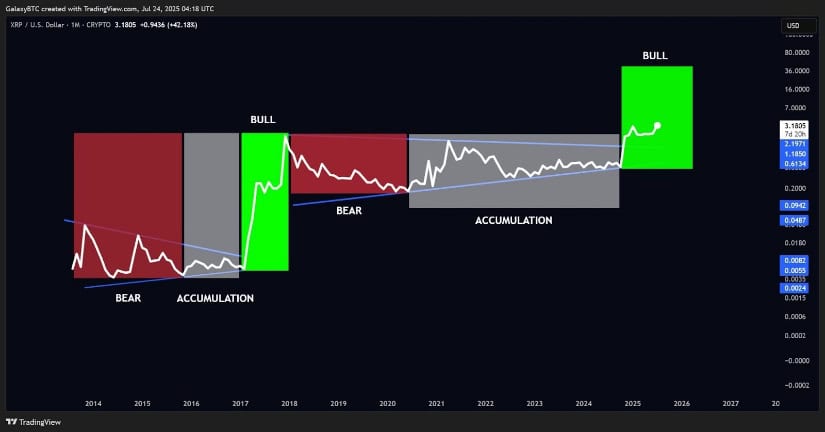

Market analysts are now openly discussing the possibility of XRP reaching double-digit prices. Popular trader GalaxyBTC points to a recurring long-term pattern of “higher lows” on XRP’s price chart—mirroring movements seen between 2014 and 2017—that previously led to explosive breakouts.

XRP’s rebound above $3 signals a bullish resumption of its uptrend. Source: @galaxyBTC via X

“If XRP clears the $3.35 resistance and flips it into support, we could see a rally toward $10,” GalaxyBTC explained, noting the striking overlap between the lawsuit’s five-year timeline and the duration of this bullish pattern.

Galaxy attributes the target to a repeating pattern of XRP, making higher lows between 2014 and 2017. Source: @galaxyBTC via X

Other analysts, such as ChartingGuy, highlight similarities to XRP’s 2017 rally, projecting near-term targets of $8, while CrediBULL crypto believes breaking past $3.80 could be the first step before aiming higher.

Institutional Interest Surges

Data from Coinglass shows a sharp rise in XRP derivatives activity, with 24-hour trading volume soaring 197% to $18.26 billion. Options trading was particularly strong, up more than 1,300%, while open interest surged 20% to $8.82 billion.

Structurally, XRP appears strong, with dips into the green zone presenting good opportunities to target range highs. Source: @CredibleCrypto via X

With the legal barrier removed, more institutions are reportedly exploring XRP for treasury holdings and payment infrastructure. Although BlackRock has denied immediate plans for an XRP ETF, many in the market believe it’s only a matter of time before exchange-traded products and corporate balance sheet allocations emerge.

The $20 “Moonshot” Scenario

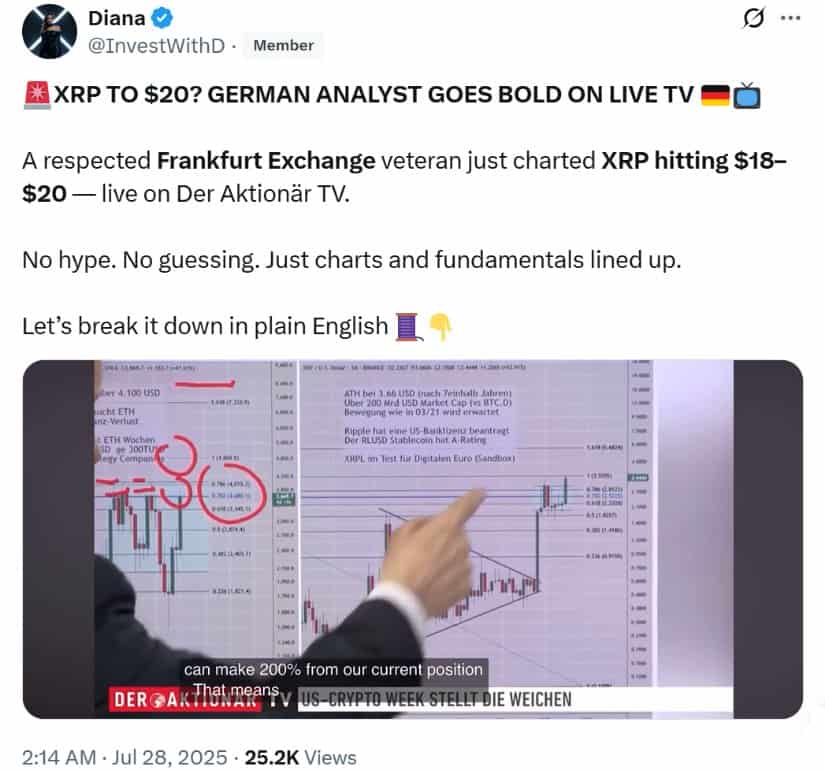

Some projections extend beyond $10, with the most ambitious targets placing XRP at $20—a valuation of over $1.2 trillion. Such a scenario WOULD require near-universal adoption for cross-border settlements, rivaling SWIFT in global reach, as well as large-scale tokenization of real-world assets on the XRP Ledger.

A respected Frankfurt Exchange veteran projected XRP reaching $18–$20 during a live broadcast on Der Aktionär TV. Source: Diana via X

Ripple CEO Brad Garlinghouse has previously suggested that XRP could capture up to 14% of SWIFT’s transaction volume within five years. If combined with favorable market cycles, regulatory clarity, and ongoing institutional adoption, this vision could push XRP into entirely new territory.

Outlook: Legal Victory as a Launchpad

The end of the Ripple vs SEC battle has removed one of the biggest uncertainties hanging over XRP. With technical patterns aligning, institutional interest climbing, and Ripple’s business expansion underway, the stage is set for significant price action in the months ahead.

Whether XRP reaches $5, $10, or beyond will depend on a mix of market sentiment, adoption rates, and macroeconomic conditions—but for the first time in years, the path forward looks clearer than ever.