Pudgy Penguins (PENGU) Price Surge: Will Bulls Smash $0.047 and Charge Toward $0.07 This August?

Crypto’s favorite flightless birds are waddling into the spotlight—again. Pudgy Penguins (PENGU) isn’t just another meme coin; it’s got traders glued to their screens, waiting for the next breakout.

The $0.047 Breakout Battle

Bulls are eyeing that critical $0.047 resistance like a fish market at feeding time. A clean break could send PENGU soaring—straight toward the $0.07 target. But will August deliver the goods, or is this just another overhyped rally waiting to collapse? (Spoiler: Wall Street ‘experts’ are already placing bets—badly.)

Meme Coin or Momentum Play?

Forget fundamentals—this is crypto, after all. PENGU’s price action hinges on trader sentiment, social media hype, and whether Elon Musk tweets about penguins this week. Technicals suggest upside, but let’s be real: in a market where a dog-themed coin once hit a $70B cap, anything’s possible.

The Bottom Line

If PENGU clears $0.047, strap in. If not? Well, there’s always next month—or the next meme coin du jour. Either way, the circus rolls on.

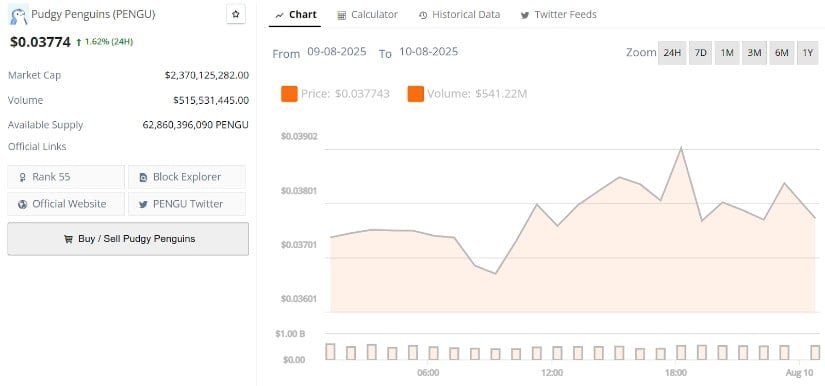

Pudgy Penguins’ token is once again pressing up against a major technical wall. Trading around $0.03774, PENGU has been one of the top 100’s standout performers, building a steady uptrend of higher lows while holding firm above key support NEAR $0.030.

Pudgy Penguins Strong 90-Day Performance Sets the Tone

PENGU has been one of the standout performers in the top 100 over the past 90 days, delivering a gain of more than 166% and climbing to $0.03774, according to CoinMarketCap data. This MOVE has been supported by a steady uptrend structure, with higher lows forming consistently and price action holding above key short-term support near $0.030. The 20-day EMA continues to guide the trend upward, showing that momentum remains firmly with the bulls despite recent consolidation.

Pudgy Penguins’ current price is $0.03774, up 1.62% in the last 24 hours. Source: Brave New Coin

For Pudgy Penguins, the next key resistance sits near $0.047, with a potential breakout opening the door towards the $0.07 target. As long as PENGU maintains its higher-low formation and defends $0.030, the broader structure points towards a continuation of its outperformance in the weeks ahead.

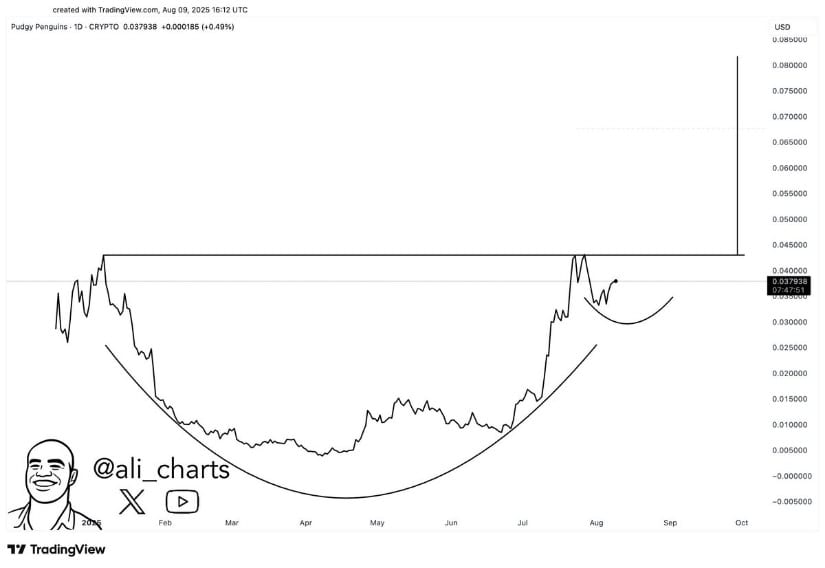

Cup and Handle Formation Strengthens PENGU’s Bullish Setup

Building on its recent outperformance, PENGU’s daily chart shared by Ali Martinez highlights a well-defined cup and handle formation, a classic continuation pattern, positioned for a potential breakout. The neckline sits just under the $0.048 mark, with a measured move projection placing the upside target near $0.082. The handle’s consolidation phase has been relatively shallow, as sellers have been unable to gain much control in this phase.

PENGU forms a textbook cup and handle pattern, eyeing a breakout above $0.048 with strong fundamentals backing the move. Source: Ali Martinez via X

Now, a breakout above the neckline on rising volume WOULD validate the pattern and trigger the next expansion phase. The bullish setup isn’t just technical, it’s underpinned by several fundamental drivers that strengthen the case for continuation:

-

Pending ETF filing with CBOE backing, which could open doors for broader institutional access.

-

Ongoing SEC review of the application, adding regulatory weight to the project’s credibility.

-

Strong expansion in Asia, where PENGU has earned the nickname “Asia’s DOGE,” boosting its cultural and retail adoption.

These catalysts add depth to the chart’s bullish structure, showing that both market sentiment and fundamental growth factors are aligned toward higher targets.

.

On-Chain Strength Seconds Ongoing Pudgy Penguins Strength

Adding to the bullish narrative, on-chain data shows Pudgy Penguins’ 24-hour trading volume surpassing the $500 million mark, as reported by Whale Insider. Such a spike in liquidity signals heightened participation from both retail and institutional players. This increase in turnover aligns with the asset’s recent technical strength, indicating that the breakout setups are being supported by actual market participation rather than speculative thin-volume moves.

With liquidity building and with the cup and handle breakout potentially lining up, the market structure now has the backbone to support a push towards higher resistance levels, keeping $0.047 and $0.07 in focus for the near term.

Bullish Breakout Structure Keeps Pudgy Penguins $0.10 Target in Play

Pudgy Penguins’ latest move saw it break through the $0.034 resistance on strong volume, locking in a new sequence of higher lows on the lower timeframes. The chart shared by Olking07 outlines a potential inverted head and shoulders formation, with price now consolidating just above the breakout zone. Volume spikes on upward pushes suggest that buyers are stepping in aggressively on each dip, keeping the short-term bias tilted to the upside.

Pudgy Penguins breaks above $0.034 with an inverted head and shoulders setup, eyeing $0.05 next. Source: Olking07 via X

From a Pudgy Penguins price prediction standpoint, the $0.05 level stands as the next key target, with the broader focus remaining on the $0.047 to $0.07 resistance band. If momentum continues to build from this structure, the path towards the $0.10 milestone gains credibility, supported by both the technical breakout setup and the market’s sustained buying interest.

PENGU Technical Analysis

PENGU’s 4-hour chart shared by aTOm_B shows a clean breakout from its recent accumulation range, with price now trading around $0.038 and pressing toward the $0.0404 resistance. The structure suggests a steady build-up of momentum, with buyers repeatedly defending the $0.034 to $0.035 zone. If price holds above this reclaimed support, the setup favors a measured push toward the $0.0432 zone, where prior highs may act as the next test for market strength.

PENGU breaks out of accumulation, aiming for $0.0404 resistance with higher lows supporting momentum. Source: aTOm_B via X

The short-term outlook leans constructive as the breakout aligns with a sequence of higher lows and controlled pullbacks. A successful retest of $0.0404 could unlock further upside potential, targeting the mid-August projection path towards $0.046. While the broader resistance band near $0.047 remains the bigger hurdle.

Final Thoughts: Pudgy Penguins to Hit New ATHs in August?

With its bullish chart structures, surging on-chain activity, and potential ETF-related catalysts, Pudgy Penguins’ setup is ticking many boxes for a strong August run. The immediate focus is on reclaiming its all-time high at $0.047, a level that has acted as a ceiling in recent attempts. A clean breakout here could shift momentum sharply, putting the $0.07 zone in play as the next major target.

If bulls can hold key supports and maintain the current higher-low formation, August could mark the start of a new expansion phase. Clearing $0.047 would not only set a fresh ATH but also send a strong message that PENGU Pudgy Penguins price has the strength to aim higher.