Trump’s Pro-Crypto Move Ignites Market: Bitcoin Futures OI Skyrockets as $300M in Shorts Get Wiped Out

Politics meets crypto volatility—again. Former President Trump's latest executive order sends Bitcoin futures open interest soaring while liquidating $300 million in bearish bets overnight. The market’s reaction? A brutal reminder that shorts don’t always win.

Here’s what’s unfolding:

The Trump Pump (and Short Squeeze)

Details of the order remain vague, but traders aren’t waiting for fine print. Bitcoin derivatives markets saw record activity as leveraged positions got steamrolled. Moral of the story? When politicians dabble in crypto, someone’s always left holding the bag—usually the overconfident hedge funds.

Liquidation Carnage

Those $300 million in liquidations came fast. Exchanges reported cascading margin calls as BTC price action defied bearish positioning. Classic case of ‘buy the rumor, sell the news’—except this time, the rumor had presidential letterhead.

What’s Next?

Regulatory clarity or just another pump-and-dump catalyst? Either way, Wall Street’s crypto skeptics just got a $300 million lesson in why they shouldn’t fight the meme.

The report ‘democratizes access to alternative assets for 401(k) investors,’ effectively legitimizing crypto in the eyes of a vast pool of potential investors.

Bitcoin reacted quickly, with almost $300M in shorts erased overnight, according to data from CoinGlass. This came just as Thursday’s Bitcoin pushed to $117,580 after breaking through the psychological threshold of $115k during the same day.

What this means: bitcoin sentiment is getting better by the day. And it’s projects like Bitcoin Hyper ($HYPER) that stand to benefit the most. Find out why below.

How Trump’s Pro-Crypto Legislation Shapes the Crypto Landscape

Trump’s executive order, which opens 401(k) investors to crypto investment, is the latest of a long string of pro-crypto policies which aim to shape the crypto landscape.

The GENIUS Act is the biggest piece of the puzzle, establishing a clear and robust regulatory framework for stablecoins and stablecoin issuers. The act aims to protect consumers in case of stablecoin issuer insolvency and strengthen the US dollar’s reserve currency status.

The CLARITY Act is another welcome addition, which, among other things, defines the distinction between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The act also creates a clear regulatory space for digital assets, shedding light on aspects like trading, classifying, and supervising crypto assets.

But it’s the 401(k) executive order that stands to produce the biggest effect. Tom Dunleavy, Varys Capital head of venture, declared in an X post that:

401ks + DATs w/ at the money shelves put a ridiculous floor of crypto going forward and MOVE the limit from the Moon to Jupiter.

—Tom Dunleavy, X post

In short, the order would open crypto to a new pool of investors, which benefits Bitcoin directly and fuels side projects like Bitcoin Hyper ($HYPER), Bitcoin’s official LAYER 2 in presale today.

How Bitcoin Stands to Gain from its Bitcoin Hyper ($HYPER) Integration

Bitcoin Hyper ($HYPER) is the elegant, clear-cut solution to Bitcoin’s subpar performance, currently stuck at 7 transactions per second (TPS.)

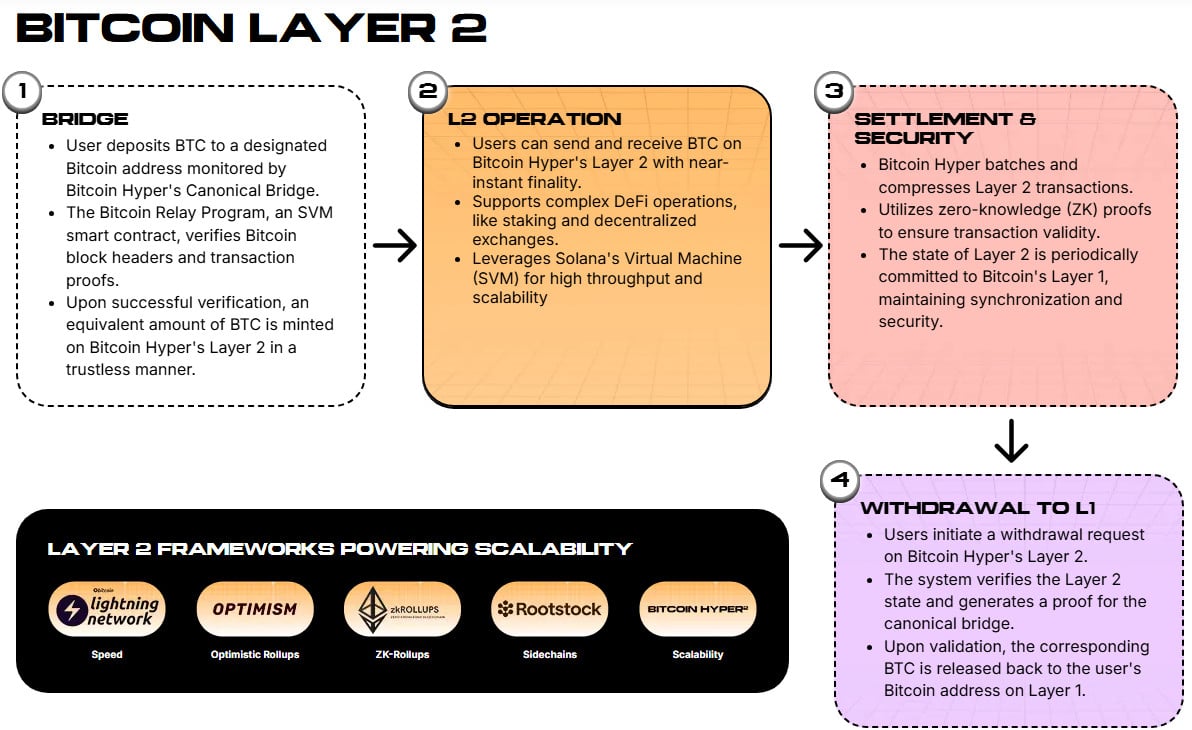

Hyper uses the Canonical Bridge to decongest the Bitcoin network by minting a number of wrapped $BTC equivalent to the users’ Bitcoins on the Hyper Layer.

Bitcoin’s Relay Program will confirm the transaction details and finalize the process in record time. Users can withdraw their Bitcoins at any time or use the wrapped $BTC within the Hyper ecosystem.

Hyper also uses the Solana VIRTUAL Machine (SVM) integration to enable ultra-fast smart contract executions, mixing Solana’s performance with Bitcoin’s security and brand appeal.

These tools recommend Bitcoin Hyper as a necessary upgrade, designed to lift the Bitcoin network to modern performance standards.

The project is in mid-presale and has accumulated over $7.7M so far, with $HYPER valued at $0.012575.

If you’re interested in investing, this could be the right time before $HYPER goes public. Based on Hyper’s project details and roadmap and provided it sees successful implementation, we expect the token to surge post-launch.You can buy your $HYPER today by heading to the presale page and following the purchase steps.

Bitcoin Targeting a New ATH Soon

With $300M in shorts deleted overnight and Bitcoin consolidating just short of $117K, it’s SAFE to say that we can expect another push soon.

Especially in the context created by Trump’s 401(k) order, which couldn’t get any more bullish for crypto.

So, keep your eyes on the charts and have Bitcoin Hyper ($HYPER) on your radar.

This isn’t financial advice. Do your own research (DYOR) and invest wisely.