🚀 Ethereum (ETH) Price Prediction: $3,900 Breakout Signals Bullish Surge—Is August 9 the Day?

Ethereum’s price just shattered the $3,900 barrier—and traders are betting this is the start of something bigger. With August 9 looming, the question isn’t *if* ETH will rally, but *how high*.

### The Bullish Case: Breaking Down the Momentum

ETH’s breakout past $3,900 wasn’t just a fluke. Liquidity’s stacking up, and the charts scream upside. Forget ‘slow and steady’—this is crypto, where 10% moves happen before breakfast.

### August 9: Catalyst or Coincidence?

Mark the date. Whether it’s options expiry, a hidden protocol upgrade, or just traders chasing the next dopamine hit, August 9 could amplify ETH’s momentum. Or, you know, it’ll be another Tuesday where Wall Street ‘discovers’ blockchain again.

### The Bottom Line

Ethereum’s primed for a run. Will August 9 be the trigger? Maybe. But in a market where ‘fundamentals’ are just astrology for finance bros, one thing’s clear: volatility’s back on the menu.

The cryptocurrency’s resilience above key support zones has analysts debating whether August 9 could trigger the next leg toward the psychological $4,000 level and beyond.

ETH Price Holds Strong Above Key Support

Ethereum’s recovery from its August 5 low NEAR $3,450 has been swift and technically significant. Price broke above the $3,708 resistance and retested it as support before rallying toward $3,950. On the 4-hour chart, ETH trades above all major exponential moving averages—EMA20 at $3,749, EMA50 at $3,686, and EMA100 at $3,623—creating a bullish alignment.

Ethereum’s swift rebound above $3,800 keeps bulls in control, with technicals pointing toward sustained upside momentum. Source: Wavervanir_International_LLC on TradingView

Bollinger Bands are widening, reflecting rising volatility, while price action rides the upper band, a sign of sustained buying pressure. The breakout has also re-established a higher-high structure on the broader trendline from July.

Short-term market structure shows the VWAP anchored around $3,918, acting as an intraday pivot. As long as ETH holds above $3,800, analysts see momentum favoring the bulls.

Institutional Buying and Network Activity Hit Records

Ethereum’s rally is underpinned by strong on-chain fundamentals. According to The Block, the network processed 1.74 million daily transactions on August 5, surpassing 2021’s bull market peak. Corporate ETH holdings jumped 127.7% in July to more than 2.7 million ETH, driven largely by ETF inflows.

ETH bull flag nears a breakout as shrinking supply, rising institutional demand, and burns fuel a potential push to new yearly highs. Source: @cas_abbe via X

This surge in ethereum ETF news and institutional adoption is shifting market sentiment, with whale wallets adding over $1.2 billion worth of ETH since ETF approval rumors surfaced. Crypto analyst Cas Abbe described the current environment as “the perfect time for ETH to rekt the bears,” highlighting the combination of declining exchange supply and rising institutional interest as a major catalyst for further gains.

Trader Sentiment: “Risk-On” Mode Returns

The derivatives market is reflecting renewed risk appetite. Data from Coinglass shows open interest climbing nearly 12% to $52.69 billion, while Binance’s top trader long-to-short ratio sits at 3.03—indicating a strong bias toward long positions. Options volume has surged more than 130%, suggesting traders are positioning for a breakout toward $4,100.

Altcoin investor sees $ETH rally as the spark for a 200–500% run across the sector in the coming months. Source: @CryptoMichNL via X

Michaël van de Poppe, co-founder of MN Trading Capital, said the recent MOVE in ETH marks “the first step forward to a more risk-on appetite” and estimated there could be “200–500% to be made in altcoins over the next few months.”

The ETH/BTC ratio has risen 38% in the past 30 days, signaling Ethereum’s growing strength relative to Bitcoin and hinting at potential Ethereum Layer 2 growth spillover across Arbitrum, Optimism, and zkSync ecosystems.

Technical Roadmap: $4,100 Resistance in Focus

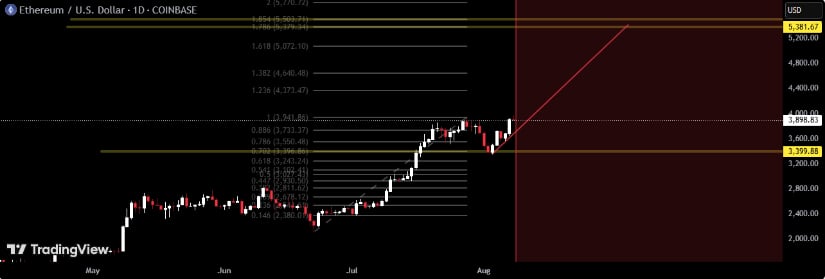

From a technical analysis perspective, $3,950 remains the near-term resistance, followed by $4,100, which aligns with a key Fibonacci extension from the 2021 highs. A clean break above $4,100 could open the path toward $5,070 and potentially $5,788 if bullish momentum accelerates.

ETH nears $3,870 daily confirmation with $4,100 resistance in sight amid strong bullish trends defying typical August weakness. Source: @TedPillows via X

The daily Supertrend remains firmly bullish above $3,387, while the DMI shows +DI leading -DI with an ADX reading above 32, confirming a trending market. Despite seasonal headwinds—August has historically been one of ETH’s weakest months—2025’s market behavior is breaking patterns, following a 48% rally in July.

August 9 Outlook and Long-Term Projections

For Ethereum price prediction into August 9, analysts say holding above $3,800 is key. A move through $3,950–$3,960 could trigger a rapid retest of $4,100, while failure to hold $3,800 could invite a pullback toward $3,749 (EMA20) or $3,708.

ETH breaks bullish falling wedge signaling upward trend, but cautious Optimism remains as August-September tend to be bearish months. Source: Ash Crypto via X

Some traders remain cautious, with Ash crypto noting that August to September are generally bearish months for crypto and advising a “cautiously bullish” stance. Others, however, are eyeing far higher targets—Fundstrat’s Tom Lee has suggested Ethereum could reach $16,000 in the long term, supported by growing ETF participation, expanding DeFi activity, and record transaction volumes.

Final Takeaway

Ethereum’s current momentum is being driven by a rare convergence of bullish technicals, record-setting network utilization, and deep-pocketed institutional accumulation.

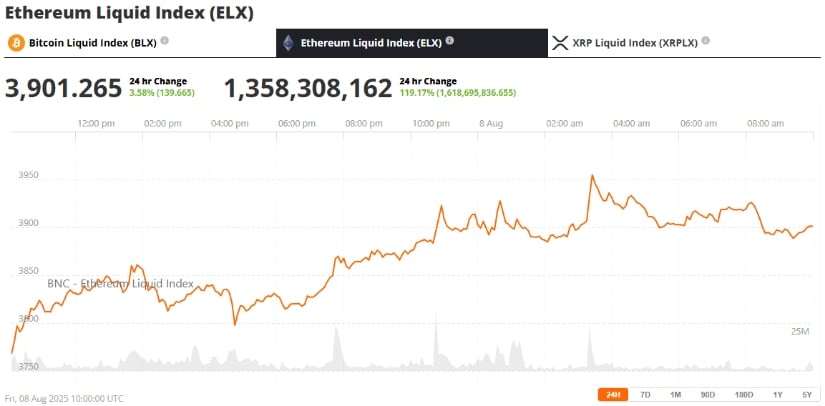

Ethereum (ETH) has been trading at around $3,901, up 3.58 % in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

With sentiment improving and market structure favoring the upside, August 9 could act as the spark for Ethereum’s next major rally—potentially setting the stage for a climb well beyond the $4,000 barrier.