Ethereum (ETH) Surges Toward $4,200: Institutional FOMO Ignites as ATH Looms

Ethereum isn't just rallying—it's dragging Wall Street into crypto kicking and screaming. The $4,200 breakout isn't just a number; it's a middle finger to traditional finance's 'mature asset' narrative.

Why institutions are late to the party (again)

Hedge funds now scrambling for ETH exposure look suspiciously like the same geniuses who called it a 'scam' at $300. Their sudden epiphany? Probably the 13x returns they missed while overpaying for ESG-approved bonds.

The technicals screaming 'higher'

No pullbacks. No distribution. Just a clean 78% quarterly gain that's vaporizing shorts. The 2021 ATH at $4,878? Might as well be a pit stop.

Warning: Contains irony

Funny how 'unregulated casino' becomes 'digital gold 2.0' when pension funds need yield. Don't worry—BlackRock will launch an ETH ETF right at the top.

The strong rally has reignited Optimism among traders and investors, fueled by significant short liquidations and rising institutional interest. Market watchers are now eyeing a possible breakout toward the next major milestone near $4,500.

ETH Price Movement and Market Drivers

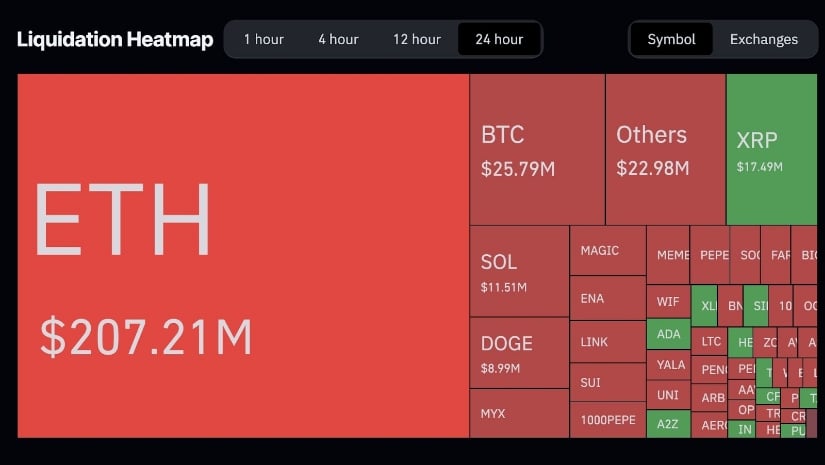

After breaking through the $4,000 resistance on August 8, ethereum quickly gained momentum, climbing 7% within the next 24 hours. This surge was supported by over $207 million in short liquidations, predominantly wiping out bearish bets and pushing buying pressure higher.

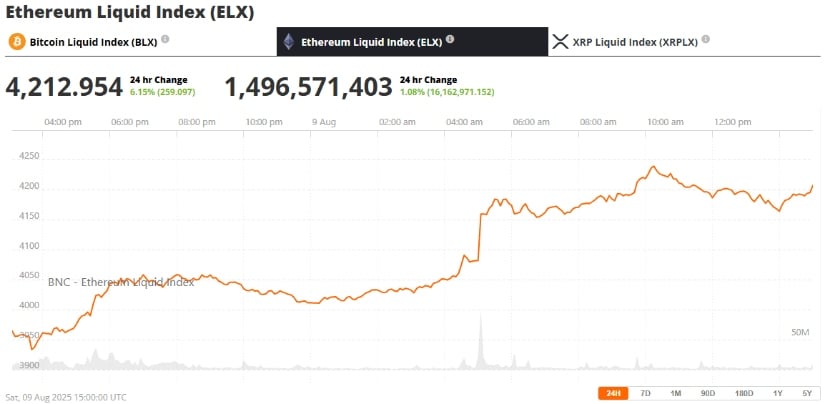

Ethereum (ETH) has been trading at around $4,212, up 6.15 % in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Miles Deutscher, a prominent crypto analyst, highlighted the “on-chain wealth effect” driving the rally: “As Ethereum’s price rises, holders—both retail and institutional—see their portfolios become profitable, encouraging capital rotation into riskier altcoins.” Deutscher outlined a potential three-stage market rotation, beginning with an ETH-led altcoin season, then shifting toward Bitcoin, and finally returning to Ethereum for a potential blowoff top.

Meanwhile, Michaël van de Poppe cautioned about the risks of buying at elevated prices but acknowledged Ethereum’s strong setup toward a possible all-time high. He noted that “allocating capital within the Ethereum ecosystem might yield better returns if the momentum holds.”

Technical Overview: Signs of Consolidation Amid Strength

Technically, Ethereum’s chart shows bullish strength but a temporary pause. On the daily chart, ETH went up steadily from around $2,488 at the beginning of the year to over $4,200. The jump over $4,000 was preceded by massive jumps in volumes, nearly doubling average daily volumes, showing strong buying sentiment.

Ethereum’s Wave 3 momentum continues strong, fueling widespread excitement as the potential peak approaches and institutional activity hints at an upcoming market shift. Source: Maddox_Metrics on TradingView

Oversold indicators such as the RSI are now greater than 70, indicating levels of overbuying that may require prudent profit-taking. MACD and moving averages on all major timeframes remain bullish, lending support to the existing uptrend.

Technically, an eventual pullback to the $4,100–$4,150 support level could be an ideal entry point. But a sustained fall below the same level may indicate a short-term loss of momentum.

Layer 2 Ecosystem and Broader Market Sentiment

Ethereum’s development has support from rising activity on Layer 2 solutions like Arbitrum and Optimism, which relieve the backlogs and reduce gas fees—two of the most significant parameters for adoption by users and DeFi growth. Increased transactional volume on such sites suggests that the ecosystem still has room to expand, as well as price appreciation.

Bears faced heavy losses with $207 million in Ethereum liquidations over the past 24 hours. Source: Miles Deutscher via X

Market sentiment is generally bullish but with a cautionary note. Data from Santiment shows a surge in retail traders using bullish language on social platforms. While enthusiasm is high, history suggests such spikes can precede brief consolidation phases.

Outlook: Ethereum’s Path Forward

Ethereum’s price today reflects a strong bullish trend, with the potential to reach new heights in the coming weeks. Traders are advised to watch critical support levels and volume signals for clues about the next major move.

Ethereum is approaching the upper boundary of the $6,000 price channel. Source: Ajamalvand0020 on TradingView

In the words of a market strategist: “Ethereum’s journey to $4,200 demonstrates resilience and renewed investor confidence. Should it hold above key support zones, the door opens for a test of $4,500 and beyond.”

Final Thoughts

Ethereum has rallied strongly to $4,200, driven by short squeeze liquidations and growing institutional interest. Technical indicators show bullish momentum with room for healthy consolidation. LAYER 2 growth and ETF anticipation provide solid fundamental backing, positioning Ethereum for a potential run to new all-time highs.