Dogwifhat Surges Into Wave 3 Breakout—$22 Peak In Sight As Meme Coin Defies Gravity

Move over, Wall Street—the dogs are running the show now.

Dogwifhat (WIF) isn't just barking up the crypto tree—it's scaling it like a squirrel on espresso. The Solana-based meme coin just triggered a textbook Wave 3 breakout, putting its $22 cycle target squarely in the crosshairs.

Technical tailwinds

Chartists are foaming at the mouth as WIF's price action mirrors classic Elliott Wave patterns. The current surge represents Wave 3 acceleration—typically the strongest impulse in a bullish sequence. Retail traders are piling in like it's a Dogecoin flashback, while institutional desks quietly adjust their 'serious investor' facades.

Market mechanics at play

Liquidity pools are getting drained faster than a degenerate's margin account. With shorts getting squeezed and spot demand spiking, WIF's price discovery phase could get... interesting. The $22 target implies a 3x from current levels—chump change in crypto terms, but enough to make your traditional portfolio manager sweat through their bespoke shirt.

Just remember: in a market where 'fundamentals' mean watching Elon's Twitter feed, even fractal patterns count as due diligence these days.

Technical patterns, on-chain activity, and market cycle alignments now point toward a potential breakout structure with targets far beyond the current range.

With the price holding key support zones and volume stabilizing, the next MOVE may determine the trajectory for the rest of the cycle. Market watchers have focused on the unfolding Elliott Wave structure for insights into the token’s next major levels.

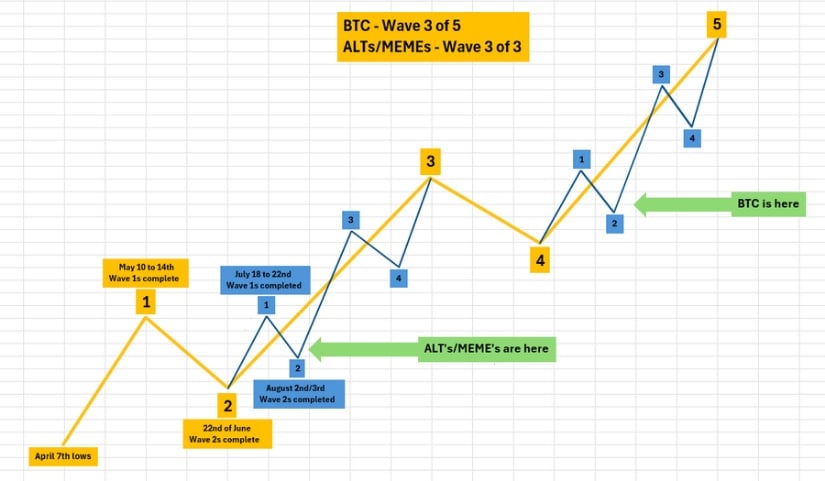

Elliott Wave Structure Highlights Multi-Leg Uptrend

Analyst Paul Webborn has charted an Elliott Wave pattern showing dogwifhat progressing through Primary Wave C, which is subdivided into five intermediate legs. According to the chart, Intermediate Wave 2 recently concluded, paving the way for the onset of Wave 3.

This wave often reflects the most significant price movement in Elliott Wave theory, and in this case, it carries an initial target range of $4.70 to $6.86. Webborn’s analysis assumes symmetry with Wave A, placing the overall projection for Primary Wave C NEAR $22.

Source: X

Supportive technicals back the bullish structure. The price has respected the 0.236 Fibonacci retracement level around $0.83, confirming it as a base for the next move. Additionally, Fibonacci extension targets at $8.74, $12.09, and $29.85 align with previous market inflection points and fit within the mapped five-wave advance.

The resistance zone near $1.00 remains a crucial level that must be surpassed to validate the formation. Until that level is breached with volume, the wave count remains conditional, though structurally intact.

Short-Term Indicators Reflect Market Hesitation

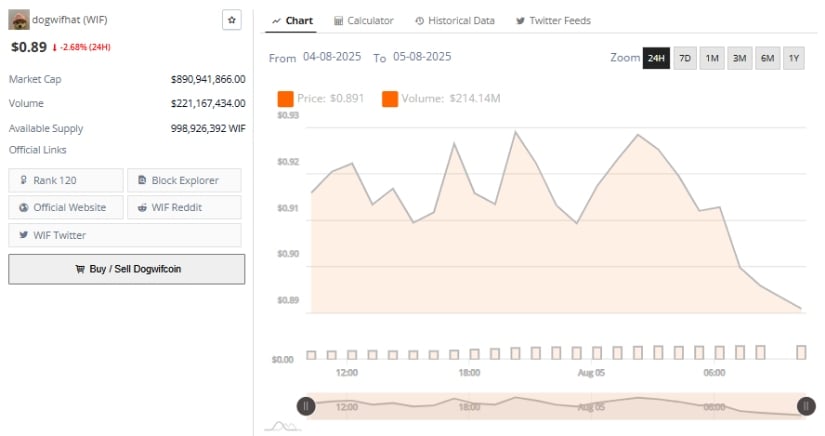

The daily chart reveals signs of cautious trading after a strong July rally. The current price sits near $0.891 after a 3.78% correction, staying below the recent $0.93 peak.

The formation of lower highs suggests mild selling pressure, while the support zone between $0.85 and $0.88 continues to act as a pivot. Failure to hold this range could expose WIF to deeper downside moves toward $0.75, though this remains unconfirmed.

Source: BraveNewCoin

Momentum indicators reflect mixed conditions. The MACD line has crossed below the signal line, with a negative histogram reading of -0.027, signaling a slowing upward momentum. Meanwhile, the Relative Strength Index (RSI) is at 42.98, below the RSI-based moving average of 47.86.

This placement in the lower neutral zone suggests weakening buyer control. A drop below 40 could reinforce bearish bias, but a rebound could signal the start of a potential bullish divergence.

Wave Timing Syncs With Meme Coin Cycle Peak

At the time of writing, Dogwifhat sits within a technical zone that correlates with broader meme coin wave cycles.

A second market overlay shared by Webborn aligns Dogwifhat’s current position with Wave 3 of 3, considered one of the most aggressive phases in cycle theory. The chart indicates that Wave 2 for meme tokens completed between August 2 and 3, matching WIF’s price behavior and retracement conclusion.

Source: X

This multi-asset wave synchronization also places Bitcoin in its Wave 3 of 5, suggesting that capital rotation into altcoins and meme assets may intensify in the coming weeks.

While exact timing remains speculative, the alignment between market cycles and Dogwifhat’s internal wave structure strengthens the probability of a coordinated upward breakout. Volume confirmation and a decisive move above overhead resistance will remain key metrics to watch.