Avalanche (AVAX) Primed for $80 Breakout—Here’s the Monthly Chart Signal You Can’t Ignore

Avalanche's AVAX isn't just knocking on $80's door—it's kicking it down. The monthly chart flashes a textbook breakout pattern, but only if bulls defend critical support. Forget 'hopium'—this is pure technicals talking.

The Setup:

AVAX coiled tighter than a Wall Street trader's stop-loss trigger finger. Symmetrical triangle? Check. Volume confirming the squeeze? Double-check. Now it's all about whether key levels crumple or catapult the price.

The Stakes:

Break $80, and AVAX paints a target even crypto skeptics can't meme into irrelevance. Lose the support zone? Cue the 'I told you so' chorus from Bitcoin maxis. Either way, chains are moving—whether it's transactions or exit liquidity.

The Punchline:

Smart money's watching the monthly close like a hawk. Retail? Too busy chasing the next 'moon mission' to notice the actual rocket on the launchpad. Classic.

AVAX is making its presence known again, and the data backs it up. From reclaiming key Fibonacci levels to showing strength across multiple timeframes, the AVAX price looks like it’s building towards a major rally ahead.

AVAX TVL Growth Signals Bullish Momentum

AVAX is quietly making a strong case for itself in the LAYER 1 landscape. The total value locked (TVL) on the network has surged to $1.9 billion, a staggering 90% increase since March. The curve on the chart shows how the figure has jumped over time. It’s not just about hype anymore; it’s a metric-backed trajectory of adoption that’s becoming harder to ignore.

AVAX’s TVL has surged 90% since March, reinforcing its position as a fundamentally strong Layer 1 contender. Source: Lennaert Snyder via X

This kind of TVL climb is often a reflection of expanding ecosystem activity, not just price speculation. With TVL now approaching the $2B mark, Avalanche is starting to position itself as one of the more fundamentally supported altcoins.

Avalanche Fibonacci Extension Points to $34.20 Target

As price consolidates after tagging the 0.618 Fibonacci retracement level, AVAX is starting to shift focus towards the next logical upside target: the 1.618 extension at $34.20. This kind of pause is typical following a strong rally, especially when key Fib zones are hit. crypto analyst CW8900 believes that the recent drop appears corrective, and volume behavior remains relatively controlled, hinting that bulls haven’t fully stepped away.

AVAX holds key Fib levels as bulls eye the 1.618 extension target at $34.20, supported by rising TVL and steady volume. Source: CW8900 via X

When placed in context with the rising TVL, this technical setup adds depth to Avalanche’s current trajectory. If price can maintain structure above the 0.5 or even the 0.382 retracement zones, the extension towards $34.20 remains well within reach.

AVAX Price Structure Aligns with Multi-Timeframe Indicators

AVAX price’s recent bounce from the $17.20 POC level is more than just a random reaction; it’s supported by a confluence of high-timeframe indicators. RSI and KDJ have reset and begun curling upward, hinting at early trend reversal potential. Price is also holding above the key VWAP and VAH zones from prior accumulation ranges, which now act as support, reinforcing the validity of this rebound from a structural standpoint.

AVAX bounces from $17.20 POC with multi-timeframe indicators aligning for a potential breakout toward the $72–$89 zone. Source: Centurion via X

Centurion shows that the $36 to $43 range emerges as the next major hurdle, aligning with the 0.618 Fib retracement, AVP resistance, and previous value zones. A strong weekly close above this range could trigger a mid-term MOVE towards $72 to $89, where multiple Fib extensions and historical FRVP levels converge.

Avalanche RWA Surge Adds Fuel to Long-Term Price Prediction

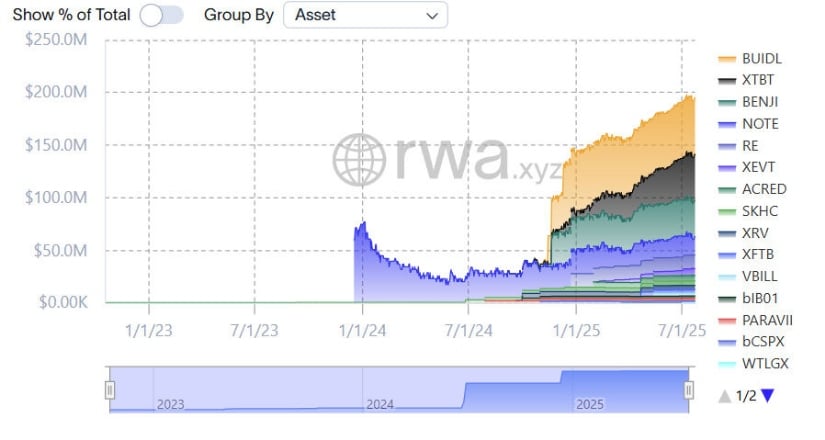

In yet another ecosystem-expanding move, Avalanche just saw its RWA exposure double thanks to a $250M inflow of tokenized Janus Henderson funds through Grove. This pushes AVAX further into the frontlines of the tokenized asset revolution. As shown in the latest update by Cointelegraph, the sharp rise in RWA allocations includes a wide mix of assets like BUIDL, BENJI, and XACRED, hinting at growing institutional confidence.

Avalanche’s $250M RWA inflow marks a major step in tokenized asset adoption. Source: Cointelegraph via X

When viewed alongside its surging TVL and bullish technical structures, this influx of tokenized assets could be the quiet catalyst powering Avalanche’s next leg of growth.

AVAX Price Prediction: Monthly Accumulation Points Toward $80+ Target

AVAX’s monthly chart is starting to draw attention as well. As highlighted by TraderSteve, the price is sitting NEAR long-term support and showing signs of rounded accumulation. This zone has historically acted as a launchpad, and with current candles forming higher lows, the structure hints at a base being built quietly but firmly.

AVAX forms higher lows near key support, with monthly structure hinting at a potential climb toward the $80+ zone. Source: TraderSteve via X

While some might view this as another stall, the technical symmetry from previous cycles adds weight to the argument for upside. If AVAX continues to hold above the $20 to $23 zone, the projected move back towards the $80 handle gains credibility. This aligns with broader narratives from recent TVL growth and real-world asset (RWA) inflows.

Final Thoughts: Can AVAX Keep This Momentum Going?

AVAX’s recent surge in TVL, strong RWA inflows, and multi-timeframe technical confluence paint a much brighter picture than just a few months ago. With price holding above key support zones and momentum slowly rebuilding, the setup looks increasingly favorable, especially if AVAX can clear the $36 to $43 resistance range.

Short-term shakeouts remain possible, but the bigger structure still leans bullish. If current accumulation zones hold, the long-discussed $80+ AVAX price prediction is likely to come into play.